Will Bitcoin (BTC) Recover from Market Fears in June 2025?

Jakarta, Pintu News – The Bitcoin market has recently experienced a significant drop, from almost $112,000 to $101,300, sparking concern among investors. The market sentiment changing from optimism to neutral, and possibly even towards fear, raises a big question: how low will the Fear & Greed Index go before Bitcoin (BTC) begins its recovery?

Current Bitcoin (BTC) Market Dynamics

Bitcoin’s (BTC) sharp price drop has shaken investor confidence and changed market dynamics. Although on-chain metrics show cautious optimism, the momentum for recovery still seems weak. Technical analysis suggests that Bitcoin (BTC) might find support in the range of $97,900 to $100,700, which is considered a fair value zone.

Heightened concerns in the traditional market could worsen the situation, pushing the price of Bitcoin (BTC) to drop below $98,000. However, the market structure that has changed since May still shows a bullish bias, giving investors some hope.

Read More: Israeli Spy Arrested in Iran: Crypto Motives Behind Digital Espionage?

Fear and Greed Index: A Predictor or a Follower?

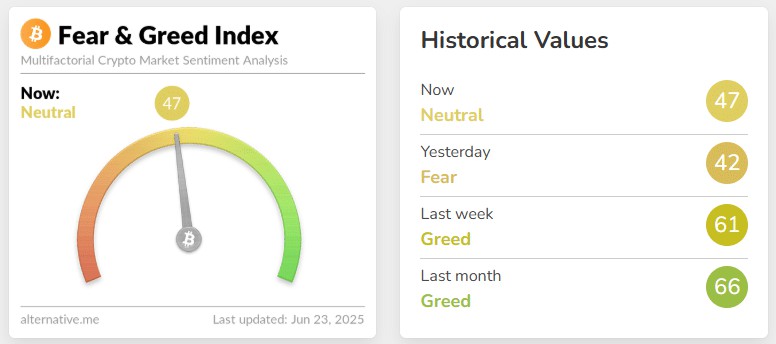

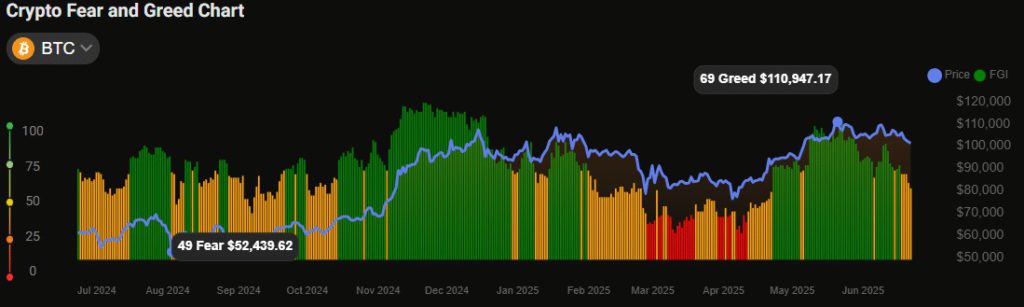

The Fear and Greed Index is often considered a barometer of market sentiment. When the index shows ‘extreme fear’, it is often considered a good time to buy, while ‘extreme greed’ can be a signal to sell. Currently, the index is at neutral levels, indicating uncertainty in the market.

The movement of this index is important to monitor as it can provide insight into possible market turning points. If the index drops further into the ‘extreme fear’ zone, this may be an indicator that the market has bottomed and is ready for a recovery.

Technical Analysis and Critical Support Levels

According to Fibonacci analysis, there are some critical support levels to watch if Bitcoin (BTC) continues to lose value. The levels of $93,200, $88,800, and $82,500 will each be important areas. Additionally, the six-month liquidation heatmap shows that $92,600 could be an attractive price target.

It is important to notice that the Volume Balance (OBV) does not show great selling pressure, which could be a sign that further declines may be limited. However, without significant demand, it is difficult to see a bullish recovery from $100,000.

Conclusion: What’s Next for Bitcoin (BTC) Investors?

Investors and traders should remain vigilant and monitor market indicators closely. The market structure on the daily chart has turned bearish, signaling that it may take a more fearful market sentiment before Bitcoin (BTC) can begin a significant recovery. Understanding these dynamics will be crucial for a successful investment strategy in the future.

Also Read: Dogecoin Continues to Slump: Is this $480 Utility Coin the Wiser Choice in the Crypto World?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. How low will the Crypto Fear & Greed Index go before Bitcoin recovers?. Accessed on June 25, 2025

- Featured Image: Generated by Ai