Dogecoin Crashes 3% in a Day — Over $132 Million in Losses Revealed! What’s Going On?

Jakarta, Pintu News – Dogecoin barely saw any significant movement on June 30, but beneath the surface, there is growing tension.

Although this meme coin recorded a weekly gain of around 5.47%, in the past month its value has dropped by more than 14%, and a number of indicators point to a potential further decline.

Analysis shows that the direction of DOGE’s movement is still unclear, as both bulls and bears continue to compete over the next move of theecoin.

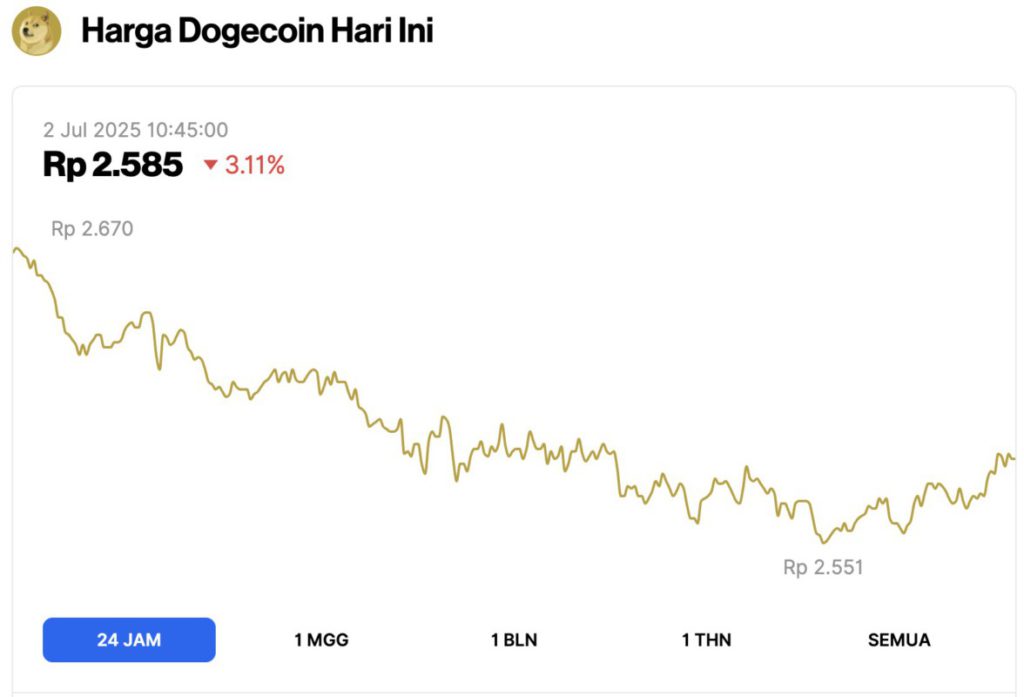

Dogecoin Price Drops 3.11% in 24 Hours

On July 2, 2025, Dogecoin saw a 3.11% drop over the past 24 hours, trading at $0.1594, or approximately IDR 2,585. During the day, DOGE reached a low of IDR 2,551 and a high of IDR 2,670.

At the time of writing, Dogecoin’s market cap stands at around $23.89 billion, with trading volume dropping 15% to $674.87 million within 24 hours.

Read also: Ethereum Holds Strong at $2,400 as ETF Inflows Soar to $260 Million — Is a Massive Rally Coming?

Short survives despite huge losses

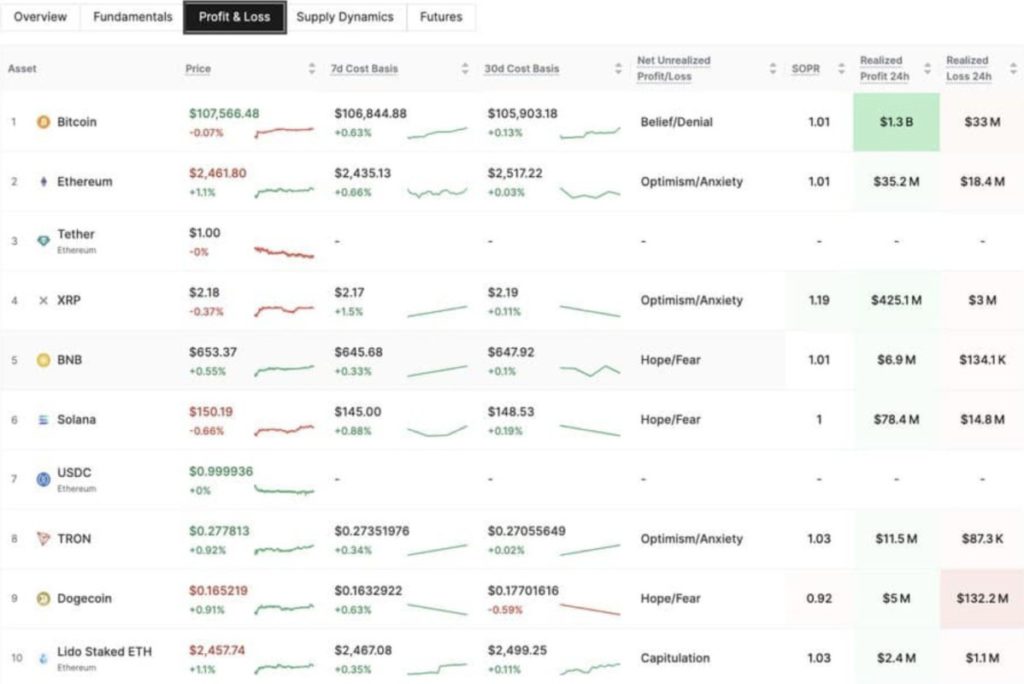

As of June 30, DOGE had shown a stark contrast between unrealized gains and losses.

Unrealized losses were recorded at $132.2 million, while profits were only around $5 million, according to data from Glassnode. This creates a ratio of 26:1 – meaning that for every profitable transaction, there are 26 losses.

The term unrealized here means that traders still have open positions – the contracts are still active, so the loss or gain has not been calculated as the final result.

However, the main question is: Why do short traders hold on to their positions despite the potential for a big drop?

The findings of the AMBCrypto page show that these traders are still anticipating a sharp decline in DOGE and are holding out for their expected returns.

Liquidity Cluster Requires Deeper Price Correction

Two important metrics support the positions of short traders. Let’s go through them one by one!

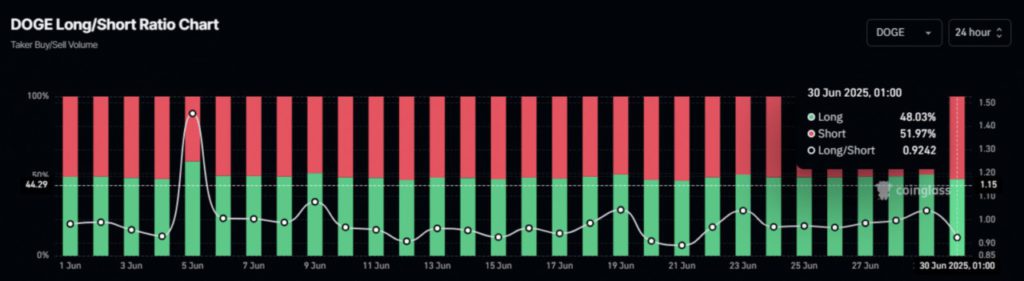

Based on data from CoinGlass, Taker Sell Volume exceeded buy volume, with 51.97% of transactions coming from short positions.

Read also: 3 Altcoins that Crypto Whales are Eyeing for July 2025!

Meanwhile, the Long/Short Ratio fell to 0.92, which indicates the dominance of bearish sentiment is strengthening. When this metric falls below 1, it usually signals increasing short pressure-suggesting that sellers are currently controlling the market direction.

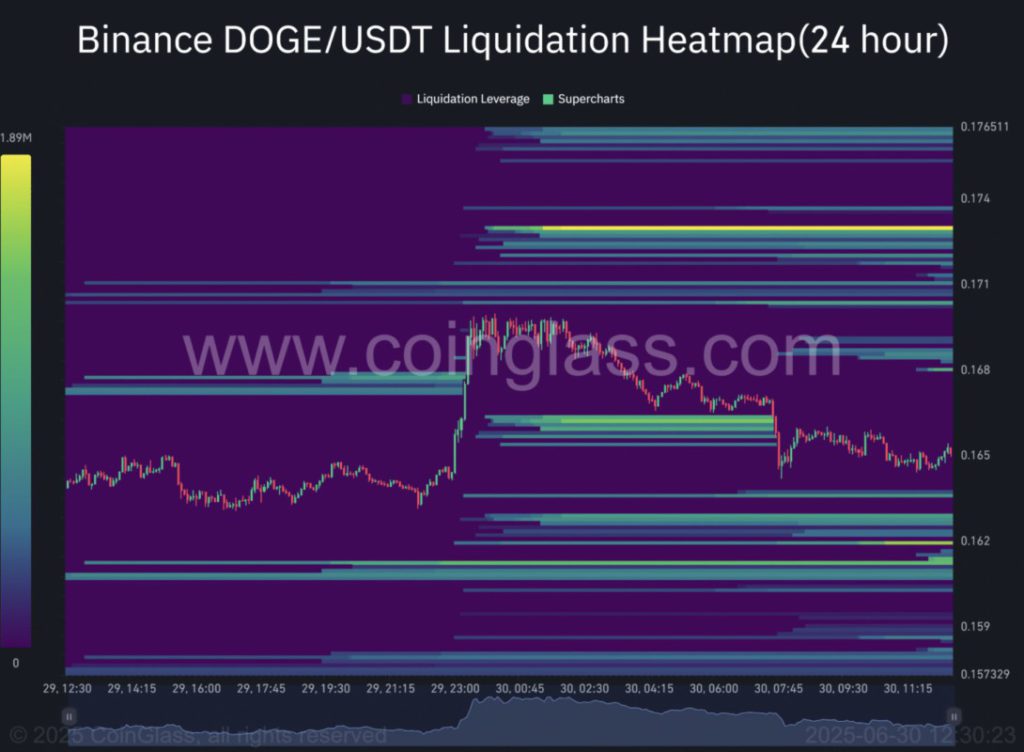

One other metric that strengthens the argument of short traders is the Liquidation Heatmap.

DOGE’s Liquidity Heatmap shows a cluster buildup below the $0.165 level – the current price zone. This cluster, which is usually an unfilled leveraged order, acts like a gravitational pull.

If a price drop does occur, the unrealized loss could turn into profit for short sellers.

Naturally, the price is expected to move close to that zone. If that happens, DOGE could test the $0.162 level or even slip to $0.159 – which is a crucial liquidation zone for long positions.

If this level is touched, unrealized losses from short positions can turn into realized profits.

Are Traders Losing Interest?

Despite the dominating bearish sentiment, the bulls haven’t given up just yet.

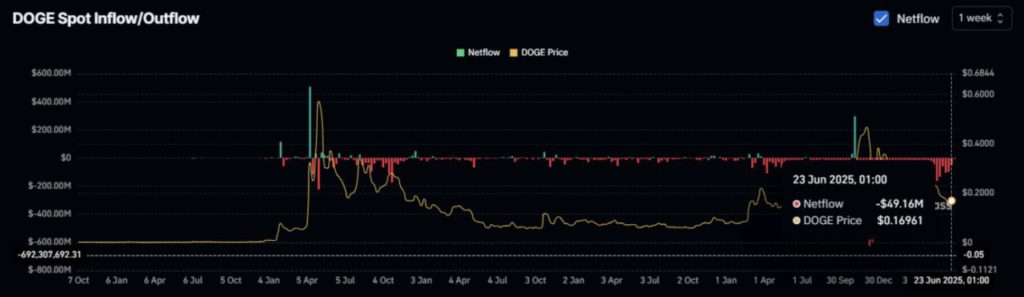

According to data from CoinGlass as of June 30, bulls have accumulated $5.5 million worth of DOGE, bringing the total accumulation in the past week to $49.16 million.

Read also: Altcoin Bullrun 2025: Here are 7 Crypto Recommended to Have in Your Portfolio!

This accumulation suggests that some investors are starting to position themselves for a possible breakout to the upside. The bullish activity so far has helped to keep prices from falling further.

However, the AMBCrypto page notes that the bullish momentum seems to be fading. After reaching a weekly accumulation peak of $105 million on June 9, the amount of DOGE purchased from the market has continued to gradually decrease.

This drop suggests that investor interest in DOGE is waning, possibly due to the token’s lackluster performance.

If this trend continues, the bears could regain full control of the market and push the DOGE price down further in the next trading session.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Dogecoin bleeds 14% in June with $132 mln in unrealized losses – What now? Accessed on July 2, 2025