$81 Million Hacking Scandal Shakes Iran, Alleged Israeli Ties?

Jakarta, Pintu News – On June 16, 2025, a massive cyberattack took place against Nobitex, the leading crypto exchange in Iran, with losses reaching over $81 million. The attack was carried out through the use of hot wallets and attracted global attention due to the alleged involvement of a pro-Israel hacker group.

Hot Wallet Intrusion

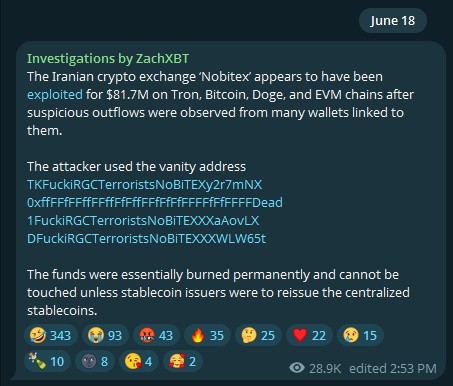

According to an investigation conducted by ZachXBT, a blockchain investigator, $81.7 million in funds have been diverted from Nobitex’s hot wallet. The funds came from the Tron network and various Ethereum Virtual Machine (EVM) chains. The attack began with the transfer of $49 million to a special address, suggesting a possible political motive behind the action.

The second address used in this theft was “0xffFFfFFffFF…Dead”, which shows great ingenuity in tricking Nobitex’s internal security system. The use of this human-readable address indicates a weakness in the exchange’s internal controls.

Hakan Unal from Cyvers Security emphasized that the system that was supposed to prevent unauthorized access was successfully breached by the hackers. Nobitex itself has confirmed that it was quick to realize the security breach and immediately suspended the affected hot wallets.

Also Read: Bitcoin Survives Global Uncertainty, Will it Continue to Rise?

Political Motives and Security Threats

A hacker group calling themselves “Gonjeshke Darande” claimed responsibility for this attack through a post on X. They called Nobitex a financing tool of the regime and threatened to release the source code and internal information within 24 hours. This attack comes amid rising tensions between Israel and Iran, which culminated in Israel’s largest incursion into Iran since the 1980s.

This attack not only stole funds, but also raised serious concerns about the security of users’ personal information and data. Nobitex has promised to cover all losses with their insurance funds and internal resources, but the threat of the release of source code and internal files could spark panic among users.

Security and User Protection Measures

Nobitex confirms that key user funds are safe in cold storage and only a small portion of assets in hot wallets were affected. Nonetheless, this incident highlights the importance of extra protection against unauthorized access, both from inside and outside the organization. It also demonstrates the importance of having strong security protocols and a quick response in the face of a cybersecurity incident.

As of now, the stolen funds have not moved, which may indicate that the hackers are planning their next move or it could be a warning shot that they could strike again. Either way, this is a reminder for all crypto exchanges to improve their security and ensure that user assets are well protected.

Conclusion

This incident is not only financially devastating but also raises serious questions about security and trust in the crypto ecosystem. Nobitex and other exchanges must take immediate steps to strengthen their security, fix weaknesses, and restore user trust. Looking ahead, the eyes of the world will be on how Nobitex and the crypto industry as a whole respond to these security challenges.

Also Read: Is it Time to Invest in Solana (SOL)? New ETF Fuels Speculation!

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Iran’s Top Crypto Hub Loses $81 Million to Hackers with Israeli Links. Accessed on June 20, 2025

- Featured Image: The Chain Bulletin