Bitcoin Surges to $108,000 Today — Will BTC Hit $120K This Month? Bitwise Thinks So!

Jakarta, Pintu News – Bitcoin price predictions for July are filled with global optimism. Recently, Bitwise released a report stating that history shows Bitcoin usually recovers strongly after geopolitical shocks.

On June 30, Bitwise CIO Matt Hougan and head of research Ryan Rasmussen reiterated their Bitcoin price target of $200,000 for 2025. They are also optimistic about the flow of funds into Bitcoin ETFs in the second half of the year.

For strategic reasons, many countries are secretly exploring or accumulating Bitcoin. With this increased optimism, experts like Mister Crypto expect the price consolidation currently occurring in a flag pattern to soon result in a breakout.

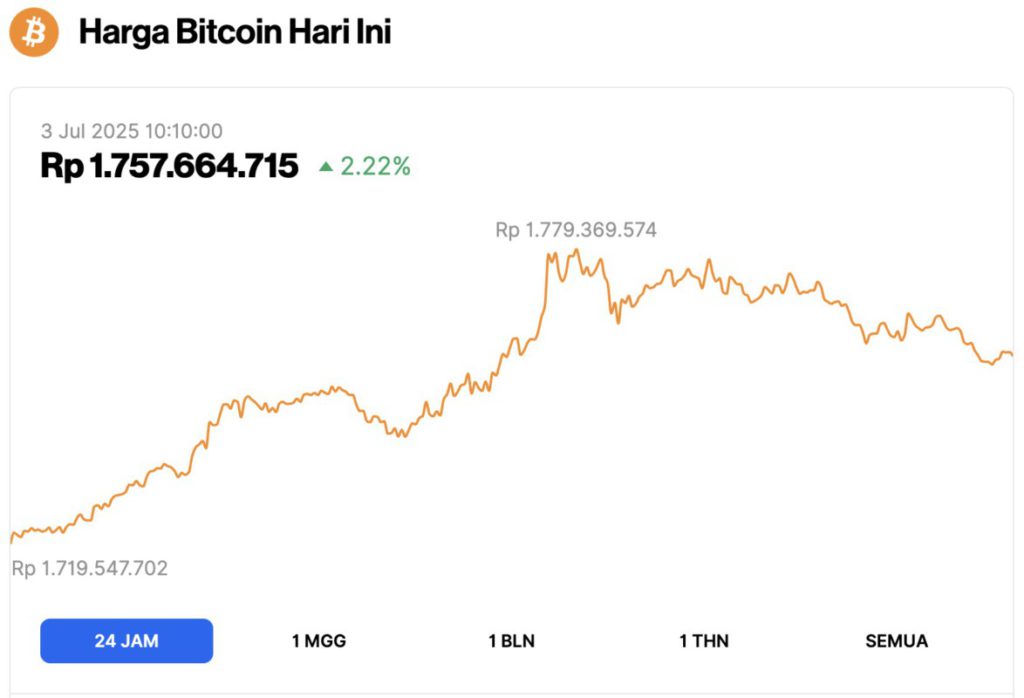

Bitcoin Price Rises 2.22% in 24 Hours

On July 3, 2025, Bitcoin was trading at $108,705, equivalent to IDR 1,757,664,715 — marking a 2.22% gain over the past 24 hours. Within that time frame, BTC dipped to a low of IDR 1,719,547,702 and climbed to a high of IDR 1,779,369,574.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $2.16 trillion, with trading volume in the last 24 hours rising 26% to $56.31 billion.

Read also: Latest Analysis: Are Bitcoin, Ethereum, and Ripple About to Crash Hard?

Why is Bitwise Optimistic about Bitcoin Price in July?

In June, Bitcoin price consolidated due to increased geopolitical risks in the Middle East. After reaching a new record high, Bitcoin was flat for the rest of the month.

Despite consolidation and geopolitical pressures, data shows strong institutional demand through Bitcoin ETFs andcorporate treasuries, contributing to supply reduction.

Therefore, Bitwise believes that as trade policy becomes clearer and the possibility of easing from the Fed, these factors create a positive environment for Bitcoin in July.

Read also: Bitcoin Price Prediction in July 2025: Will BTC Soar?

Bitcoin Price Chart Analysis: Breakout Possible from Flag Pattern

Bitcoin price is nearing its record high of $112,000, currently trading at $107,685 after a recent surge of 2%. The MACD analysis tool shows an increase in bullish sentiment with the formation of a golden cross.

In addition, the CMF value stood at 0.12, reflecting an increase in fund inflows, while the RSI was supportive at 55.24.

From late June to early July, both the Awesome Oscillator (AO) and the MACD histogram showed growing bullish momentum.

Short-term exponential moving averagebands (EMA bands) also show a positive outlook, with the latest spike coming from a bounce on the 20-day EMA band.

If the price breaks the upper limit of the wedge pattern on the Bitcoin chart, it could target $112,000 and potentially touch $120,000 by the end of July, especially if short-term news related to Bitcoin triggers accumulation by market participants.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. Bitwise Says Bitcoin Price Could Hit $120K in July. Accessed on July 3, 2025