Bitcoin Crashes to $106K After Senate’s Shocking Vote — Is the “Big Beautiful Bill” Behind the Drop?

Jakarta, Pintu News – In early July 2025, Bitcoin recorded another drop below $107,000 after President Trump’s remarks about a “big, beautiful bill” sparked fresh concerns in the crypto market.

As of July 2, Bitcoin price was trading at $106,121, a slight decline. However, with pro-crypto Senator Cynthia Lummis proposing more tax-friendly changes, will BTC recover or will it drop to the $100,000 mark?

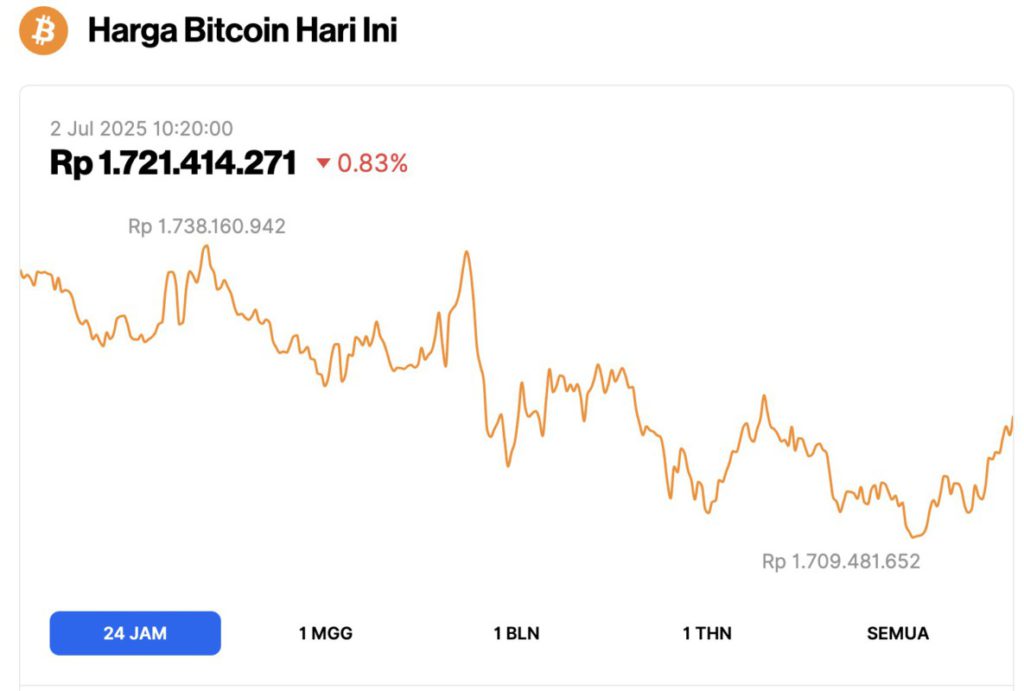

Bitcoin Price Drops 0.83% in 24 Hours

On July 2, 2025, Bitcoin was trading at $106,121, equivalent to IDR 1,721,414,271, marking a 0.83% decline over the past 24 hours. During that time, BTC reached a daily high of IDR 1,738,160,942 and dipped to a low of IDR 1,709,481,652.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $2.1 trillion, with trading volume in the last 24 hours up 8% to $45.69 billion.

Read also: This Coffee Shop Just Spent $1.17 Billion on Bitcoin — Is It Genius or Insane?

Bitcoin Price Volatility Increases as US Senate Votes on Big Beautiful Bill

The United States Senate is currently undergoing a marathon vote-a-rama on President Trump’s One Big Beautiful Bill.

In the vote-a-rama process, legislators propose various amendments that are then processed quickly through voting, while Trump hopes that the bill will be approved by the Senate on July 4.

This process triggered a spike in Bitcoin price volatility, which fluctuated between a daily high of $107,971 and a low of $106,526. Meanwhile, more than $36 million has been liquidated from the BTC market in the past 24 hours according to data from Coinglass.

This drop comes amid renewed conflict between Trump and Tesla CEO Elon Musk over the bill. Reporting from the Coingape page, the crypto market became volatile after Musk stated that if this proposal was passed, it would trigger inflation.

However, there is optimism from some crypto market participants who think that even if inflation increases, this condition will actually be bullish for BTC prices. Popular analyst Max Keiser said that this bill will be“a Bonanza for Bitcoiners“.

Meanwhile, Senator Cynthia Lummis has proposed a number of amendments to this bill that are considered to have a bullish impact on the price of Bitcoin. In a post on X, she stated:

“It’s time to stop this unfair tax treatment and ensure America becomes the Bitcoin and crypto superpower of the world.”

Bitcoin advocate Matthew Pines also highlighted that one of Lummis’ proposed amendments includes a “Bitcoin de minimis tax exemption”, and he urged voters in the US to contact their Senators to support the change.

BTC at Risk of Falling to $100,000 Before Recovering

The daily time frame chart (1/7/25) shows that the price of BTC may be on the verge of falling towards $100,000 if the uncertainty continues.

The MACD line indicates this downside potential as it starts to point downwards and approaches a negative crossover with the signal line-a signal that supports Bitcoin’s bearish price prediction.

Read also: Bitcoin, Ethereum & XRP Price Prediction for July 2025: Are These Crypto Giants About to Skyrocket?

At the same time, BTC has broken below the centerline of the ascending parallel channel, which suggests that the bears may start trying to reclaim control.

If the price closes convincingly below this support level, the next target will be the 78.6% Fibonacci level at $104,067. Another close below this key Fib level could see Bitcoin price drop further to $97,766.

The RSI indicator has also started to decline, signaling that the bullish momentum that has been supporting the uptrend is weakening. If this indicator falls below the average level of 50, it will be a confirmation that Bitcoin is likely to slip to $100,000.

Overall, with the emergence of new macroeconomic factors, the bears will probably try to push Bitcoin price to the $100,000 range before buying activity picks up again.

On-chain data shows declining demand

CryptoQuant ‘s Bitcoin Apparent Demand metric shows a significant drop in new buying interest.

For the first time in a month, this metric turned negative at -37,000 BTC-a sign that traders are bearish on BTC prices.

Despite accumulation strategies, such as Kazakhstan’s recent move to launch a national crypto reserve, the lack of demand from retail is likely to impact prices.

In conclusion, Bitcoin price is currently at a tipping point as US legislators prepare to vote on the One Big Beautiful Bill.

Concerns over the surging US national debt and potential inflation have fueled bearish sentiment, although some traders remain optimistic that tax changes will push prices higher.

However, with declining demand and weakening buying pressure, BTC is at risk of dropping towards $100,000.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Bitcoin Price Falls Back Below $107K As Senate Votes on Big Beautiful Bill, Is $100k Next? Accessed on July 2, 2025