Will Bitcoin Explode in July 2025? Price Forecast Signals a Big Move Ahead

Jakarta, Pintu News – Bitcoin price has recently been under downward pressure, influenced by macroeconomic factors that have weighed on the performance of the flagship crypto.

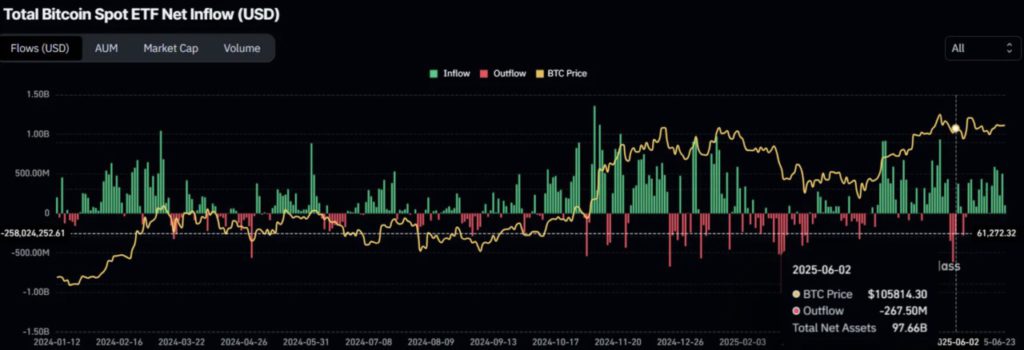

Nevertheless, Bitcoin price continues to show resilience, thanks in part to the steady growth of exchange-traded funds (ETFs).

These ETFs are proving to play a significant role in propping up the price of Bitcoin, giving hope of a possible price surge in the next few months.

Bitcoin ETFs Show Investors Real Outlook

Despite the general bearish market sentiment, Bitcoin ETFs have recorded consistent inflows.

Read also: 3 Altcoins Worth Buying If Bitcoin Surges to a New All-Time High!

In recent months, these ETFs have experienced only three outflows, even amid challenges such as the conflict between Israel and Iran. In July, Bitcoin ETFs received inflows of $4.5 billion, pushing the cumulative total to $48.95 billion.

This shows that institutional investors still find Bitcoin ETFs an attractive option. However, in his interview with BeInCrypto, Mete Al, co-founder of ICB Labs, stated that Bitcoin is not yet fully detached from the stock market.

“There is still room for Bitcoin to decouple further from the stock market. Spot ETFs do play a role in connecting Bitcoin to Wall Street, but in risk-off situations like the escalating Israeli-Iranian conflict, crypto does not fully follow the correlation with S&P. That is: the decoupling process is not over, but don’t expect it to be permanent-more like episodic,” Mete explains.

Citing the BeInCrypto report, Bitcoin’s current macro momentum is supported by its safe haven zone, which is in the range between $100,000 to $103,000.

Bitcoin Movement Remains Stable

The latest data from IOMAP shows that in the price range between $100,668 and $103,876, investors bought a large amount of Bitcoin, around 574,170 BTC worth more than $61.41 billion.

Despite its recent decline, Bitcoin has consistently managed to recover in that price range, providing a sense of stability for investors.

Although there is ademand zone above this price range, so far it has not shown strong enough support to prevent further price declines.

This demand zone indicates that Bitcoin will most likely be able to stay above the $100,000 level, and Mete Al shares this view.

“It looks like this supply zone will last a little longer. There is a thick layer of limit bids and in-the-money call options stuck in this range. Unless some big news pushes the price below $100,000 on a closing basis,dip buyers should be able to keep the floor strong,” Mete said.

BTC Price Breakthrough May Still Take Time

On July 1, Bitcoin was trading at $107,075, after failing to maintain the $108,000 level assupport. This reinforced the formation of a descending wedge pattern, which has strengthened over the past month.

Read also: Bitcoin Crashes to $106K After Senate’s Shocking Vote — Is the “Big Beautiful Bill” Behind the Drop?

The failure to maintain the $108,000 level signals that downward pressure on Bitcoin is still ongoing in the market.

Historically, July has been a positive period for Bitcoin, with an average monthly return of 8.09%. This suggests that despite the current downward trend, Bitcoin is still likely to experience a recovery in July.

However, this recovery may be preceded by a further decline, possibly breaking below $101,000, which could then pave the way for a breakout towards $110,000.

Even so, it’s important to consider the worst-case scenario. If the overall market crashes, Bitcoin could fall even deeper, below $105,000, even touching $100,000.

Losing support at these levels would invalidate the bullish scenario, and signal that Bitcoin will likely continue to face pressure.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. What To Expect From Bitcoin Price In July 2025? Accessed on July 2, 2025