Bitcoin (BTC) is in free fall, is this the end of its June 2025 bull run?

Jakarta, Pintu News – Recent geopolitical tensions have created huge waves in the cryptocurrency market, particularly Bitcoin . With attacks taking place in the Middle East, short-term Bitcoin (BTC) investors have been seen selling heavily despite losses. This phenomenon shows how global volatility and uncertainty can affect investor behavior in the crypto market.

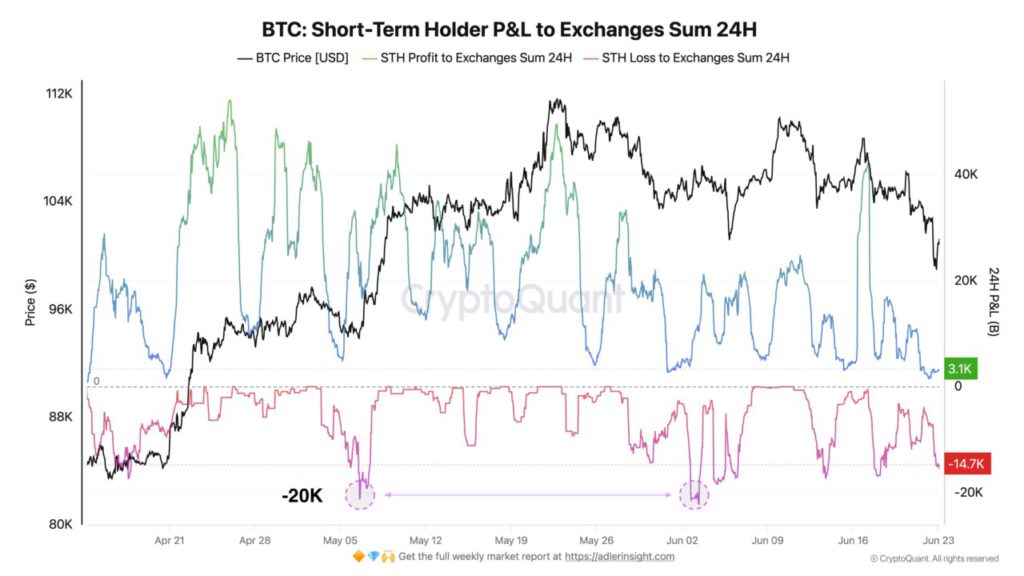

Loss Selling by Short-term Holders

The latest on-chain data shows that Bitcoin (BTC) short-term holders have moved around 14,700 BTC to exchanges at prices lower than their purchase price. This is a clear indication of panic action triggered by extreme price instability.

Short-term holders, defined as those who hold Bitcoin (BTC) for less than 155 days, tend to be more quickly affected by market changes and make sell under pressure decisions. At the same time, long-term holders of Bitcoin (BTC) seem to be more stable and less affected by price fluctuations.

This group, which owns Bitcoin (BTC) for more than 155 days, is usually made up of more experienced investors who have a stronger belief in their investment over the long term.

Read More: Israeli Spy Arrested in Iran: Crypto Motives Behind Digital Espionage?

Technical Analysis and Price Predictions

According to Elliott Wave analysis, Bitcoin (BTC) is expected to experience a further decline towards $94,000 before finding a stable point. However, the analysts also warn that this downward trend may not be over yet and there is still potential for a deeper drop. At the beginning of the week, Bitcoin (BTC) briefly rose above $105,000, but soon fell back below that mark.

In addition, Dogecoin is also showing signs of a big move. Analysts predict that Dogecoin (DOGE) could experience price changes of up to 60%, but it is still unclear whether it will go up or down. This shows that not only Bitcoin (BTC) is experiencing volatility, but also other cryptocurrencies.

Geopolitical Impact on Crypto Market

The unexpected peace between Iran and Israel on June 24, 2025 has created a price surge in the crypto market. Bitcoin (BTC) managed to peak at $106,000 after the announcement of the ceasefire. This shows that while the crypto market is highly vulnerable to geopolitical issues, it can also recover quickly from negative impacts if there are positive developments.

This event provides an important lesson on how external factors such as political policies and global conflicts can affect the value of cryptocurrencies. Investors should always be aware of global dynamics that can change market conditions at any time.

Cover: The Future of Bitcoin (BTC)

Despite facing many challenges and volatility, the Bitcoin (BTC) market is still showing resilience. Long-term investors may continue to support the stability of this market, while short-term holders may need to evaluate their strategies to avoid heavy losses. Moving forward, it is important for all parties to understand the risks and opportunities involved in crypto investments.

Also Read: Dogecoin Continues to Slump: Is this $480 Utility Coin the Wiser Choice in the Crypto World?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin STHs Capitulate, 14,700 BTC Exchanges Lose. Accessed on June 25, 2025

- Featured Image: Generated by AI