3 Cryptos Whales Are Snapping Up — Are They About to Skyrocket?

Jakarta, Pintu News – As the overall market begins to show signs of rebounding amidst easing macroeconomic volatility, crypto whales have begun to shift their capital into certain assets.

On-chain data shows significant accumulation on Ethereum , Ondo Finance , and Chainlink , as large holders begin to position themselves for potential gains this month.

Ethereum (ETH)

Ethereum remains one of the main assets targeted by crypto whales this month. Despite the altcoin ‘s underwhelming performance over the past week, large holders took advantage of the situation to accumulate.

Read also: Ethereum Surges 5% Today (July 3, 2025) — Is a Massive Rally to $3,000 Coming Soon?

They increased their net inflows in anticipation of potential price hikes in the coming weeks.

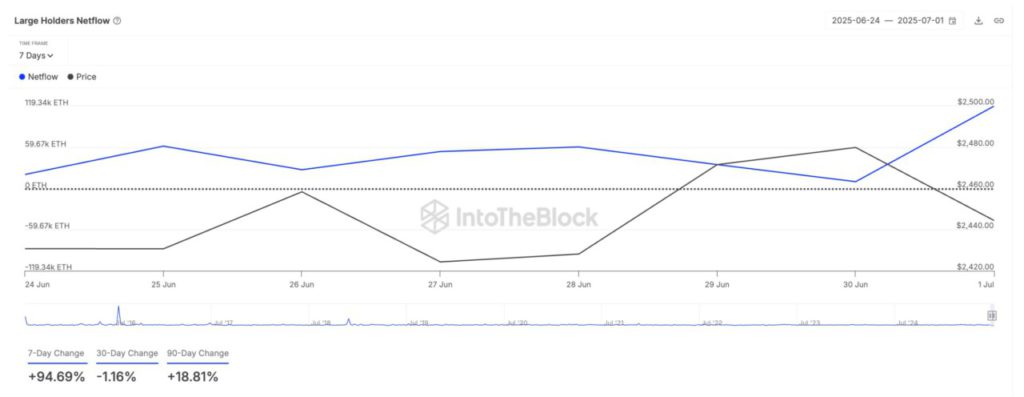

According to data from IntoTheBlock, netflows from large holders of ETH surged by 95% in the past week, reflecting the growing demand from this group of investors.

Large holders refer to investors who own more than 0.1% of the total circulating supply of an asset. Netflow measures the difference between the amount of tokens bought and sold by whales in a given period.

When the value increases, it indicates strong accumulation by whales. This trend could potentially encourage retail traders to also increase their ETH accumulation, which could ultimately drive up its value in the near future.

Ondo Finance (ONDO)

ONDO token based on Real World Assets (RWA) is another asset that crypto whales are watching this month.

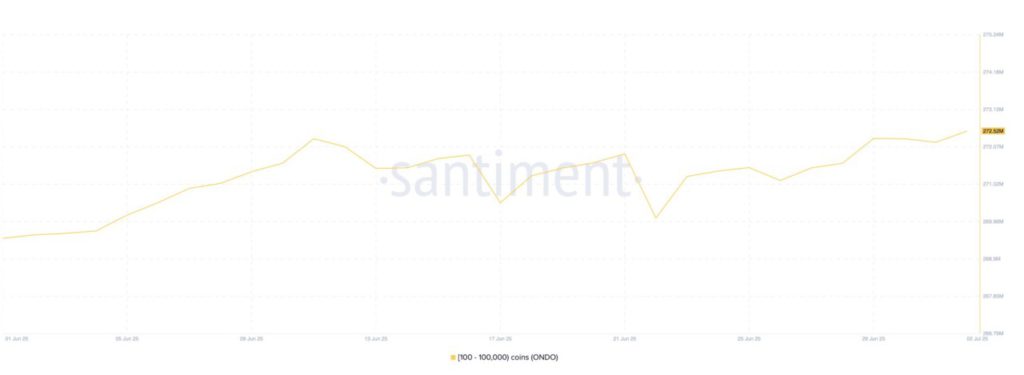

Data from Santiment shows a significant increase in the number of tokens held by wallet address whales that hold between 100 and 100,000 ONDO tokens.

In the past week, the group has accumulated a total of 3 million tokens, indicating growing confidence in ONDO’s performance in the short term.

If demand from whales continues to increase, this could provide the necessary impetus to break the important resistance level of $0.92.

Conversely, if market sentiment changes and the whales choose to secure profits, the token price risks dropping back to the $0.66 range.

Read also: XRP, SOL, and ADA Ready to Explode? Grayscale ETF Approval by SEC is the Reason!

Chainlink (LINK)

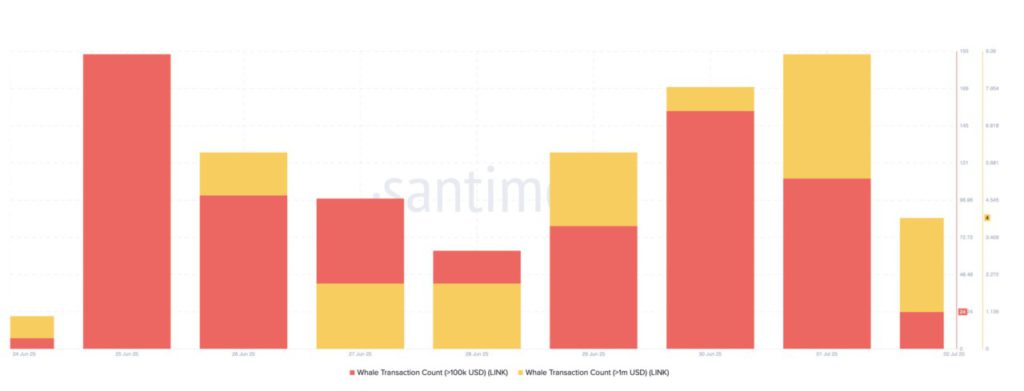

LINK has seen a spike in transaction activity from whales in recent days, signaling increased confidence in the token’s near-term performance.

According to data from Santiment, there has been a consistent increase in the number of LINK transactions over $100,000 and $1 million. This suggests that large investors are actively positioning themselves for potential gains in July.

The increase in high-value transactions reflects the growing bullish momentum for the LINK price. If this trend continues, then increased buying pressure could push the price of this altcoin up to $15.53.

On the contrary, if demand weakens, the token price risks dropping to the $11.04 range.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. What Crypto Whales Are Buying in July. Accessed on July 3, 2025