Dogecoin Spikes 5% in One Day — Is a Major Rally to $0.24 Looming?

Jakarta, Pintu News – The price of Dogecoin has slipped by around 8% in the past two days, as investors’ risk appetite now leans more towards small-cap meme tokens.

This capital turnover indicates a shift in market interest from established assets like DOGE to more speculative projects with high potential returns.

Now, attention is on whether the bulls are able to reverse the pressure from the significant pool of leveraged short positions around the $0.18 resistance level.

Before discussing further, let’s explore the current Dogecoin price movement first!

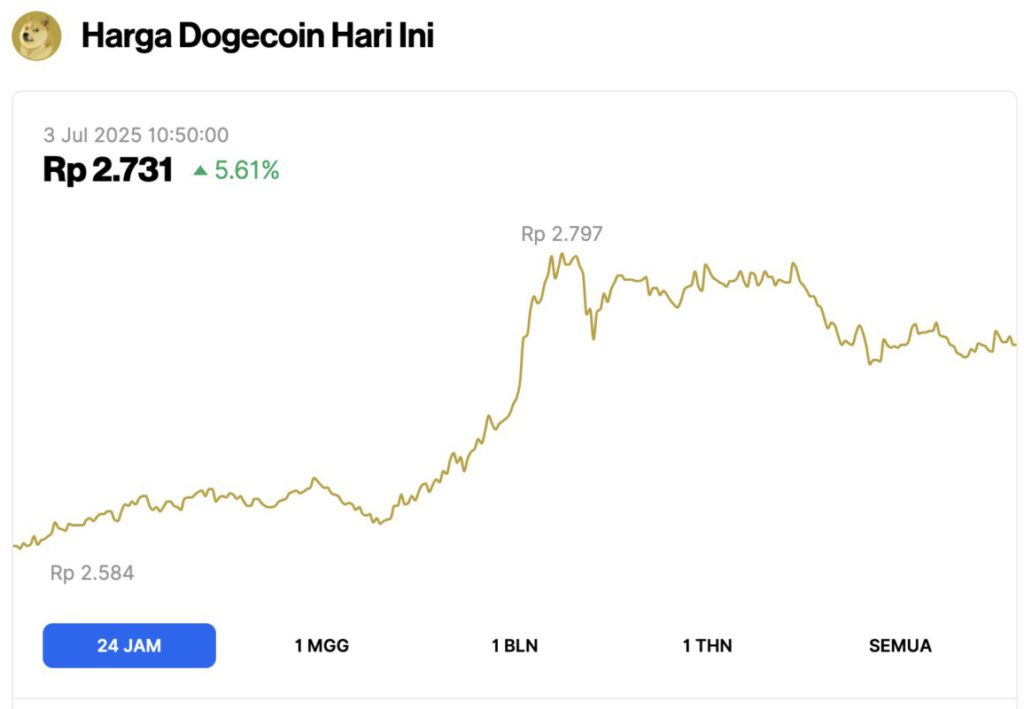

Dogecoin Price Rises 5.61% in 24 Hours

On July 3, 2025, Dogecoin surged by 5.61% over a 24-hour period, reaching a trading price of $0.1690, or approximately IDR 2,731. During the day, DOGE hit a low of IDR 2,584 and climbed as high as IDR 2,797.

At the time of writing, Dogecoin’s market cap stands at around $25.32 billion, with trading volume rising 84% to $1.23 billion within 24 hours.

Read also: Dogecoin Set to Soar? Analysts Say “$1.17 Is in Sight — No Reason This Rally Stops at Just $1!”

DOGE Traders Face $60 Million Selling Wall as Market Shifts to Smaller Coin Memes

Dogecoin declined towards $0.16 on July 1, 2025, continuing a two-day correction despite the generally positive crypto market sentiment.

This price drop coincides with a broader capital rotation, where traders are chasing profits on small-cap token memes such as $USELESS, which surged more than 2000% throughout June.

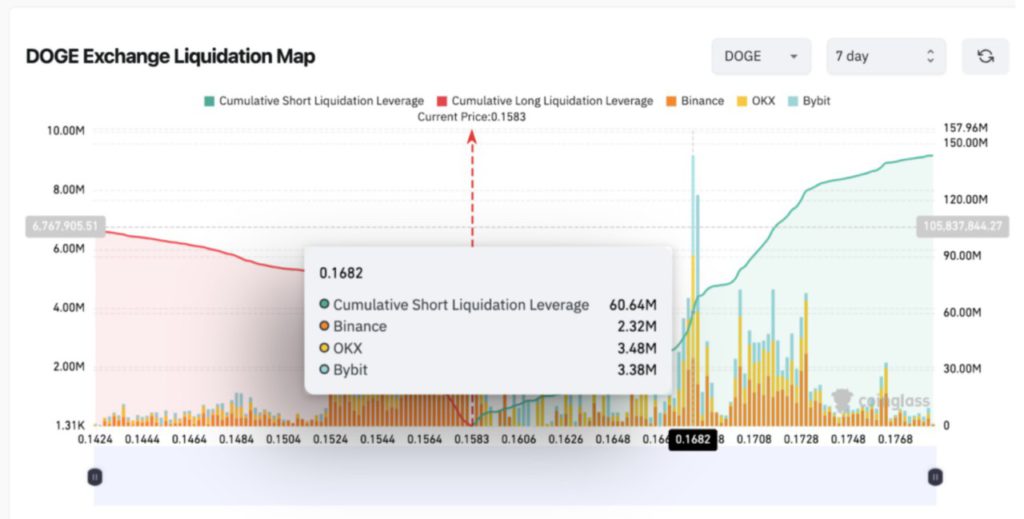

In addition, derivatives data from Coinglass shows that large short contracts hanging above the current price are exacerbating the downward trend in Dogecoin’s price.

The liquidation map chart below tracks the value of active futures contracts at specific price levels, indicating points of possible price reversal.

As seen above, short traders still dominate the Dogecoin derivatives market, with $143 million worth of active short contracts – far surpassing long positions of only around $103 million.

On a closer look, short sellers have opened more than $60 million worth of DOGE open positions over the past seven days, creating strong resistance at the $0.18 price range.

Growing speculative demand and risk appetite towards small-cap meme tokens have diverted fund flows away from major meme assets such as DOGE.

Despite the decline, DOGE remains strongly supported by bull traders who seem to be trying to defend the $0.15 level.

Read also: Bitcoin Reaches $108,000, These 3 Coin Memes Surge up to 30% Today (July 3)!

If the price of DOGE is able to absorb the selling pressure and not break below $0.15, then a potential sharp recovery through the $0.18 level could trigger a short-squeeze-whichcould potentially drive a quick rally above $0.20.

Falling Wedge pattern hints at $0.24 target as DOGE holds key support

From a technical standpoint, Dogecoin’s daily chart is currently showing a Falling Wedge pattern, which is often considered an early signal of a potential price breakout to the upside.

A falling wedge forms when the price movement of an asset creates a narrowing range between lower highs and lower lows. This pattern usually ends with the price rising after breaking the downtrend line.

As of July 1, DOGE is testing the upper resistance area of the wedge pattern at around $0.16. If there is a sustained breakout-especially accompanied by increased volume-then the price of DOGE could potentially go up to $0.22, based on the projected measured move from the high of the wedge pattern.

This scenario is reinforced by the Relative Strength Index (RSI) indicator which is at 37, still below the overbought zone, signaling that there is still room for improvement.

Conversely, if DOGE breaks below $0.15, Dogecoin’s optimistic price projections could be invalidated, potentially triggering a deeper drop towards $0.12.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinSpeaker. Dogecoin Price Prediction: $60M Shorts Threaten DOGE Recovery as Falling Wedge Targets 41% Rally. Accessed on July 3, 2025