Bitcoin Slips to $107K Today— Is a Drop to $105K the Next Big Move?

Jakarta, Pintu News – Bitcoin has slowly recovered towards the $108,000 price level over the past week, supported by a modest recovery in the overall crypto market.

However, on-chain data suggests that this recovery may soon face obstacles.

Increased selling pressure fromminers andlong-term hold ers ( LTHs) could potentially correct the king coin ‘s recent gains.

Then, how is the current Bitcoin price movement?

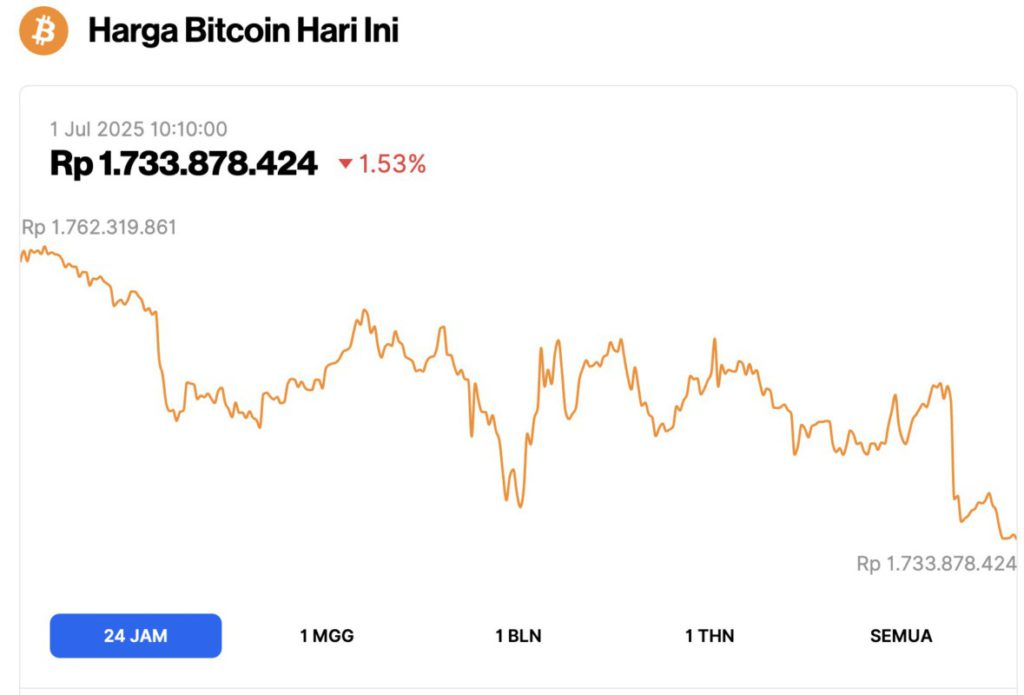

Bitcoin Price Drops 1.53% in 24 Hours

On July 1, 2025, Bitcoin was trading at $107,143, or approximately IDR 1,733,878,424, marking a 1.53% dip over the past 24 hours. Throughout the day, BTC reached a high of IDR 1,762,319,861 and a low matching its current price, highlighting a modest but noticeable correction in the market.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $2.13 trillion, with trading volume in the last 24 hours up 12% to $42.17 billion.

Read also: 3 Altcoins to Watch Closely in Early July 2025 – Could These Be the Next Big Breakouts?

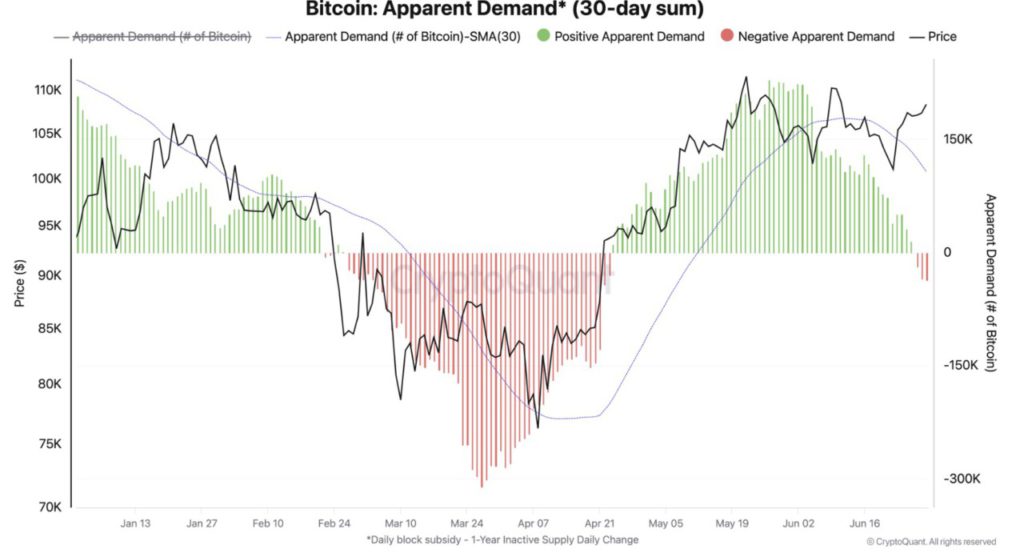

Bitcoin Selling Pressure Increases

According to CryptoQuant, BTC’s Apparent Demand recorded a negative value again. This indicates that buyer activity is failing to keep up with the growing supply in the market.

As of June 30, 2025, the metric-observed through the 30-day small moving average (SMA)-is at -36.98.

The Apparent Demand metric measures the balance between new market demand and two main sources of supply: newly mined coins and coins sold by previously dormantlong-term holders ( LTHs).

Negative readings like this suggest that the volume of BTC coming into the market currently exceeds the absorptive capacity of new buyers. This reflects the weak market conditions lingering from the recent geopolitical tensions involving Israel, Iran, and the US-although those tensions seem to be easing.

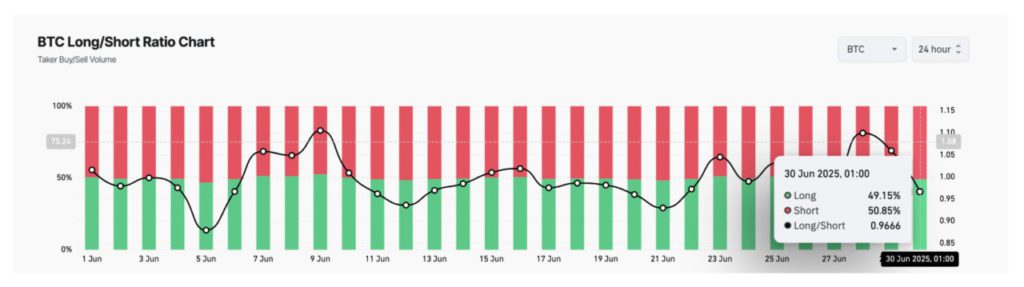

BTC Long/Short Ratio

Moreover, data from the BTC long/short ratio supports this bearish view. At the time of writing, the ratio stands at 0.96, which means more traders are betting against a fall in BTC prices.

This ratio compares the number of long and short positions in the market. When the long/short ratio of an asset is above 1, it means that there are more long positions than shorts, signaling that traders are predominantly betting on price increases.

Conversely, as is the case with BTC, a ratio below 1 indicates that most traders are positioning themselves for a price drop. This reflects the increasing bearish sentiment and the expectation of continued price declines.

Read also: Massive Altcoin Surge Ahead? Analysts Say This Could Be the Next Big Crypto Explosion!

With short positions outweighing long positions among BTC holders, sentiment in the derivatives market reflects the same scarcity of demand as seen from on-chain data, confirming rising expectations of a potential price correction.

Bitcoin Supply Surge Threatens to Fall to $105,000

On June 30, BTC was trading at $108,102. If buyers fail to absorb the rising tide of supply, the price of the coin could struggle to stay above that level and risk retesting the support zone at $107,745.

If this level is unable to withstand the selling pressure, BTC could potentially fall below $105,000 and trade around $104,709.

However, if there is a surge in demand, it could prevent further declines. In that scenario, BTC has a chance to recover, break the resistance level at $109,304, and try to retest its all-time high at $111,917.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Why Bitcoin Price Might Drop Below $105,000 in the Coming Days. Accessed on July 1, 2025