Booming: Solana Rakes In $1 Billion in Q2 as dApps and Meme Coins Fuel Massive Surge!

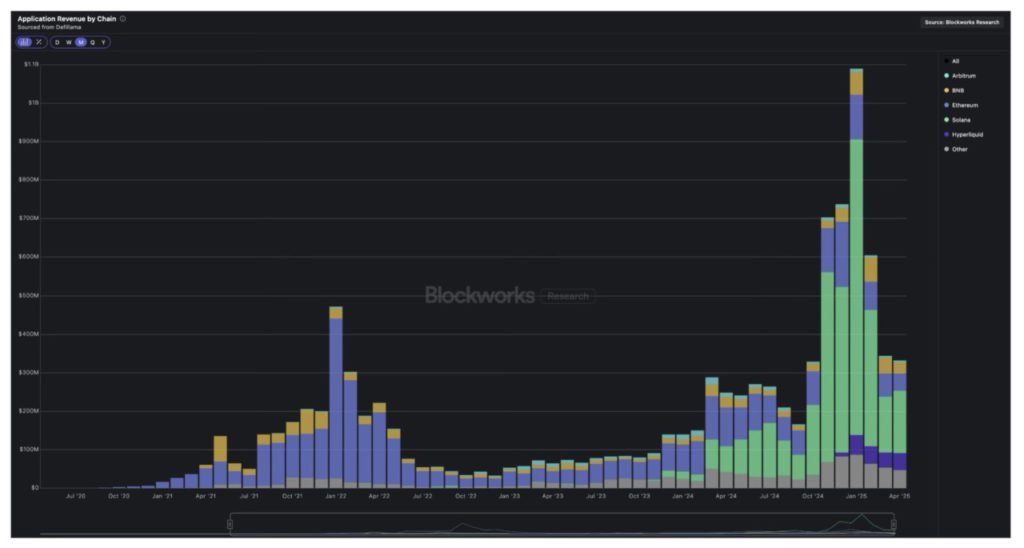

Jakarta, Pintu News – Solana continued to show positive growth throughout 2025, recording app revenue of more than $1 billion for the second consecutive quarter.

The Solana Foundation’s latest Network Health report published on June 20 highlights the improved economic performance of the blockchain.

According to the report, this growth is driven by improved protocol efficiency, developer engagement, and incentives for validators.

Thanks to Meme Coin, Solana is One of theBblockchains with the Highest Revenue!

The report shows that app revenue on the Solana network peaked in January 2025, generating more than $806 million in just one month.

Read also: Fartcoin Whale Drops $2 Million Right Before $6 Million Crash – Is a Major Dump Incoming?

This was followed by $376 million in February, which pushed the network app’s total revenue for the quarter over the one billion dollar mark.

One of the main factors behind this surge is that the Solana blockchain network has become a hub for meme coin trading. Meme coin launch platforms like Pump.fun have emerged as a dominant force within the ecosystem.

In addition, the launch of viral political tokens such as the Trump and Melania meme coin helped drive user activity and increased transaction fees across the network.

According to the report, these tokens are not only socially viral-but also generate real transaction fees, which contribute significantly to the network application’s revenue metrics, much like GDP(Gross Domestic Product) in a traditional economic context.

With this in mind, fees from decentralized exchanges and other on-chain services are now a key indicator of Solana’s economic activity.

This growing revenue encourages developers to stay on the Solana network. In addition, it allows the network to reinvest into critical infrastructure, so that the ecosystem can continue to evolve with the needs of its users.

Solana Outperforms Ethereum by 7,000% in Polling Stations

Furthermore, the report also highlights Solana’s dominance in attracting developers.

In 2024, Solana became the top blockchain for new developers, maintaining more than 3,200 monthly active contributors and recording 83% growth in developer engagement compared to the previous year.

The stability of Solana’s network has been instrumental in driving this trend. The network has maintained 100% uptime for more than 16 consecutive months. This includes periods with the highest daily trading volumes, which reached $39 billion in January 2025.

Read also: Shiba Inu to the Moon? When SHIB Could Skyrocket from $0.01 to $1!

Meanwhile, major technical upgrades in the Solana network also managed to bring down the average relay time to less than 400 milliseconds-a significant leap compared to previous years.

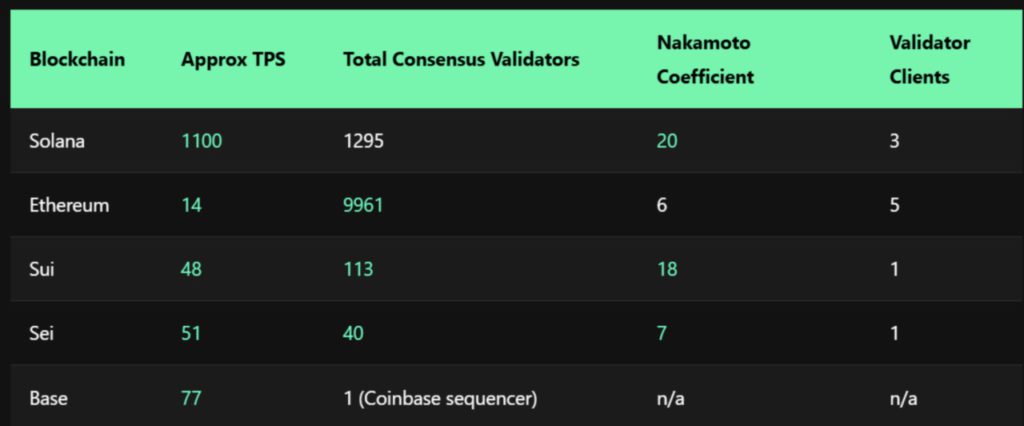

Transaction capacity remains a key metric, with Solana processing around 1,100transactions per second ( TPS)-far beyond Ethereum’s average of around 14 TPS.

Validator rewards are also on the rise, withreal economic value ( REV) reaching a record $56.9 million on January 19.

Average quarterly REV now stands at $800 million, while the break-even staking threshold (for yield to be proportional to cost) dropped from 50,000 SOL in 2022 to just 16,000 SOL this year.

Overall, Solana’s consistent improvements in performance, developer retention, and revenue show that the network is on a growth path.

All these advancements indicate that Solana is evolving into one of the most sustainable ecosystems in the industry.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Solana Hits $1 Billion Revenue in Q2 as dApps and Meme Coins Take Off. Accessed on June 23, 2025