Bitcoin Holds Strong at $109K — Top Analyst Peter Brandt Predicts Massive Surge to $140K Soon!

Jakarta, Pintu News – On July 3, BTC prices showed significant strength, rising by 2.43% to reach the $109,500 level, as veteran trader Peter Brandt highlighted the strong breakout seen on the charts, with a potential rally to $140,000.

However, Arthur Hayes took a bearish view ahead of the Jackson Hole event in August, forecasting a potential Bitcoin crash to $90,000. Important upcoming CPI data as well as the July FOMC meeting are also expected to add to market volatility.

Then, how is the current Bitcoin price movement?

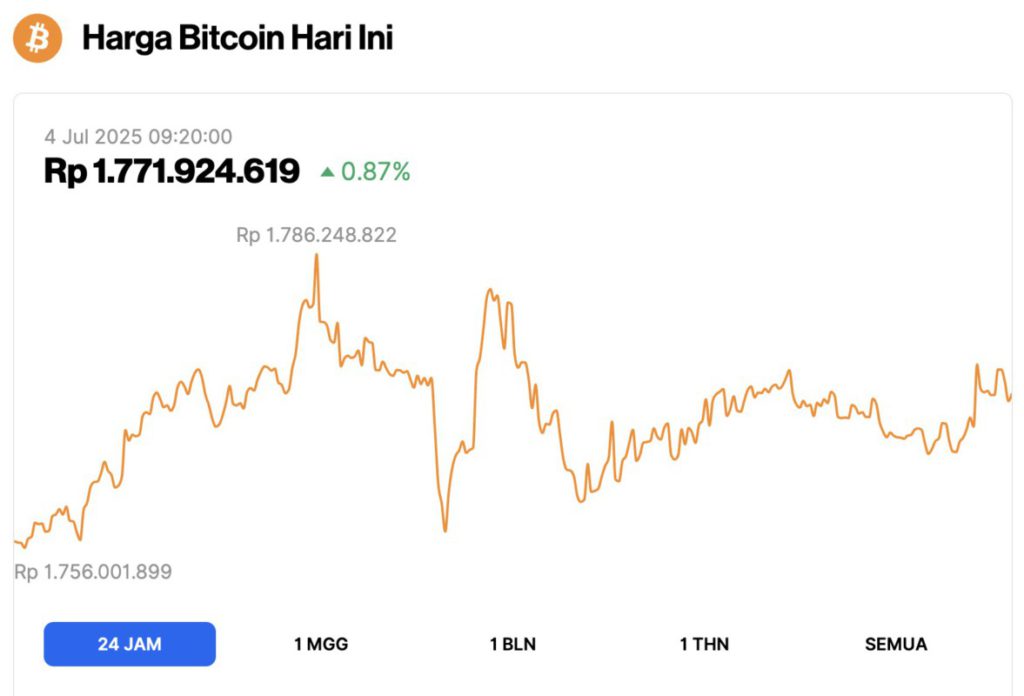

Bitcoin Price Up 0.87% in 24 Hours

On July 4, 2025, Bitcoin was trading at $109,274, equivalent to IDR 1,771,924,619 — marking a 0.87% increase over the past 24 hours. During this period, BTC hit a low of IDR 1,756,001,899 and peaked at IDR 1,786,248,822.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $2.17 trillion, with trading volume in the last 24 hours falling 10% to $49.49 billion.

Read also: Will Altcoins Explode in July? Check out the Prediction!

Peter Brandt Predicts Bitcoin Price to Break $140,000

In a mysterious message on the X platform, veteran trader Peter Brandt shared the latest chart for the BTC/USD pair.

While sharing the inverted chart, Brandt sarcastically commented: “Is this bear flag (yellow box) too obvious for everyone to end up not working? Or is this chart about to fall off a cliff? Just asking.”

The chart shared by Peter Brandt shows Bitcoin’s next price target at $104,000 after the breakout, which is in line with Standard Chartered’s recent predictions.

Brandt’s prediction is in line with Bitcoin’s movement following the trajectory of the global money supply M2, which recently reached an all-time record high of $55.48 trillion. Since 2024, Bitcoin has closely followed M2 ‘s movement pattern, and the current breakout could be a pivotal moment for BTC.

At the time of this report, Bitcoin price is trading at $109,274 with daily trading volume up to $49 billion. On the other hand, data from Coinglass showed a 7.28% increase in BTC futures open interest, indicating a bullish sentiment among traders.

In addition, the US CPI data for June is expected to play a crucial role in determining the next direction of the market. The market is also expecting an interest rate cut by the Fed this July.

Arthur Hayes takes the opposite position, predicts BTC plummeting to $90,000

Arthur Hayes, CIO of crypto investment fund Maelstrom, warned that the crypto market is likely to move sideways or slightly decline ahead of the Jackson Hole symposium in August.

In his latest market review, Hayes highlighted the potential USD liquidity squeeze due to the replenishment of the Treasury General Account (TGA), which he said could drag the Bitcoin price down to the $90,000-$95,000 range.

Read also: Solana Wallet Activity Surges: Can SOL Reach $184?

“I believe that between now and the Fed’ s August Jackson Hole speech by beta cuck towel bitch boy Jerome Powell, the market will move sideways to slightly lower,” Hayes wrote.

As a precautionary measure, Maelstrom has liquidated its entire holdings of illiquid altcoins.

The fund also signaled that it may cut its exposure to Bitcoin further if market conditions deteriorate in the next few weeks.

Major Events in the US that May Affect Bitcoin Price

Ahead of the CPI data release and the Fed‘s decision, investors face a crucial moment as the dynamics of liquidity and market sentiment will largely determine Bitcoin’s next big move.

With the Consumer Price Index due today and the Fed scheduled to announce its interest rate cut decision, Bitcoin is likely to experience a price surge.

If inflation shows a satisfactory upward surprise, then real yields will remain low and liquidity will flow into non-yielding assets like BTC, pushing the rally through key resistance areas.

Even a slightly hawkish rate decision from the Fed would only cause a short-term dip as shorts are liquidated, but the impact is likely to be limited if the central bank signals future rate cuts or a pause in itsbalance-sheet runoff policy.

An easing in quantitative tightening in this context would free up a huge amount of funds that have been sitting outside the market, and is poised to push Bitcoin through its latest price peak.

Overall, the most likely direction right now is bullish, with a higher CPI report or a dovish statement from the Fed potentially being the catalyst for an upward breakout.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Bitcoin Price: $90k or $140k? Crypto Pundits Divided Ahead of FOMC and CPI Data. Accessed on July 4, 2025