Bitcoin (BTC) Headed to $107K: Derivatives Market Latest Analysis

Jakarta, Pintu News – Bitcoin has struggled to retest its highest price peak, creating an atmosphere of caution in the derivatives market. However, despite the signs of caution, recent analysis suggests that there is still potential for price gains.

Futures Market Shows Bearish Tendency

According to analyst from CryptoQuant, Axel Adler, the Bitcoin (BTC) Futures Market Strength has recently turned bearish, with a value of approximately -$93,000. This signals a moderate bearish tendency in the market. Nonetheless, this shift reflects more investor confidence in the possibility of a rise above the current high rather than any real threat to the overall uptrend.

Historically, similar drops in the $50,000 to $150,000 range usually trigger a small correction of 5% to 10%. If this pattern repeats, Bitcoin (BTC) could pull back to the $93,000 to $98,000 range. However, aggressive selling has not been seen, suggesting that this shift may be more of a hesitation than a crash.

Also Read: Bitcoin Survives Global Uncertainty, Will it Continue to Rise?

Optimism Still Dominates the Market

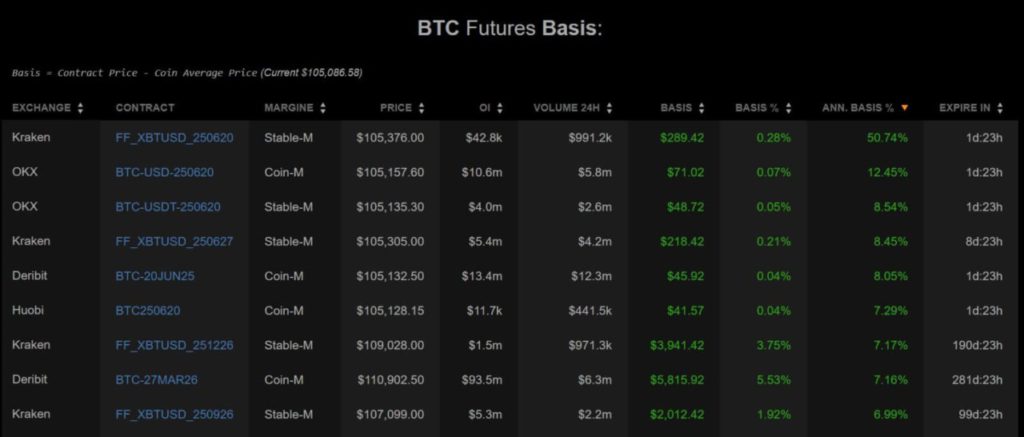

Although Bitcoin (BTC) Futures Market Strength has turned bearish, other market indicators show a different story. The Bitcoin (BTC) Futures Basis remains positive across all major exchanges, indicating a bullish bias. This suggests that traders are willing to pay a premium for long positions, an indication that expectations of price increases are still strong.

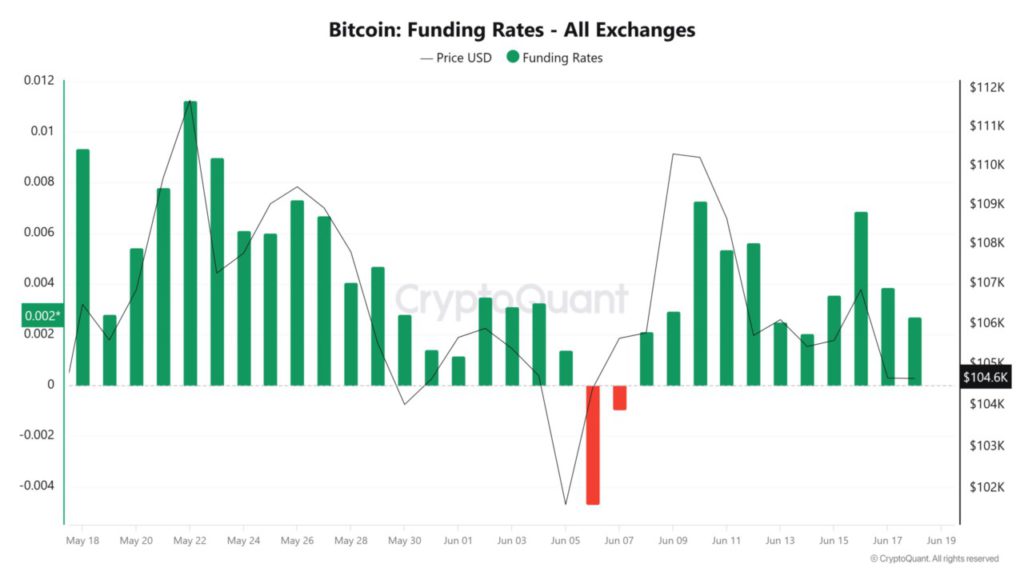

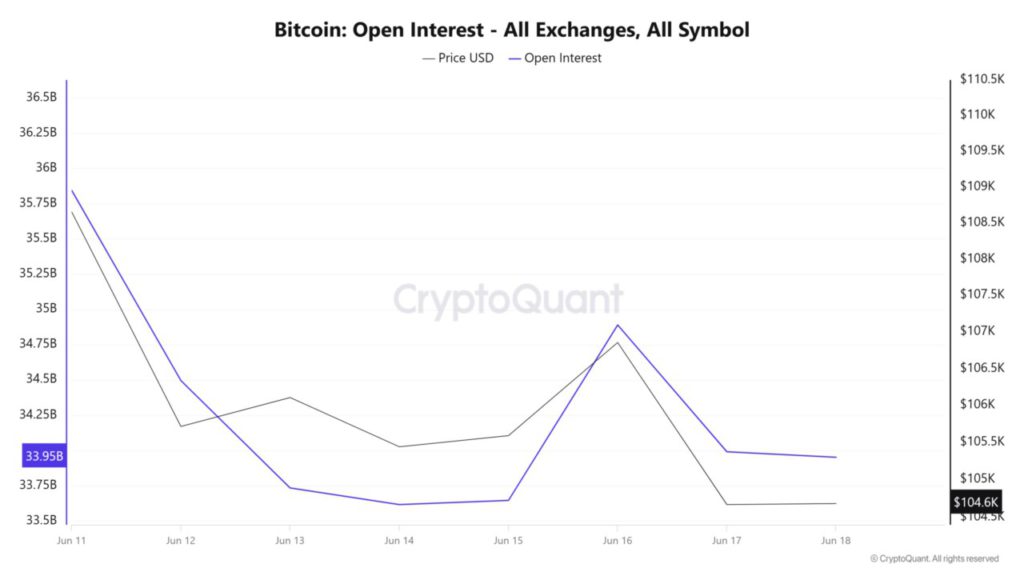

In addition, the Bitcoin (BTC) Funding Rate has remained positive since 10 days ago, signaling that investors are still very bullish and expect the price to continue rising. Bitcoin (BTC) Open Interest has also remained around the $33 billion mark over the past week, indicating that traders are not aggressively opening new positions, whether bullish or bearish.

Final Thoughts: Bitcoin (BTC) Still Strong

Although there are bearish indications in the Futures Market Forces, these do not seem strong enough to sway Bitcoin (BTC) from its current path. In the event of a correction, historical support near $102,850 could serve as a cushion. On the other hand, if macro metrics and derivatives remain stable, Bitcoin (BTC) could continue to consolidate between $104,000 to $107,000, staying close to its peak. In short, although bears may have appeared, they have not yet taken over.

Conclusion

Taking into account the current dynamics and historical data, the Bitcoin (BTC) market is still showing strong resistance to bearish pressure. Investors and traders should stay alert to key indicators to make informed decisions in the face of market fluctuations.

Also Read: Is it Time to Invest in Solana (SOL)? New ETF Fuels Speculation!

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Mapping Bitcoin’s Road Ahead: Is $93k or $107k Next for BTC? Accessed on June 20, 2025

- Featured Image: Generated by AI