Ethereum Surges to $2,600 Today—Could $2,800 Be Next?

Jakarta, Pintu News – Ethereum price recovered from key support levels as open interest jumped 4.75%, and liquidation of short positions exceeded $34 million. Key resistances are at $2,699 and $2,800.

At the time of writing, Ethereum registered an intraday gain of 1.79%, reflecting Bitcoin’s bullish recovery.

Amidst the overall market recovery, the decline in Ethereum reserves on exchanges, along with growing optimism in the derivatives market, points to further upside potential.

Ethereum Price Up 1.79% in 24 Hours

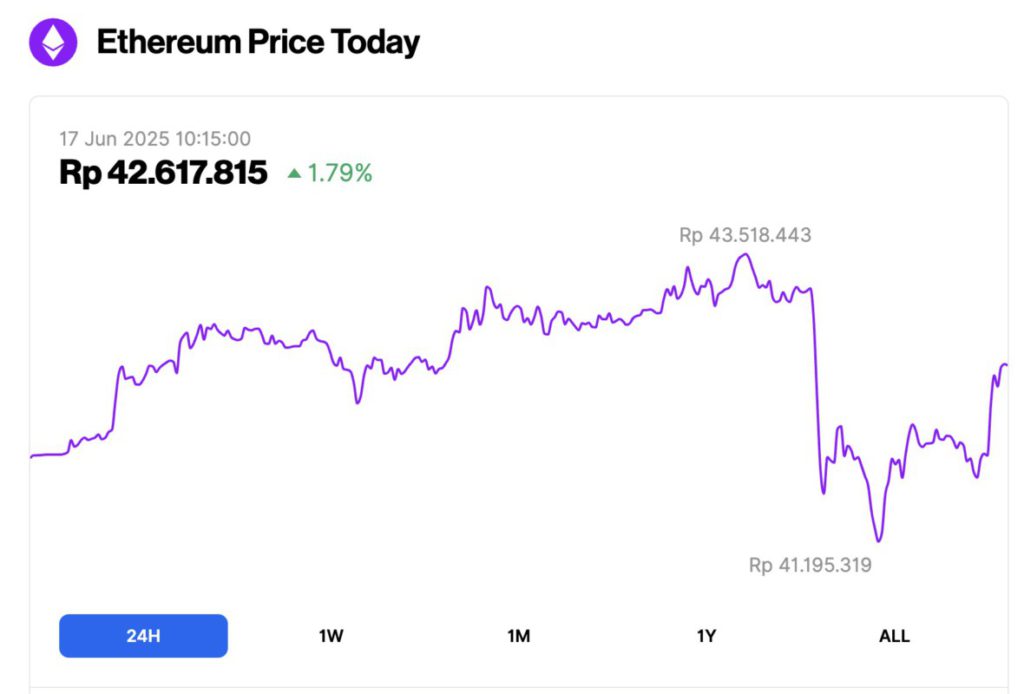

As of June 17, 2025, Ethereum (ETH) is priced at approximately $2,613, or around IDR 42,617,815, marking a 1.79% increase in the past 24 hours. Over this period, ETH reached a low of IDR 41,195,319 and a high of IDR 43,518,443.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $315.52 billion, with daily trading volume rising 50% to $23.93 billion within the last 24 hours.

Read also: Top Crypto Expert Says Ethereum Is About to Explode to $4,000 — Here’s What’s Fueling the Surge

Ethereum Price Analysis Eyes Breakout Above $2,699

On the daily chart, Ethereum showed a significant bullish failure last week, failing to hold above the 50% Fibonacci level at $2,699. This led to a price drop to a weekly low of $2,439, before a bullish reversal finally occurred.

With the long lower shadow of the last candlestick, Ethereum has bounced back to the market price of $2,626, indicating a bullish reversal.

Currently, Ethereum is attempting to retest the 50% Fibonacci level, and the surge in bullish momentum increases the likelihood of a breakout.

The MACD and signal lines are getting closer to a bullish crossover, while the RSI is starting to move upwards from the midpoint, indicating an increasing buying pressure. As such, technical indicators remain optimistic towards Ethereum.

Based on Fibonacci levels, a breakout above the 50% level could lead to the 61.8% Fibonacci level at $3,003. However, the recent peak around $2,800 could be a temporary resistance.

On the downside, crucial support is at the 38.2% Fibonacci level at $2,395.

Supply Pressure Eases as Ethereum Reserves Decline

According to CryptoQuant data, last week’s bullish failure was followed by a brief surge in Ethereum’s reserves on exchanges, reaching a weekly peak of 18.89 million ETH.

However, as the market recovered, investors again withdrew ETH from centralized exchanges, which eased the selling pressure.

Read also: 3 US Economic Indicators This Week That Could Shake Up the Crypto Market!

Currently, the exchange’s reserves stand at 18.67 million ETH, close to the all-time low of 18.63 million ETH recorded on June 4.

Bulls Rule the Ethereum Derivatives Market

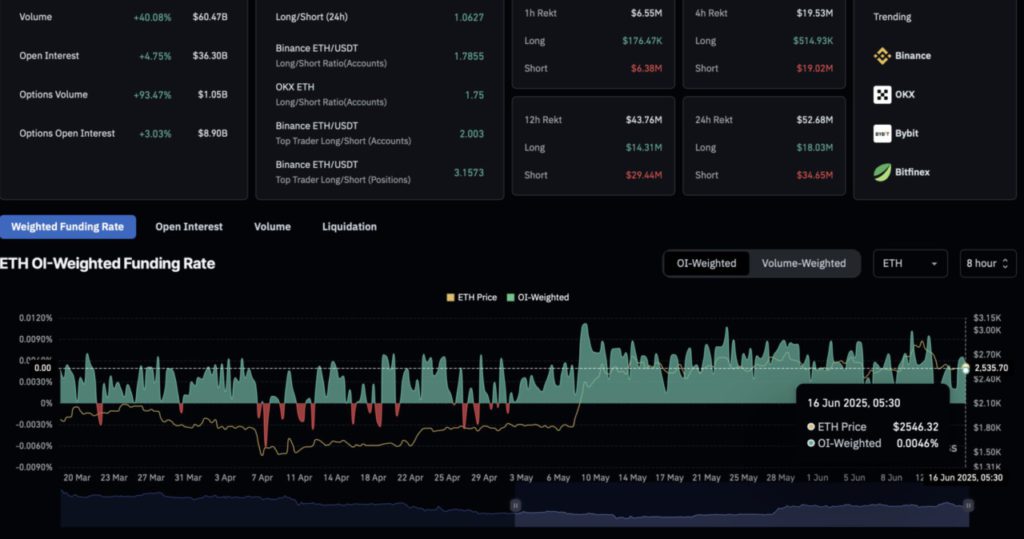

Data from CoinGlass shows growing optimism towards Ethereum as the overall market recovers.

Ethereum’s open interest (OI) rose 4.75%, reaching $36.30 billion, while the OI-weighted funding rate stood at 0.0046%. This reflects an increase in bullish sentiment and hopes for a continued recovery.

In the last 24 hours, liquidations showed a bullish bias, with short positions liquidated amounting to $34.65 million compared to $18.03 million in long positions.

After a significant short squeeze, the long-to-short ratio has risen to 1.0627, indicating a bullish imbalance in open positions.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Crypto Basic. Ethereum Rebounds as Bullish Signals Point Toward $2,800. Accessed on June 17, 2025