3 US Economic Indicators This Week That Could Shake Up the Crypto Market!

Jakarta, Pintu News – Following the Bureau of Labor Statistics (BLS) report on the US CPI (Consumer Price Index) last week, crypto traders and investors are still monitoring the country’s economic calendar.

This week, three US economic indicators will influence Bitcoin and crypto market sentiment. In particular, Trump’s trade policies and geopolitical tensions in the Middle East continue to affect the US economy.

Here are the US economic indicators that could affect the portfolios of crypto traders and investors this week.

US Retail Sales

This week, retail sales data released by the US Census Bureau will kick off the list of US economic indicators. This data reflects consumer spending, which accounts for about 70% of the US economy and thus influences market sentiment.

Read also: 3 Crypto Made in USA to Watch in the Third Week of June!

Data from MarketWatch showed retail sales growth of 0.1% on a monthly basis (MoM) in April 2025, reported in May. This reflects moderate growth in consumer spending.

A survey of economists reported by MarketWatch predicted a 0.6% MoM decline in retail sales from April to May 2025.

This suggests that economists expect consumer spending to shrink, most likely due to the uncertainty that comes in the wake of Trump’s tariff chaos.

A confirmed decline of -0.6% or worse could increase expectations of a Federal Reserve (Fed) interest rate cut, as this indicates economic weakness.

Such an outcome would favor Bitcoin as a hedge against monetary easing or inflation, potentially pushing the price higher.

Conversely, if the data surprises positively, for example, if the figure is stagnant or more than 0.1%, this could strengthen the US dollar and reduce rate cut speculation. In the same way, such an eventuality could push crypto prices down.

Initial Jobless Claims

As Thursday is the Juneteenth holiday, last week’s initial jobless claims report will be released on Wednesday, June 18. This US economic indicator measures the number of US citizens who filed unemployment insurance claims for the first time.

Recently, the BeInCrypto website reported that the US labor market is increasingly becoming a key macroeconomic data point for Bitcoin. Therefore, this data will be a major concern this week.

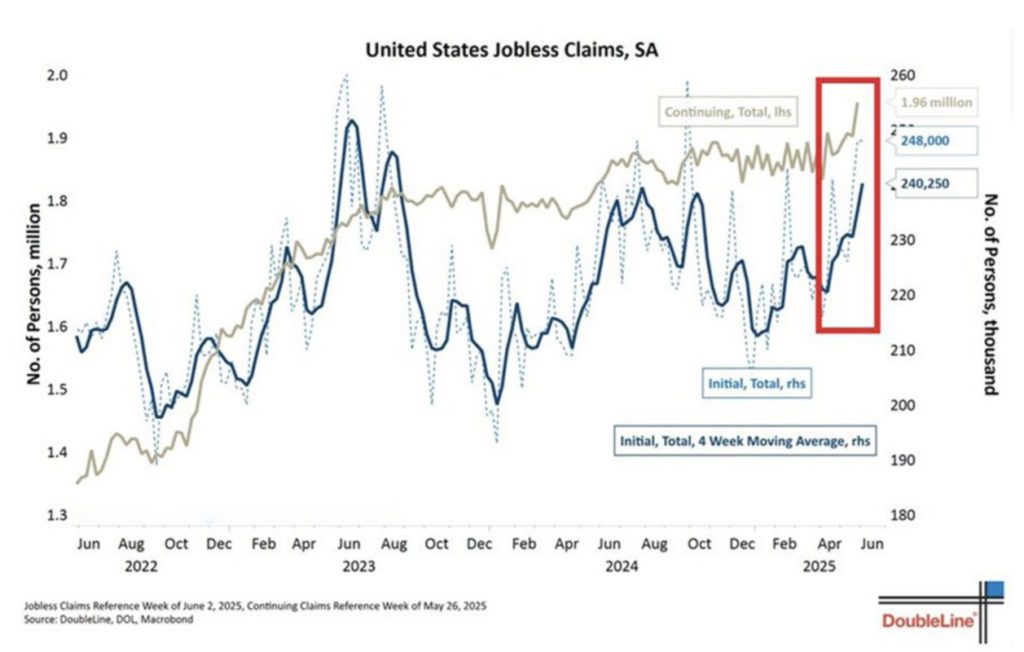

After the previous reading of 248,000 claims for the week ending June 7, which was higher than economists’ projections of 242,000, economists expected even higher unemployment insurance claims, reaching 250,000 for last week.

This expected rise in initial jobless claims shows that economists are aware of the slowing labor market in the US. This is bullish for Bitcoin as it further opens up opportunities for the Federal Reserve (Fed) to pivot policy.

Read also: Amazon and Walmart Prepare to Launch Stablecoins, Rocking the Financial World!

“Labor market starts WEAK → Initial jobless claims hit 248K (highest since Oct.) → 4-week average: 240K (highest since August 2023) → Number of benefit recipients: 1.96 million (highest since November 2021) Weakness = Fed pivots = crypto soars,” eye zen hour analysts wrote in a post.

FOMC Interest Rate Decision

Meanwhile, the main highlight of this week’s US economic indicators will be the Federal Open Market Committee (FOMC) interest rate decision, which will also be announced on Wednesday. This macroeconomic data point will complete the discussion after last week’s US CPI.

Furthermore, the BeInCrypto page reported that inflation increased in May, and for the first time since February. The US CPI is a lagging indicator, making it a key focus in inflation targeting and, therefore, linked to the 2% inflation target set by the Federal Reserve.

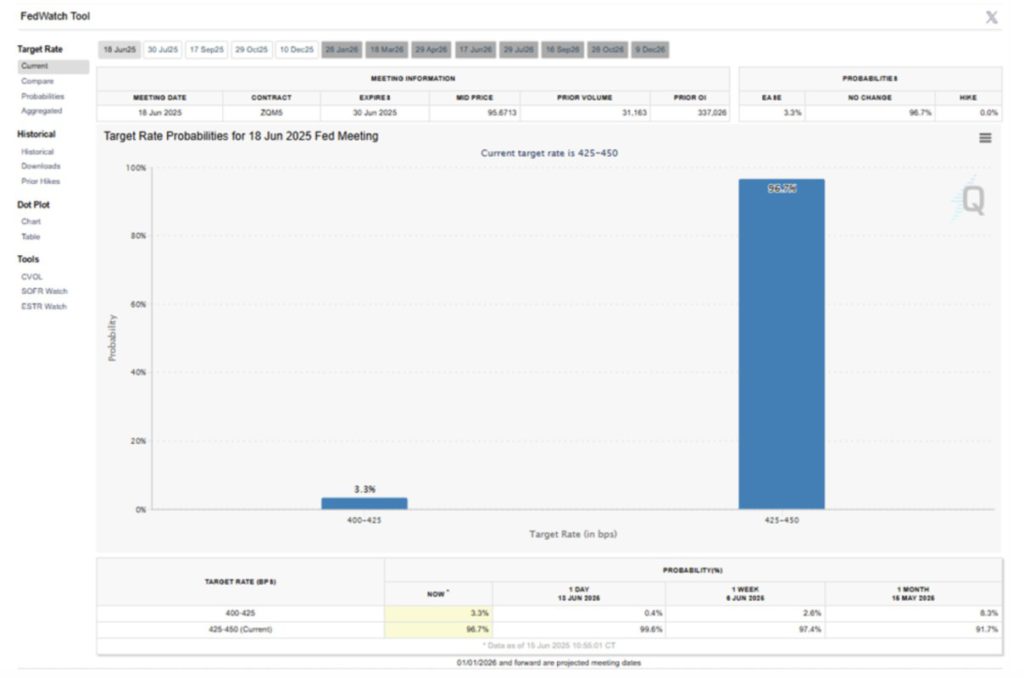

Last week’s US CPI inflation data will influence the FOMC interest rate decision. According to the CME FedWatchTool, the market projects a 96.7% probability that the Fed will keep rates at 4.25-4.5%.

Meanwhile, there are those who see a 3.3% probability of a rate cut, possibly to a range of 4.0 to 4.25%, which would signify a cut of a quarter of a basis point (bp).

This week’s FOMC rate decision will hinge on economic data indicating the need for monetary stimulus to support the Fed’s dual mandate of price stability (2% inflation target) and maximum employment.

In addition to the US economic indicators already mentioned, a major factor for a rate cut could include political pressure from President Donald Trump. Despite the Fed’s commitment to caution, Trump continues to urge Jerome Powell to lower rates.

“Fed should lower by a full point. Will pay much less interest on maturing debt. Very important,” Trump wrote on Truth Social after the CPI data was released.

With the market already factoring in the possibility of cuts starting in September, a sudden cut on Wednesday would take the market by surprise, and would most likely send Bitcoin prices skyrocketing.

This surge will occur as lower interest rates reduce the opportunity cost of holding non-interest-earning assets.

In contrast, the decision to keep interest rates on hold may not affect the market significantly, given that it is already expected and already reflected in prices.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. 3 US Economic Indicators With Crypto Implications This Week. Accessed on June 16, 2025