Bitcoin Liquidation Surge: Threat or Opportunity?

Jakarta, Pintu News – Bitcoin has shown narrow price movements over the past week, but the futures market is showing a different development. Analyst Axel Adler Jr. of on-chain analytics platform CryptoQuant, highlighted a surge in long liquidation dominance that could change market sentiment and wash the bears out of the market.

Long Liquidation Spike without Price Crash

The dominance of long liquidations has jumped from 0% to over 10% in the last seven days. This usually indicates pressure on bullish traders. However, what’s interesting is that, despite the increase in liquidation pressure from the long side, the price of Bitcoin (BTC) has not experienced a sharp decline.

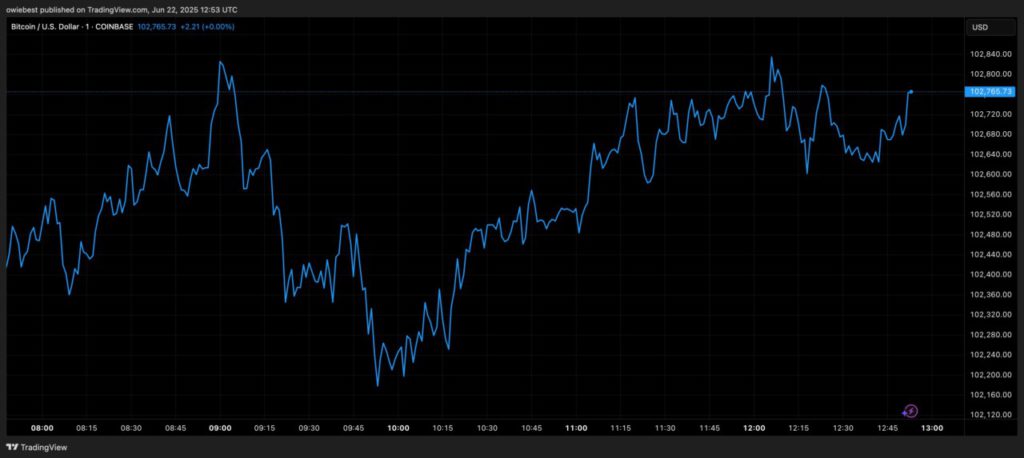

In the week just passed, Bitcoin (BTC) held in the range of $103,000 to $106,000, before finally experiencing a decline. Despite the increase in liquidation, the price of Bitcoin (BTC) remained stable, indicating the presence of underlying forces in the market. This stability suggests that the market may be preparing for a bigger move, especially if selling pressure can be controlled and overcome.

Read More: Crypto Market Crisis: The Impact of US Attack on Iran on Bitcoin and Ethereum!

Large Wallet Accumulation as Retail Exits

Data from Santiment, another on-chain analytics platform, shows an interesting dynamic between Bitcoin (BTC) holders. In the last ten days, the number of wallets holding more than 10 Bitcoin (BTC) has increased by 231 addresses, up 0.15%.

Meanwhile, the number of small wallets holding between 0.001 to 10 Bitcoin (BTC) has decreased by 37,465. This trend suggests a divergence in sentiment between large and retail holders. Large holders seem to be more optimistic and continue to accumulate Bitcoin (BTC) despite the uncertainty in the market, whereas retail investors tend to exit the market.

Geopolitical Impact on Bitcoin Price

Bitcoin’s (BTC) price drop in the past 48 hours can be largely attributed to the US military strike on Iran. This attack caused anxiety in the market in general. Bitcoin (BTC) fell 3.2% after the announcement of the attack, similar to the 6% drop during similar tensions with Iran in 2020.

The impact of these geopolitical tensions shows how sensitive the cryptocurrency market is to global events. Although Bitcoin (BTC) is often considered a “safe haven” asset, in the short term, prices can be greatly affected by global instability.

Conclusion: Bitcoin’s Future Amid Uncertainty

Despite facing pressure from long liquidations and geopolitical instability, Bitcoin (BTC) is still showing signs of underlying strength. Accumulation by large wallets and price resilience suggest that Bitcoin (BTC) may be poised for a recovery. However, investors should remain wary of potential volatility caused by external factors.

Also Read: Sharp ADA Decline Amid Geopolitical Tensions, What’s the Impact? (23/6/25)

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bears Washed Out Bitcoin. Accessed on June 23, 2025

- Featured Image: Generated by AI