XRP Price Prediction July 2025: Ready to Soar or Fall?

Jakarta, Pintu News – XRP has had a tumultuous June, with the altcoin showing little to no clear direction.

Throughout the month, macro bearish signals continued to loom, affecting prices and market sentiment.

However, there is potential for a reversal in July, thanks to the growing influence of whale investors.

Can XRP Whales Be the Deciders?

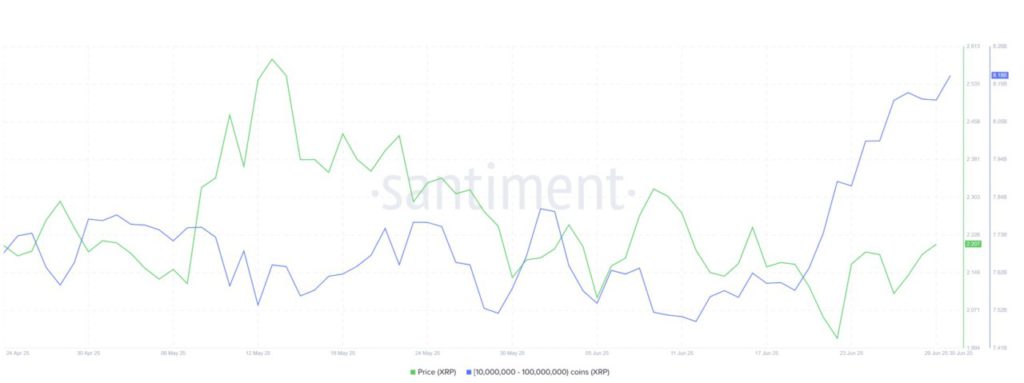

Whale activity has been an important factor in the past ten days, as large holders of XRP continue to accumulate large amounts despite price volatility.

Read also: Altseason Is Near – These Cryptos Are Already Shifting Into High Gear!

Wallet addresses holding between 10 million and 100 million XRP have purchased over 610 million XRP worth over $1.33 billion.

This accumulation action took place amid generally uncertain market sentiment. The influence of the whales has the potential to balance out erratic market behavior, especially that of small investors.

Their move shows that some big players still have faith in XRP’s long-term prospects, despite the overall market struggling to gain momentum.

Lack of certainty, delayed launch of XRP ETF makes investors hesitant

However, investor sentiment remains mixed, with many small investors still unsure of the direction in which XRP will move next. This uncertainty is further exacerbated by macroeconomic conditions that have led to a prolonged downward trend.

The absence of clear developments-such as the delayed launch of the XRP ETF-has investors cautious, reflecting a broader trend of uncertainty in the market.

In an interview with the BeInCrypto page, Temujin Louie, CEO of Wanchain, stated that XRP will likely face difficulties in launching its ETF.

“XRP remains a highly speculative asset, even more so than BTC or ETH. As such, the delay by the SEC is not entirely surprising, as they are clearly reluctant to set a precedent that could trigger a wave of ETF filings for other altcoins. What makes the situation even more complicated is the uncertainty of the current Trump administration and the possibility of a policy reversal in the coming years,” Louie said.

The overall market momentum for XRP was also affected by changes in net positions on exchanges, reflecting a lack of conviction from retail investors. Over the past month, buy-sell patterns on exchanges have been volatile and have not shown a consistent trend.

This suggests that investors are still unsure of XRP’s short-term prospects, especially with the long-awaited ETF launch delayed.

This lack of clarity in developments creates an uncertain atmosphere around the altcoin.

Read also: 3 Crypto Top Gainers on CoinGecko that are Must-Hunts in Early July!

XRP Price on a Downward Trend

The price of XRP has been stuck in a downward trend for over a month, trading at $2.18 and still holding above the $2.13 support level. The failure to break the resistance level suggests that this downtrend is likely to continue until early July.

The lack of positive movement makes XRP vulnerable to further declines, unless there is a major trigger capable of reversing the market’s direction.

Early July and the third quarter (Q3) could be a bleak period for XRP if its price remains trapped in the $2.23 to $2.13 range. This scenario would signal a continued downward trend.

Nevertheless, XRP has historically recorded positive performance in July. XRP’s median monthly yield for the upcoming month stands at 6.91%.

If a similar surge occurs in July 2025, then the price of XRP is expected to break the $2.23 resistance and reach $2.32.

Even so, if the whales change their strategy from accumulation to selling, XRP prices could face more pressure. If the crucial support level of $2.13 is broken, XRP is at risk of a sharp decline.

The altcoin could even fall to as low as $2.02, which would erase all bullish prospects for XRP.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. What to Expect from XRP Price in July 2025. Accessed on July 1, 2025