Ripple (XRP) Potentially Obtains Banking License, Next Payment Revolution!

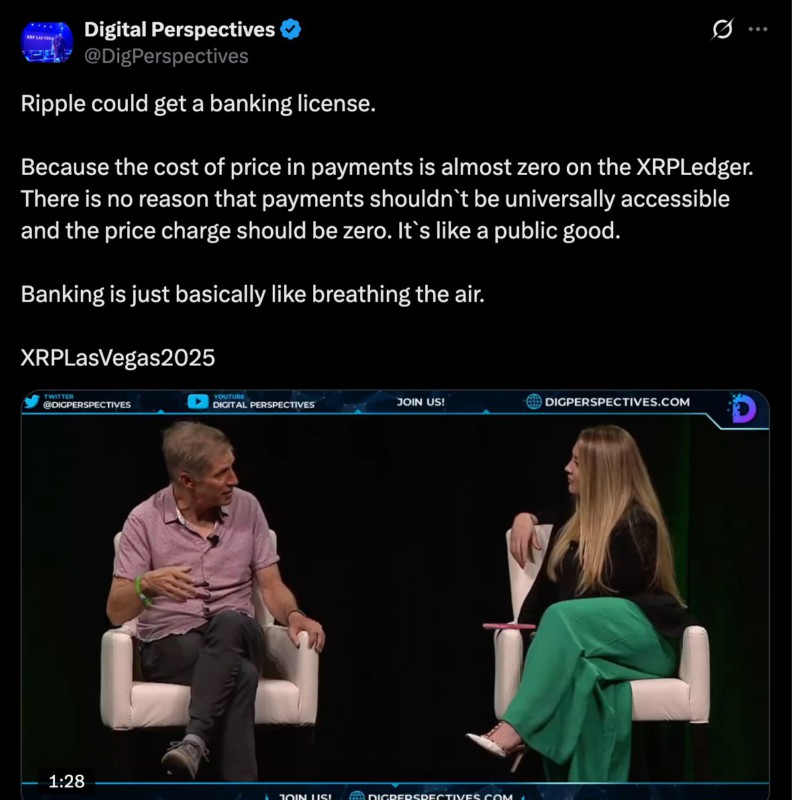

Jakarta, Pintu News – Greg Kidd, a US politician and former congressional candidate, recently revealed his vision of the future of banking and blockchain, specifically in relation to Ripple . As co-founder of Haka Yaka Ventures and owner of Vast Bank, Kidd showed his interest in pushing for regulations that would allow companies like Ripple to obtain a banking license.

Although Ripple has not explicitly stated a desire to obtain such a license, Kidd is ambitious to end the current banking monopoly. Kidd believes that this will open up new opportunities in the banking industry which is currently dominated by traditional models.

A New Vision for Banking

In his interview, Kidd explains how fintech companies and remittance platforms can be directly involved in banking functions through open decentralized networks. According to him, digital wallets, remittance platforms, and even retailers should be able to participate in banking. This marks a big step towards greater financial inclusion, where access to banking services can be easier and more affordable for all.

Kidd also discussed the potential of moving the banking industry to blockchain. Using a system like XRP Ledger, banks in the US could place US dollars directly on the blockchain, replacing the decades-old traditional records system. This would reduce the need for intermediaries such as stablecoin issuers and speed up the transaction process.

Also Read: Vietnam Officially Recognizes Bitcoin and Other Digital Assets!

XRP Ledger and Payment Innovation

XRP Ledger offers several advantages that could change the way payments are made. Transaction fees on the network are almost zero, and transactions can be completed in about 3-5 seconds. In addition, XRP Ledger has a decentralized exchange (DEX) that allows users to trade tokens directly on the network. These advantages show great potential for reducing costs and friction in payment delivery.

Kidd believes that with the adoption of blockchain technology such as that offered by XRP, the costs and barriers in remittances will decrease significantly. This will bring huge benefits to consumers and businesses around the world, speeding up transactions and reducing operational costs.

Ripple Partnerships and Future Prospects

Ripple has built partnerships with various banks around the world through its RippleNet payment network and XRP Ledger. One of its loyal partners is SBI Holdings in Japan, which launched MoneyTap, an instant domestic transfer app powered by Ripple. In the US, PNC Bank joined RippleNet in 2018 to enhance its cross-border payment capabilities.

With the possibility of obtaining a banking license, Ripple will not be starting from scratch. The network it has built so far will provide a solid foundation for further expansion. According to Sistine Research, the price of Ripple (XRP) which is currently at around $2.17, has the potential to rise up to $73, indicating a very positive outlook for the future.

Ripple Towards Banking Transformation

With the potential to get a banking license and the technology constantly evolving, Ripple (XRP) is at the forefront of the digital banking revolution. This move will not only change the way banks operate but also the way consumers and businesses conduct transactions. The future of banking may be very different from what we know today, with Ripple at the center of the change.

Also Read: Ripple (XRP) Legal Case: Strong Arguments in Joint Motion Revealed!

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto News Flash. XRP News: Ripple Could Get a Banking License Under Proposed Charter from US Lawmaker. Accessed on June 16, 2025

- Featured Image: Crypto Times