Astonishing Prediction: Bitcoin (BTC) Has the Potential to Reach $205,000 by the End of the Year!

Jakarta, Pintu News – Bitcoin has experienced a modest price correction since June 11, dropping from around $111,000 to just above $104,000 currently. Although geopolitical tensions in the Middle East may be affecting the asset, some analysts remain confident that Bitcoin’s (BTC) long-term bullish trajectory is still intact.

Bitcoin Annual Trend: Peak $205,000?

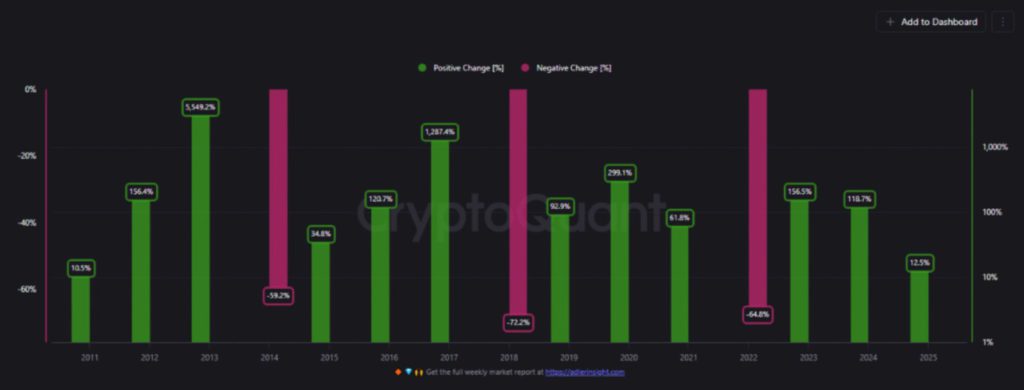

In a recent post on CryptoQuant Quicktake, Carmelo Aleman highlighted the Bitcoin Annual Percentage Trend as a strong potential growth indicator for Bitcoin (BTC) price throughout the rest of 2025. This trend, which follows Bitcoin’s (BTC) annual price performance since 2011, shows a recurring pattern of three bullish years followed by one year of consolidation. This pattern aligns with Bitcoin’s (BTC) four-year halving cycle, which helps investors identify long-term market phases beyond short-term volatility.

Aleman shared a chart that supports his outlook for 2025. If Bitcoin (BTC) maintains the usual growth rate seen in the third year of this cycle, its price could rise 120% in 2025. The surge would take Bitcoin (BTC) from $93,226 at the beginning of the year to as high as $205,097, potentially marking the peak of the cycle for this year. If realized, this would be the third consecutive year of gains and complete another full bullish cycle.

Also Read: Bitcoin Survives Global Uncertainty, Will it Continue to Rise?

On-Chain Indicators Point to Upside Potential

Besides the Annual Percentage Trend, several other on-chain metrics continue to support the bullish case for Bitcoin (BTC). Specifically, both whale and retail Bitcoin (BTC) inflows to Binance have reached cyclical lows, often an indication that investors are holding the asset in anticipation of further upside.

This decrease in inflow suggests that less Bitcoin (BTC) is being sold into the market, which could reduce selling pressure and support price increases. This analysis adds a deeper layer of understanding of how investor behavior can affect Bitcoin (BTC) market dynamics.

Filtering out Market Noise with Cyclical Trends

Bitcoin Annual Percentage Trend is a tool that allows analysts and investors to filter out the daily market noise and reconnect with the true cyclical nature of Bitcoin (BTC). The tool is a reminder that beyond micro metrics and short-term candles, Bitcoin (BTC) follows a recurring structural rhythm with striking consistency: three years of expansion followed by one year of compression.

This understanding is especially important for investors trying to navigate short-term price fluctuations while maintaining a long-term investment strategy in line with the larger market cycle. By utilizing insights from the Annual Percentage Trend, investors can make more informed decisions and avoid the panic that often occurs in the crypto market.

Conclusion

Taking all indicators and analysis into account, 2025 seems to be a very promising year for Bitcoin (BTC). If these predictions and historical patterns prove to be true, investors who understand and follow these cyclical rhythms may see very favorable results. Therefore, understanding and capitalizing on these trends could be the key to success in crypto investing.

Also Read: Is it Time to Invest in Solana (SOL)? New ETF Fuels Speculation!

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin Yearly Trend Suggests Cycle Top Near $205,000 By Year-End, Analyst Says. Accessed on June 20, 2025

- Featured Image: Generated by AI