SEI Crypto on Fire: Exploding User Activity Could Trigger Massive Short Squeeze at $0.35!

Jakarta, Pintu News – Sei experienced a significant surge in user activity, with Daily Active Wallets increasing by 10.49% to 561,000, and Daily Transactions jumping 20.13% to 1.47 million.

These figures confirm that the SEI adoption wave, which has been building since the beginning of the second quarter, has now entered an accelerated phase, pushing the SEI price to $0.3039.

These indications point to renewed momentum – but will it be enough to take the SEI higher?

Will SEI’s Social Momentum Lead to Sustained Market Confidence?

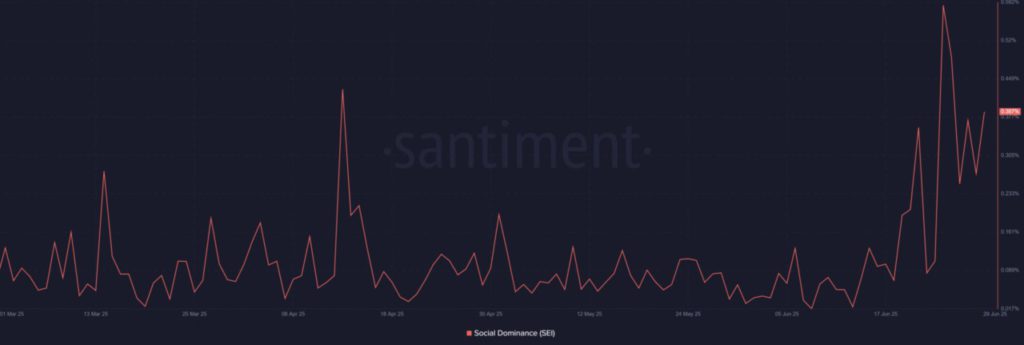

According to AMB Crypto, SEI’ s Social Dominance briefly touched 0.59% before settling at 0.387%, while Positive Sentiment surged past 14 on June 27, according to data from Santiment.

Read also: 3 Cryptos You Must Watch in the First Week of July 2025!

This rise in visibility suggests that the token is starting to attract wider interest, likely driven by strong community support as well as media exposure.

However, while a spike in social chatter is often the first sign of a breakout, it can also trigger speculative activity.

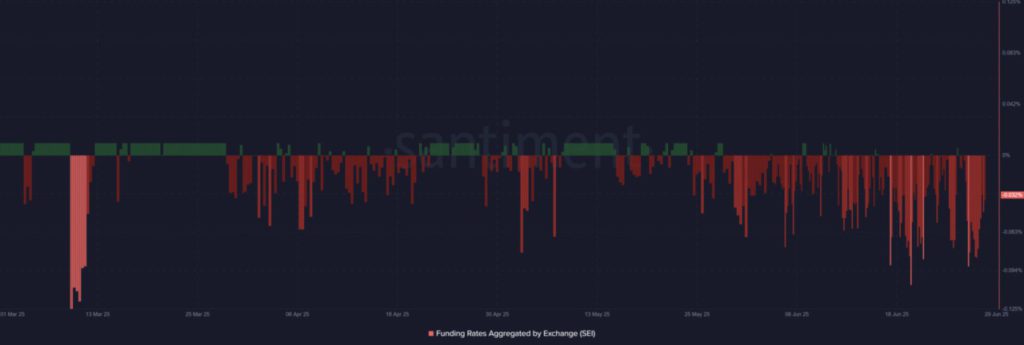

Despite the on-chain support and positive sentiment, Funding Rates remain negative at -0.032% at the time of this report-a clear sign that market positioning is still dominated by shorts.

The consistency of the red funding bar reflects the hesitation of derivatives traders to fully support this rally.

However, these contrarian positions can actually fuel a potential short squeeze, especially if prices continue to rise and force liquidation on the bearish side.

Could this Strengthen SEI’s Upward Pressure?

On June 29, Open Interest jumped 7.78% to $310.87 million-reinforcing the view that speculative capital flows are starting to return to the SEI.

Read also: Massive Altcoin Surge Ahead? Analysts Say This Could Be the Next Big Crypto Explosion!

A rise in this metric along with the price usually signals increased market confidence. In fact, it shows that both bulls and bears are preparing for the next big move.

Now, traders will have to watch whether the flow of fresh capital will continue, or if it will start to weaken as the SEI approaches the resistance area.

Meanwhile, SEI managed to break out of the descending channel after several months in a bearish market structure. As of June 29, the price is holding around $0.3039 and is getting closer to the next major resistance at $0.3508.

As of June 29, the RSI stood at 67.89-signaling that it is still bullish, but has yet to reach the overbought level. This gives the bulls additional room to maneuver, especially if the trading volume is supportive.

However, failure to break the $0.35 mark may cause the price pressure to narrow, or even trigger a retest of the previous breakout zone.

Ultimately, the SEI breakout was supported by a surge in user activity, high speculative interest, and positive sentiment.

However, the presence of a still negative funding rate and strong resistance at $0.35 brings short-term risks. If the bulls are able to maintain momentum and break the level, SEI could enter a new price discovery phase.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. SEI’s user activity soars – Is a short squeeze here as price nears $0.35? Accessed June 30, 2025