Bitcoin Stalls at $104K—But Sentiment Hits Rock Bottom: Are the Bulls Losing the Fight?

Jakarta, Pintu News – According to Cointelegraph (20/6), retail traders’ sentiment towards Bitcoin is currently split almost evenly: some expect the price to fall, while others believe it will rise.

The level of optimism towards the crypto asset is back at the low point last seen in April – when Donald Trump’s announcement of global tariffs shook the world markets.

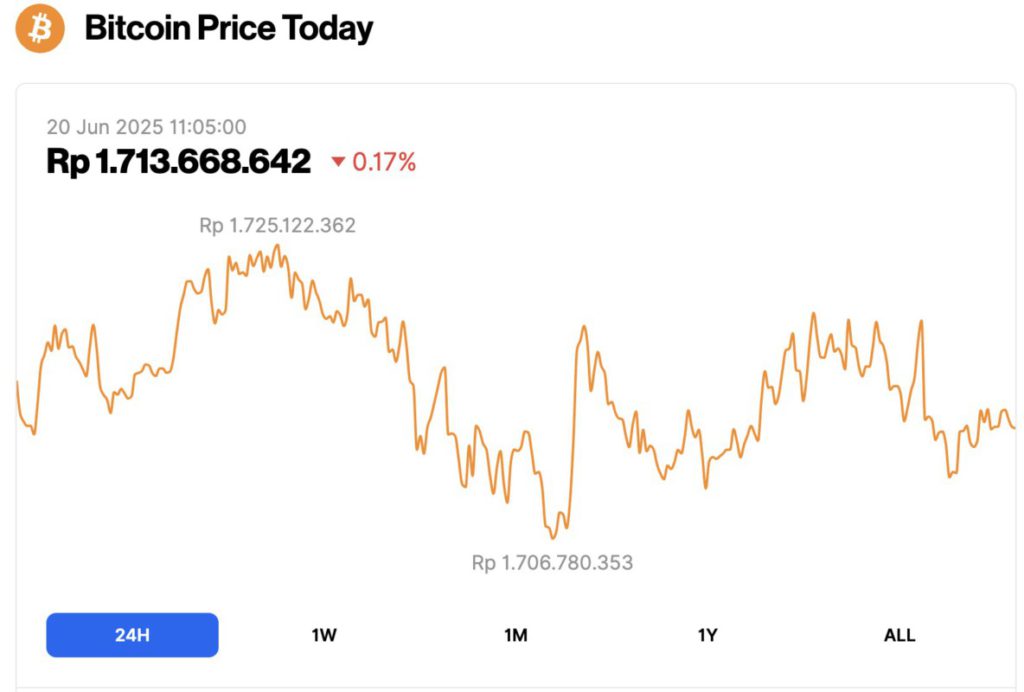

Bitcoin Price Drops 0.17% in 24 Hours

As of June 20, 2025, Bitcoin was trading at $104,624, or approximately IDR 1.71 billion, marking a slight 0.17% dip over the past 24 hours. Within that time frame, BTC reached a high of IDR 1.73 billion and dipped as low as IDR 1.70 billion.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $2.07 trillion, with trading volume in the last 24 hours falling 25% to $36.44 billion.

Read also: DOGE Tumbles to $0.16—When Could a Mind‑Blowing 600% Rally Hit?

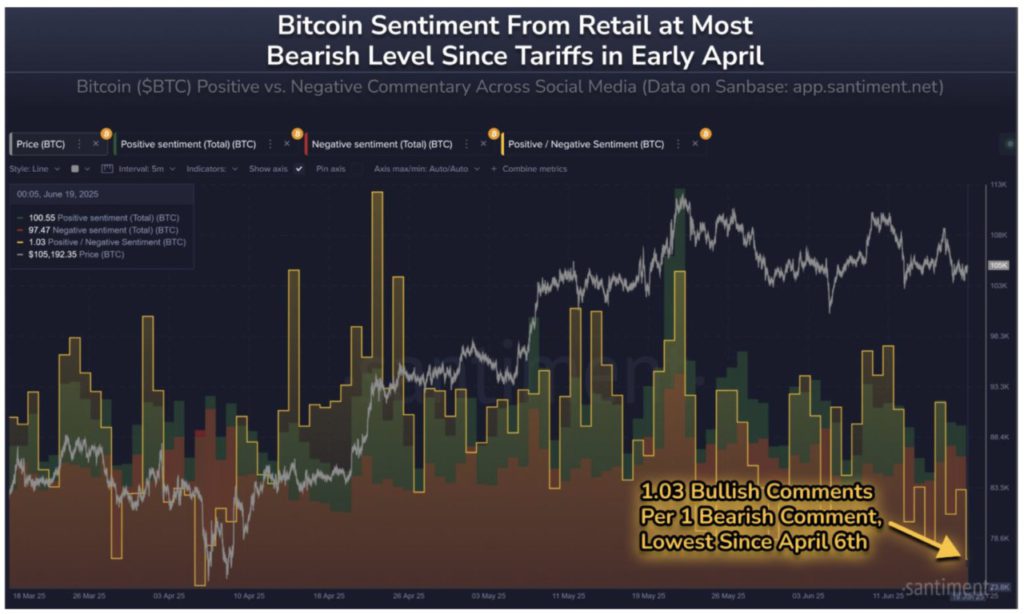

Trader Sentiment towards Bitcoin is Split

Brian Quinlivan, Marketing Director of crypto research platform Santiment, stated on Thursday that the current state of the crypto market is “sluggish,” and traders are showing “signs of impatience and bearish sentiment.”

He added that based on Santiment’s social media analysis, the ratio of positive to negative comments is currently only 1.03 bullish comments for every 1 bearish comment.

According to him, such a low number has not been seen since the peak of panic (FUD: fear, uncertainty, and doubt) due to the initial reaction to the tariff policy on April 6.

However, Quinlivan thinks that this metric could actually be a bullish signal, as historically, the market tends to move in the opposite direction to the expectations of the majority of retail traders.

Santiment’s Sanbase platform uses social tools that monitor crypto topics and trader sentiment across various social media channels such as Telegram, Discord, Reddit, and X (formerly Twitter).

Fear & Greed Index Drops to “Neutral” Level

Meanwhile, another market sentiment tracking tool, the Crypto Fear & Greed Index, saw a drop to a score of 54 from 100 on Friday, which changed the market’s attitude from “Greed” to “Neutral”.

Read also: ETH Stabilizes at $2,500 Today — Could a Breakout to $3,237 Be Next?

The index is calculated based on various signals that influence trader and investor behavior-such as Google search trends, survey results, market momentum, market dominance, social media activity, and price volatility, according to the methodology used.

The average score last week, from June 9 to 15, stood at 61, which falls into the category of “Greed.” A month earlier, the index recorded an average score of 70, which also reflected greedy market conditions.

Whale Wallet Stacks Bitcoin Again

In a separate update on Thursday (19/6), Santiment’s Brian Quinlivan revealed that large and small Bitcoin holders are currently moving in opposite directions.

Over the past 10 days, Santiment found that 231 new wallets had accumulated more than 10 Bitcoins, while more than 37,000 wallets with less than 10 Bitcoins chose to sell their assets.

“As large wallets continue to accumulate while retail investors lose confidence, this situation has historically been the ideal combination to drive a return of bullish momentum in the crypto market,” Quinlivan said.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Bitcoin sentiment at ‘peak FUD’ with divide between bears and bulls – Santiment. Accessed on June 20, 2025