Bitcoin & Gold ETF Inflows Explode — Is the US and UK About to Join the Iran-Israel War?

Jakarta, Pintu News – With tensions rising in the Iran-Israel conflict, fund inflows into Bitcoin ETFs have surged again, along with gold prices.

On Wednesday (June 18), net fund flows into BTC ETFs reached $386 million, almost doubling from the previous day, indicating growing confidence from institutional investors.

This surge came after the FOMC meeting led by Jerome Powell, who decided to keep interest rates on hold, while crypto markets took a wait-and-see attitude amid growing geopolitical tensions.

Fund Flows to Bitcoin ETFs Increase Amid Iran-Israel Conflict

Fund flows into spot Bitcoin ETFs surged to $388 million on Wednesday across ETF issuers in the United States.

Read also: Bitcoin Holds Strong at $104K — Is a Skyrocketing Surge to $466K Coming Soon?

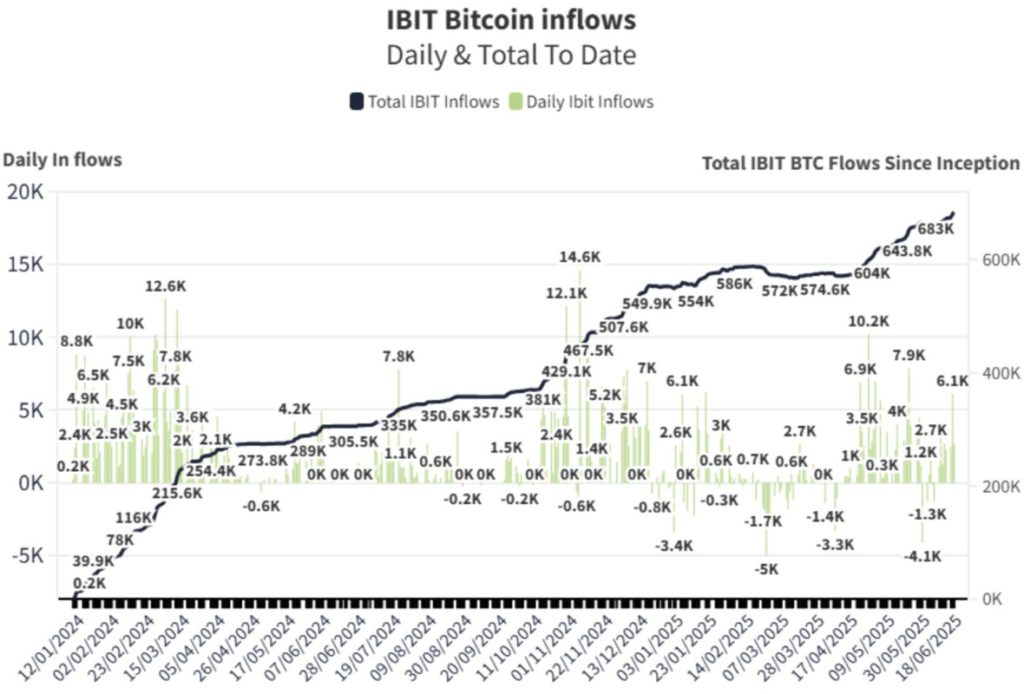

BlackRock’s iShares Bitcoin Trust (IBIT) regained the lead with inflows of $280 million, while Fidelity’s FBTC managed to recover with inflows of over $100 million.

Based on official IBIT data, BlackRock bought an additional 2,861 Bitcoins yesterday, bringing their total BTC holdings to 680,336 units.

Bitcoin ETFs in the US have recorded strong fund inflows for eight consecutive trading days.

Since the beginning of 2025, these products have raised a total of $11.25 billion in net flows, reflecting the high demand from institutional investors.

Iran-Israel Conflict Potentially Escalates with UK and US Involvement

Geopolitical tensions are rising amid the ongoing conflict between Iran and Israel, with major countries such as the United States and Britain signaling that they are willing to intervene in the war.

According to a recent report from Bloomberg, top US officials are preparing for an attack on Iran. This comes after Donald Trump earlier this week denied any peace talks with Iran over the conflict.

Read also: Is HYPE Set to Skyrocket 70%? Whale Bets Big with $12 Million Long Position

Several sources told Bloomberg that Washington officials are designing the infrastructure for possible direct involvement in a conflict with Tehran.

Meanwhile, according to a report in The Times, Britain is considering joining the conflict against Iran if the United States intervenes alongside Israel.

Ahead of the FOMC meeting, Bitcoin price experienced selling pressure and is currently holding at the $104,000 support level. Amid the escalation of geopolitical conflicts, investors are likely to take a wait-and-see attitude.

The Short-Term (STH) to Long-Term (LTH) Supply ratio decreased to 15.7%, below its lowest statistical limit. This shows that short-term traders are still passive, while long-term holders are maintaining their positions.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Bitcoin ETF Inflows Rise With Gold as Britain, US Likely to Join Iran-Israel War. Accessed on June 19, 2025