Ethereum Surges 5% Today (July 3, 2025) — Is a Massive Rally to $3,000 Coming Soon?

Jakarta, Pintu News – Ethereum briefly fell on Wednesday (July 2), extending its decline throughout June despite positive undercurrents such as strong ETF inflows, long-term accumulation by historical holders, and adoption by corporate cash.

The recent addition of ETH to a company’s balance sheet has again sparked optimism among traders.

Crypto analyst Ali noted this movement, acknowledging the shift in sentiment, but he warned investors not to get too carried away. He emphasized the importance of a confirmed breakout to confirm Ethereum’s continued upward momentum.

Then, how is Ethereum’s current price movement?

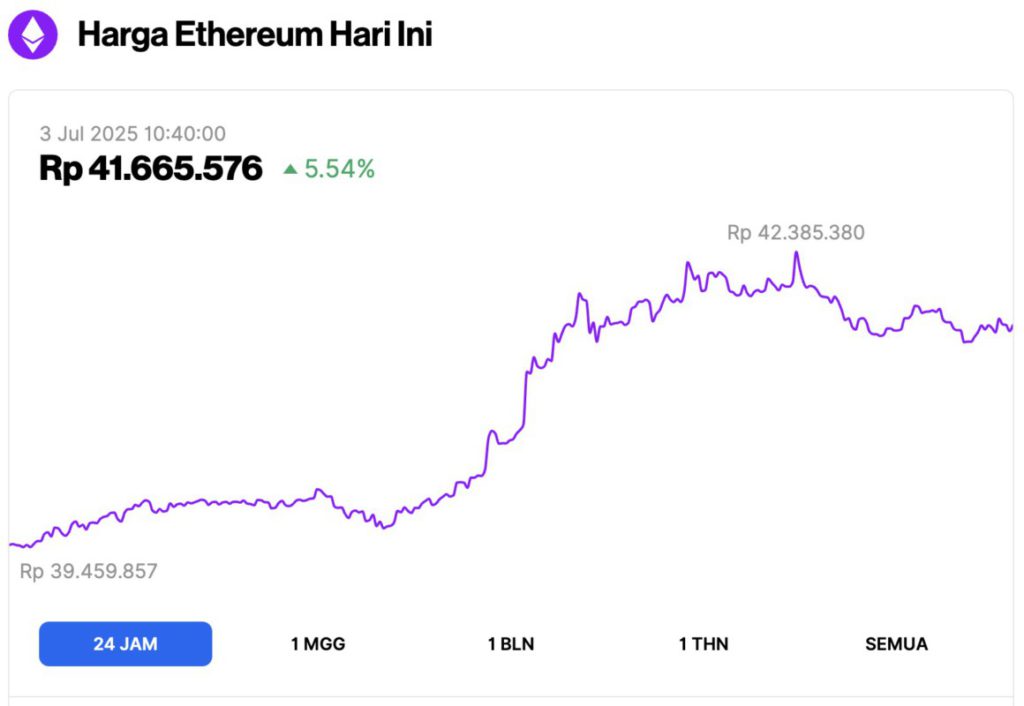

Ethereum Price Up 5.54% in 24 Hours

As of July 3, 2025, Ethereum was trading at approximately $2,570, or around IDR 41,665,576 — marking a 5.54% increase over the past 24 hours. Within that time frame, ETH hit a low of IDR 39,459,857 and reached a high of IDR 42,385,380.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $310.27 billion, with daily trading volume rising 49% to $24.52 billion in the last 24 hours.

Read also: Bitcoin Surges to $108,000 Today — Will BTC Hit $120K This Month? Bitwise Thinks So!

Range of $2,227-$3,385 Limits Ethereum’s Movement

Analyst Ali emphasized that Ether is still inflationary, meaning that its supply continues to grow, which limits price traction based on scarcity.

He states that without structural changes in tokenomics or technical breakouts, bullish expectations could be premature-especially given the inconsistent historical price performance within defined trading channels.

To be called a real breakout, ETH needs to be able to close decisively outside the $2,227-$3,385 range, which for the past few months has limited both its upside and downside movements.

Until that happens, prices will most likely remain within that range, and choppy trading will be the norm.

Continuing to trade on balance while waiting for price movements to level off will only frustrate both bulls and bears in the absence of a clear trend direction.

Read also: New EVM Sidechain on XRP Ledger Opens Access to Large Multi-Chain Liquidity for DeFi Developers!

Breakout could trigger rally towards $3,000

A recent post from Fortis Crypto shows a more optimistic technical picture.

The analysis highlighted that Ethereum formed higher lows on the price chart-a classic bullish structure that indicates accumulated demand. This pattern indicates fundamental strength, especially in the short term.

Adding to this bullish argument, Ethereum’s 7-day moving average has crossed above the 14-day average, which is usually a signal of positive momentum.

Fortis Crypto also points out that the $2,300-$2,400 price range is a strong support zone, where ETH prices often bounce back.

However, there is still resistance in the range of $2,700 to $2,800. In case of a breakout above this range, it is likely to trigger another attempt to reach the psychological level of $3,000, which has a great influence on market sentiment.

Ethereum also received an additional boost as the number of addresses collecting Ethereum reached an all-time record high in June. Addresses that simply hold Ether without selling reflects a long-term commitment to the asset.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Tron Weekly. Ethereum Strengthens at $2,400 Support, Bulls Target $3,000 Next. Accessed on July 3, 2025