Will Bitcoin and Ethereum Go into Freefall? Check out the Post Expiry Predictions of $17 Billion in Options!

Jakarta, Pintu News – Currently, Bitcoin and Ethereum are showing upward momentum after successfully defending key support levels. However, with the upcoming monthly options expiry and PCE inflation data from the US, there is potential for a retracement or even a crash this Friday.

Check out the full analysis in this article!

Bitcoin and Ethereum Options Expiration Worth Over $17 Billion

According to data from Deribit, 139K Bitcoin (BTC) options with a face value of over $15 billion will expire on June 27. Currently, the put-call ratio is 0.74, indicating a slightly bearish sentiment among traders. This is the largest options expiry this year, and traders seem to be cautious.

The max pain point for Bitcoin (BTC) is at $102,000, which signals a possible price correction. Traders may adjust their positions, which could lead to increased volatility.

Read also: Crypto Trader Experiences Spectacular Ups and Downs: From $6.8 Million Profit to $10 Million Loss!

Bitcoin and Ethereum Price Movement

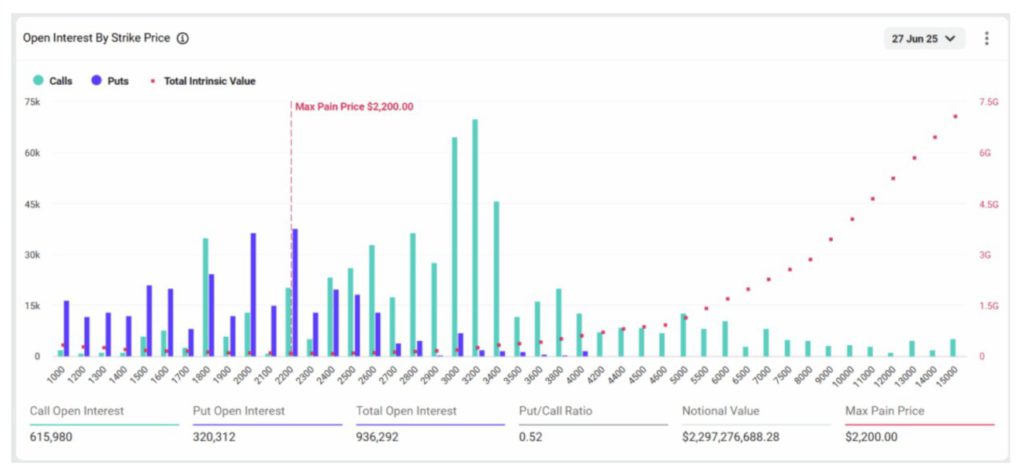

Meanwhile, 936K Ethereum (ETH) options with a face value of nearly $2.3 billion will also expire. The put-call ratio for Ethereum (ETH) is 0.52, showing a slightly bearish change in sentiment in the past 24 hours to 0.95.

PCE inflation data expected by economists to be 2.3%, up from 2.1% the previous month, will also have an effect on prices. Fed Chairman, Jerome Powell, has displayed a hawkish stance during congressional testimony, indicating a reluctance to cut interest rates due to US tariffs.

Also read: Bitcoin (BTC) Preparing to Break Record Highs in the Next 42 Days, Here’s the Analysis!

On-Chain Analysis and Trading Volume

On-chain data from CryptoQuant shows the risk of Bitcoin (BTC) selling off. The MVRV ratio shows a slowdown in momentum, which could mean that the bull market is entering its final stages.

Bitcoin (BTC) price today is moving sideways to the downside, with the current price at $107,199. The 24-hour low and high were $106,817 and $108,305. Trading volume has decreased by 7% in the past 24 hours, indicating a decrease in interest among traders.

On the other hand, the price of Ethereum (ETH) also reduced its previous gains, with the current price being $2,436. The lowest and highest prices in 24 hours were $2,399 and $2,519. Trading volume has increased by 13% in the last 24 hours, indicating increased interest.

Conclusion

With various factors at play, the Bitcoin (BTC) and Ethereum (ETH) markets are likely to experience high volatility in the near future. Investors and traders are advised to monitor trading volumes and liquidations for clues on the upcoming price direction.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto Times. How Will Bitcoin and Ethereum Price Move Amid $17 Billion Options Expiry. Accessed on June 30, 2025

- Featured Image: Cityam