Pepe Coin on the Brink: Whale Activity Sparks Panic as Price Teeters Below $0.00001!

Jakarta, Pintu News – As reported by Crypto Basic, the price of PEPE fell 20% in the last six days as it tested the support level at $0.000010. Meanwhile, whale activity increased sharply, sparking fears of a deeper correction.

At this crucial point, PEPE is in danger of losing the psychological level of $0.000010 due to the increasingly strong selling pressure.

Will the surge in whale activity, plus the continued downward trend, push PEPE to a new low this month?

PEPE Coin Price Analysis

On the daily chart (17/6), Pepe coin is seen struggling to maintain its position above the $0.00001037 support level. With an intraday drop to $0.00001024, PEPE recorded its lowest trading price in the last 30 days.

Read also: Altcoin Ranking: 3 Most Favored Altcoins in 2025!

This reflects the growing selling pressure from above, which has led to a 20% drop in prices in the past six days.

As market sentiment deteriorates, a daily close below the psychological level of $0.000010 could extend the correction down to the $0.0000090 support zone – a level that was previously an important resistance area.

If the bearish momentum continues, the downside risk could extend to $0.00000570, which is the lowest closing price so far this year.

On-Chain Data Indicates Whale Selling

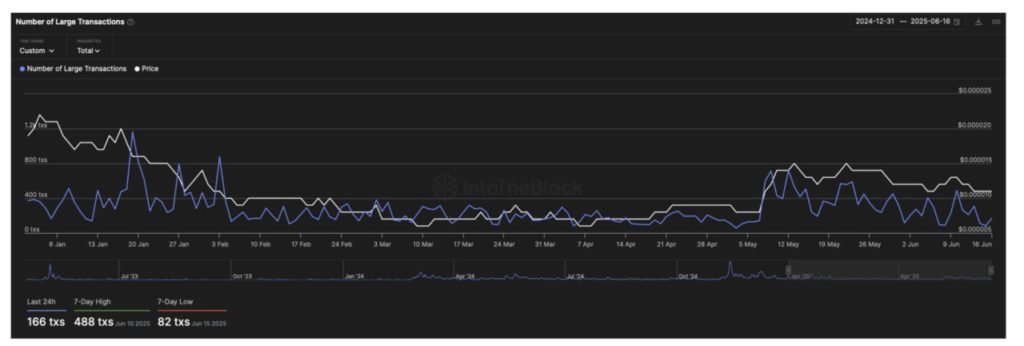

Based on data from IntoTheBlock, the number of large transactions (over $100,000) has increased significantly in the last 30 days.

Since the beginning of May, the number of transactions has increased compared to the relatively quiet period between February and April.

Typically, a spike in large trades can be an indicator of a peak or bottom forming in a price cycle. With increasing selling pressure, this increase in the number of large trades is likely to point to a sell-off by PEPE whales.

As such, the on-chain data reinforces indications of increased downside risk to the frog-themed meme coin.

Read also: Shiba Inu Price Set to Skyrocket 62%? 211 Million SHIB Sales Signal a Great Awakening!

Fear Emerges in the PEPE Derivatives Market

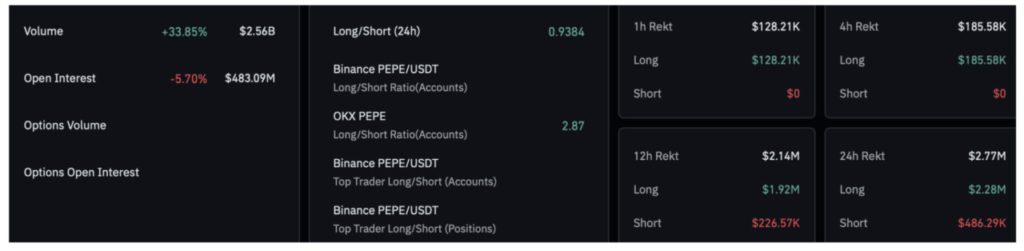

Data from CoinGlass shows that PEPE’s open interest fell by 5.70%, now standing at $483.09 million.

On June 17, 2025, the total liquidation of long positions amounted to $2.28 million, much larger than the liquidation of short positions which amounted to only $486,000.

This imbalance pushed the long-to-short ratio down to 0.9384, further strengthening the bearish sentiment. Overall, the PEPE derivatives market indicates that traders are preparing for a significant price correction.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- The Crypto Basic. Pepe Risks Breakdown Below $0.0001 Amid Whale Activity. Accessed on June 18, 2025