Will Bitcoin Cash Companies Go Bust in 2025?

Jakarta, Pintu News – Venture firm Breed recently issued a stern warning to all companies that hold Bitcoin on their balance sheets.

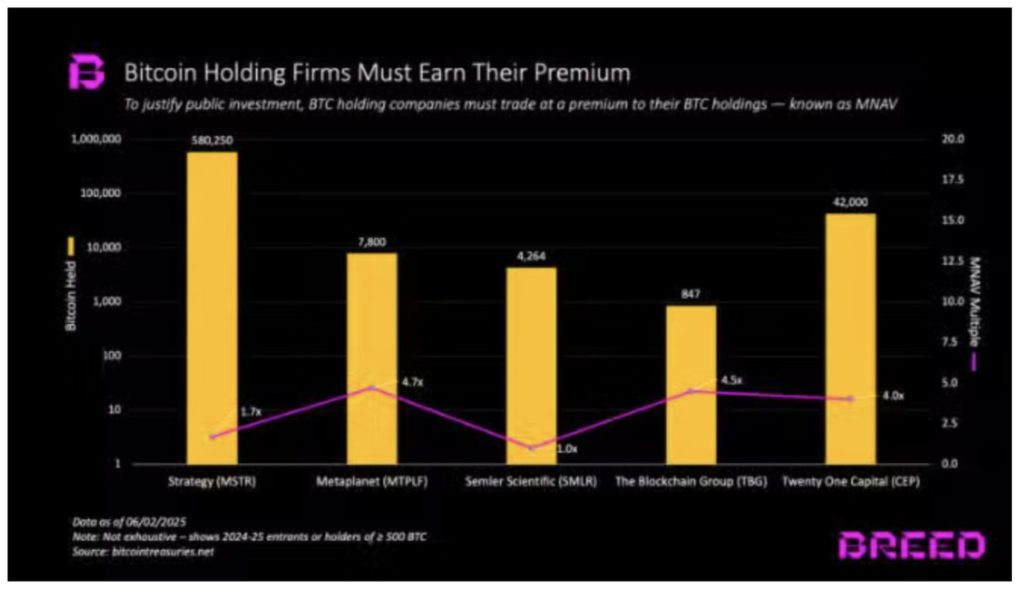

According to their latest report, many companies using this strategy will not survive in the event of a sharp drop in Bitcoin (BTC) price, unless they can maintain a trading value that is well above their net asset value (NAV).

Check out the full information below!

Early Warning from Breed

Breed identifies the main risks faced by companies with Bitcoin (BTC) cash on their balance sheets. If the price of Bitcoin (BTC), which is currently above $107,000, experiences a drastic drop, the market-to-NAV (MNAV) premium will shrink.

This will make investors reluctant to pay more for shares backed by assets that are declining in value, so new funding will quickly dry up. Without fresh capital, these companies will struggle to meet their financial obligations.

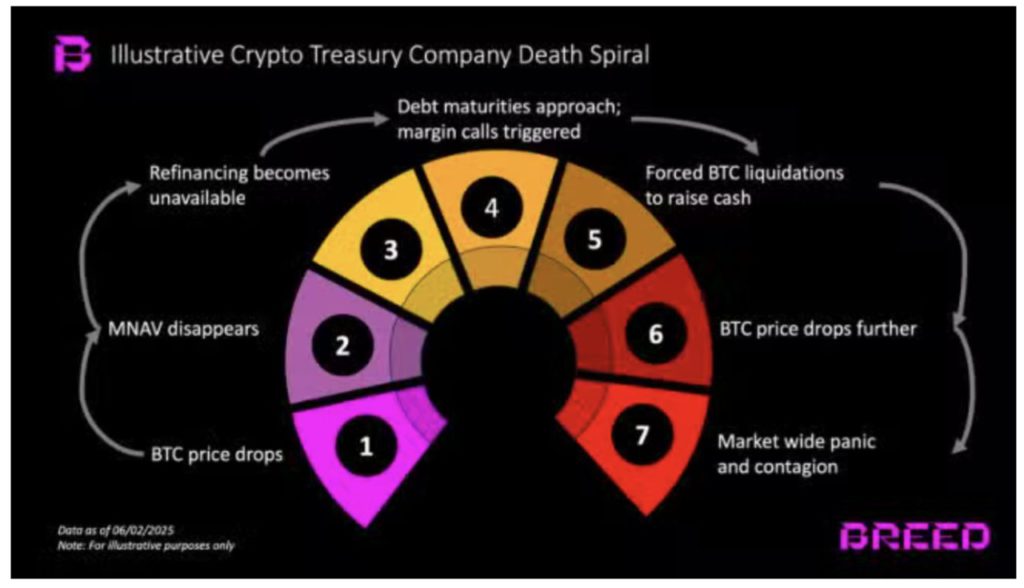

Many of them borrow or raise funds to buy more Bitcoin (BTC), hoping that the coin’s price will rise faster than their financing costs. If the capital is depleted while the loan matures, the lender will demand a margin and force a sale.

Also read: Ripple CEO’s 1000% Commitment to XRP Goes Viral, Why?

Risk of Death Spiral

These forced sales will lower the price of Bitcoin (BTC) further, which in turn will affect the balance sheets of other companies playing in the same arena. Breed calls this phenomenon a “death spiral”.

Currently, many cash companies still rely on equity funding, which gives them a cushion from margin calls. However, Breed warns that the situation could change if cheap debt tempts stewards to increase leverage. A sector built on leverage will become more fragile; one sharp price swing could push dozens of companies into compulsory liquidation simultaneously.

Only a few companies are expected to survive. The ones that survive are the ones that can increase Bitcoin (BTC) per share even in a stagnant market, communicate clearly, and avoid unsustainable leverage.

Also read: Hal Finney’s Prediction: “Bitcoin (BTC) Will Reach $10 Million!”

Survival Strategy

The importance of strong governance and cash reserves is more important than the total amount of Bitcoin (BTC) held. Companies that have both of these elements are more likely to weather the storm.

Since MicroStrategy opened its corporate cash guidebook in 2020, more than 250 organizations, ranging from ETFs, listed miners, pension funds, to sovereign entities, have followed suit.

If 2025 brings the deep correction Breed fears, the metric that matters is not how much Bitcoin (BTC) a company has ever bought, but how much they can still hold when the dust has settled.

Conclusion

In an uncertain investment world, companies with Bitcoin (BTC) cash on their balance sheets should prepare themselves for the worst. By understanding the risks and taking appropriate precautionary measures, they can avoid pitfalls and ensure the future viability of their business.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto Times. Bitcoin Treasury Firms May Face Death Spiral in 2025 – Report. Accessed on June 30, 2025

- Featured Image: Generated by Ai