Bitcoin Soars Past $107,000 Today (June 26) — Here Are the 4 Reasons Behind the Surge!

Jakarta, Pintu News – Since mid-June, Bitcoin has shown remarkable resilience by convincingly reclaiming the support level above $100,000.

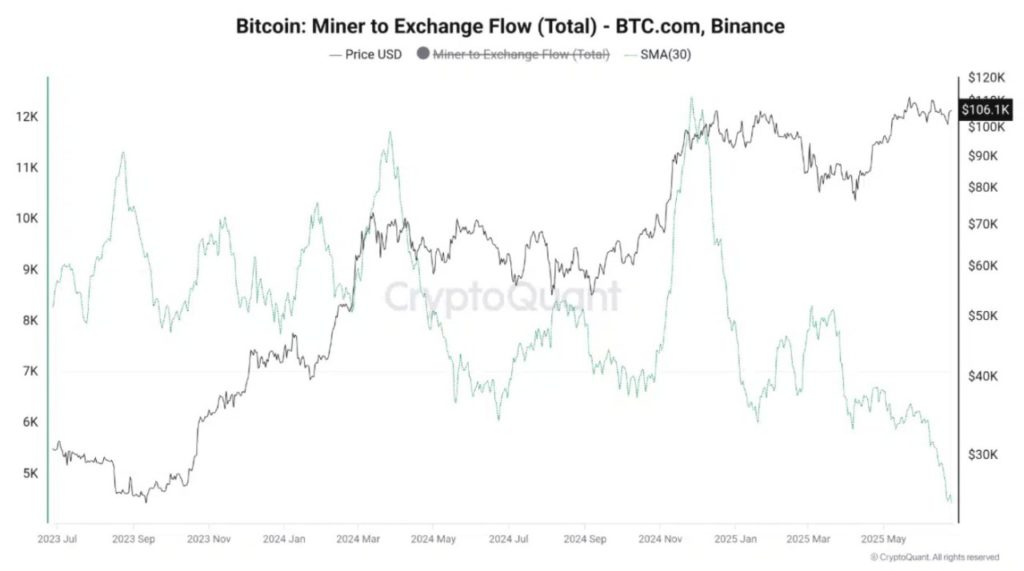

Simultaneously, more than $240 million in BTC exited the exchange. This was a signal of aggressive accumulation, not fear. Naturally, the most noticeable change came fromminers.

Before discussing further, let’s explore the current Bitcoin price movement first!

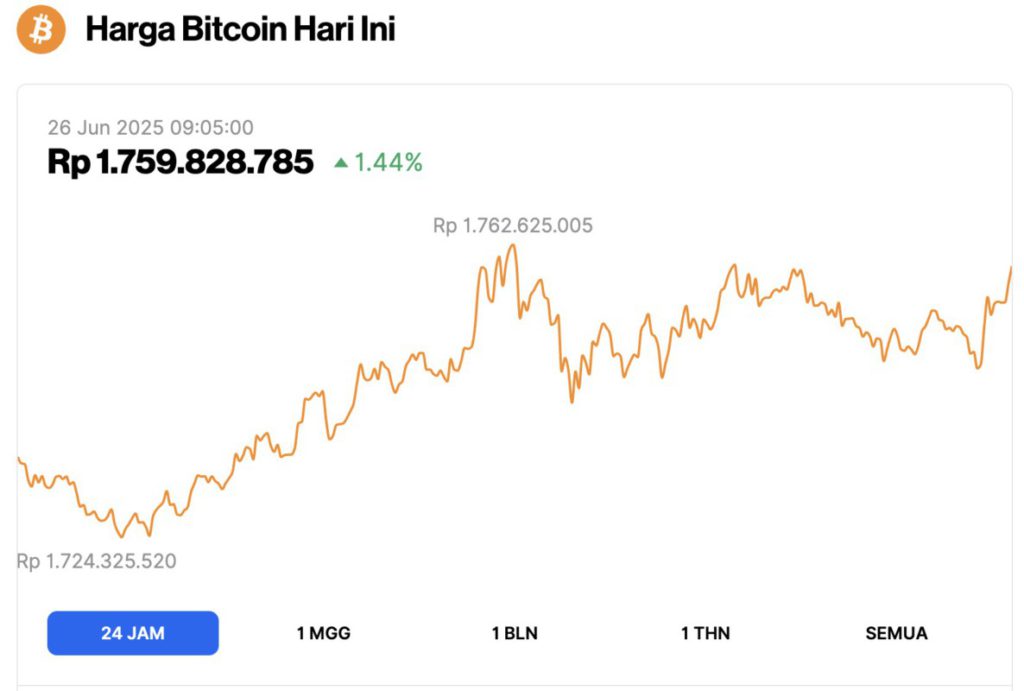

Bitcoin Price Rises 1.44% in 24 Hours

On June 26, 2025, Bitcoin was trading at $107,926 — equivalent to IDR 1,759,828,785 — marking a 1.44% gain over the past 24 hours. Throughout the day, BTC fluctuated between a low of IDR 1,724,325,520 and a high of IDR 1,762,625,005.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $2.14 trillion, with trading volume in the last 24 hours rising 3% to $50.3 billion.

Read also: Altcoin Season 3.0 Set to Ignite on July 1? Golden Cross Sparks Massive Rally Hype, Say Analysts!

Miners Stop Selling, Smart Money Takes Notice

As reported by AMB Crypto (25/6), BTC.com’sMiner to Exchange Flow fell to its lowest point in a year, just as the price remained above $100K.

In fact, it is historically one of the most consistent indicators of sales.

With Bitcoin price trading at $106,654 at the time of writing, the convergence between miner confidence and whale accumulation creates a bullish backdrop.

These signals suggest that long-term holders are preparing for a possible breakout, while short-term volatility is still ongoing.

Are these big players secretly laying the foundation for Bitcoin’s next big surge on a macro level?

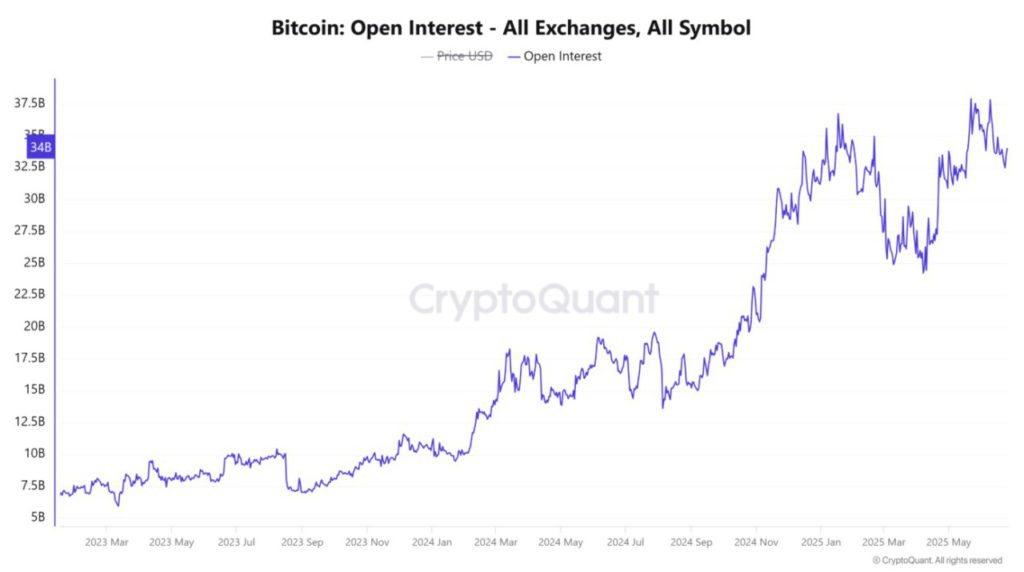

Bitcoin Open Interest Reaches $33.97 Billion

Meanwhile, Open Interest jumped 4.07% in 24 hours (25/6), reaching $33.97 billion across various derivatives platforms. This increase indicates that traders are getting back into the market with renewed leverage exposure.

However, the absence of large price movements accompanying this rise suggests that the market is in abuildup phase.

Read also: Bitcoin, Ethereum, and Sui: Which Crypto Will Explode This Year?

This kind of divergence often precedes explosive volatility spikes, especially when Funding Rates remain balanced.

And indeed, Funding Rates registered slightly negative at -0.0009%, signaling a healthy long/short dynamic without excessive position density.

Network Activity Increases, but is Undergoing a Shift

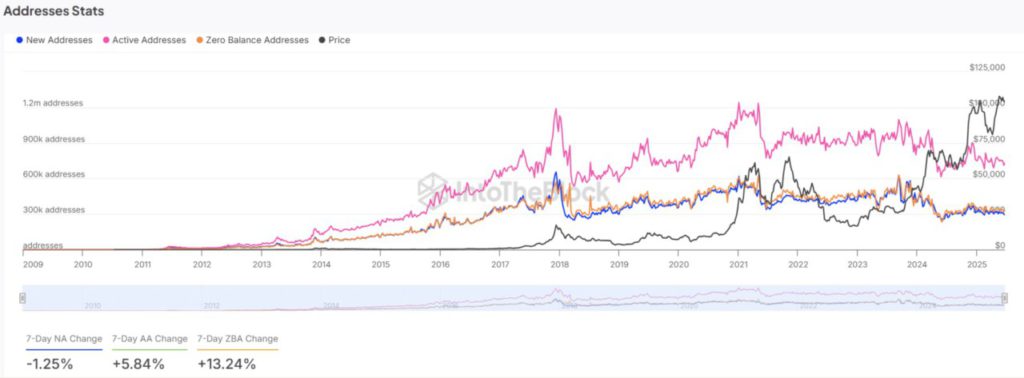

Address metrics provide a more complex picture of current sentiment. Active Addresses are up 5.84% this week, reflecting stronger user engagement.

However, New Addresses actually fell by 1.25%, which clearly shows that the latest activity came from old participants, not newcomers.

On the other hand, Zero Balance Addresses surged 13.24%-probably due to wallet consolidation or asset redistribution, not panic selling.

These contrasting patterns suggest a shift among existing participants, not an influx of new investors.

Even so, the increasing activity of active users provides a foundation for continued demand if broader market interest returns.

Why has the Scarcity of Bitcoin Increased Dramatically?

If supply determines value, then Bitcoin’ s Stock-to-Flow Ratio(S2F) just made a big statement. This metric jumped to 757-the highest level in years.

Historically, a very high S2F ratio often coincides with the start of a major bull run, especially if accompanied by a strong accumulation trend.

When this high scarcity is combined with growing demand, it creates very favorable conditions for long-term price appreciation.

Can BTC touch higher levels after bouncing off $100K?

Bitcoin found strong support in the $100K-$102K zone, which coincides with an important Fibonacci cluster.

Read also: Texas Allocates $10 Million for the First Public Bitcoin Reserve!

This bounce pushed the price back above $106K, while the RSI rose to 54.12-indicating recovering strength without entering overbought conditions.

If the bulls are able to maintain this momentum, the next important resistance levels are around $110K, $112K, and $119K.

As such, recovery from the strong support zone-plus healthy technical momentum-could potentially trigger a retest of the higher Fibonacci extensions in the near term.

In conclusion, BTC’s recent price stability above $100K is no coincidence-it is supported by a decrease in outflows from miners, a rise in Open Interest, and deep on-chain accumulation.

The convergence of easing selling pressure, record-breaking scarcity, and technical recovery sets a strong stage for the next bullish phase.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Bitcoin at $106K – Examining 4 catalysts driving BTC’s steady rise. Accessed on June 26, 2025