Ethereum Stuck at $2,500 Today — Is a Massive Breakout Just Around the Corner?

Jakarta, Pintu News – Ethereum’s lackluster price performance over the past few weeks has become a rising concern for investors.

Despite signs of a broader recovery in the crypto market, ETH continues to show slow movement.

The coin’s price is still struggling to break through the $2,600 region, reflecting weak demand, especially among retail investors. Then, how is Ethereum’s current price movement?

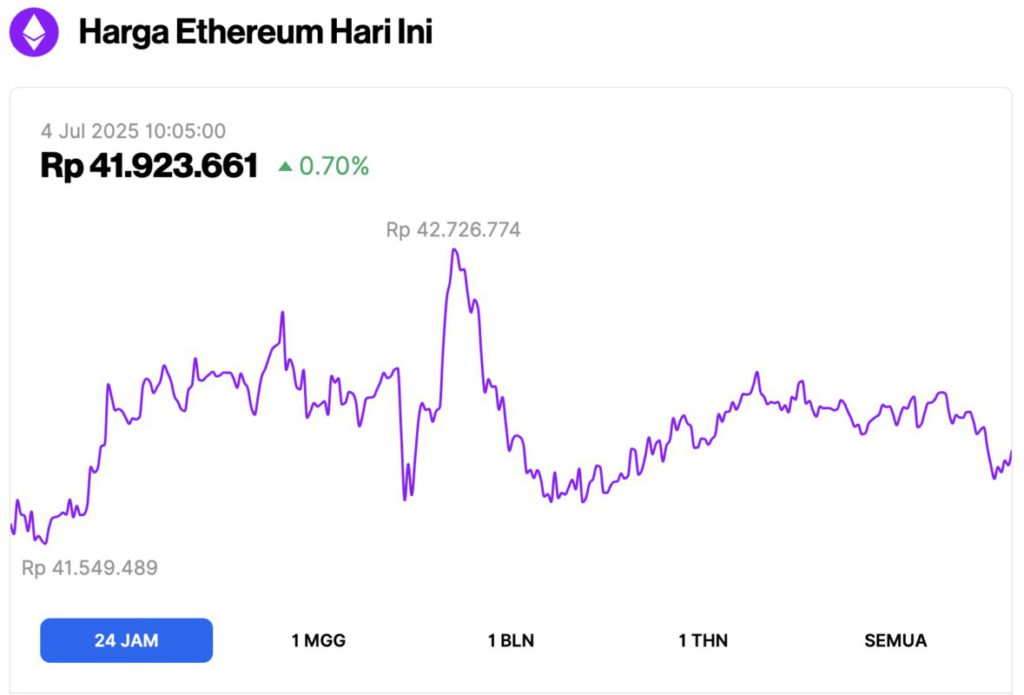

Ethereum Price Up 0.70% in 24 Hours

As of July 4, 2025, Ethereum was trading at approximately $2,578, or around IDR 41,923,661 — marking a 0.70% gain over the past 24 hours. Within that timeframe, ETH dipped to a low of IDR 41,549,489 and climbed as high as IDR 42,726,774.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $311.31 billion, with daily trading volume falling 17% to $19.9 billion within the last 24 hours.

Read also: Bitcoin Holds Strong at $109K — Top Analyst Peter Brandt Predicts Massive Surge to $140K Soon!

Ethereum Stagnates as Whale Support Fails to Spark Demand from Retail

Reporting from BeInCrypto (3/7), based on the daily chart of ETH/USD, ETH has been moving sideways since May 9. During this period, the leading altcoin faced resistance around $2,750 and found support around $2,185.

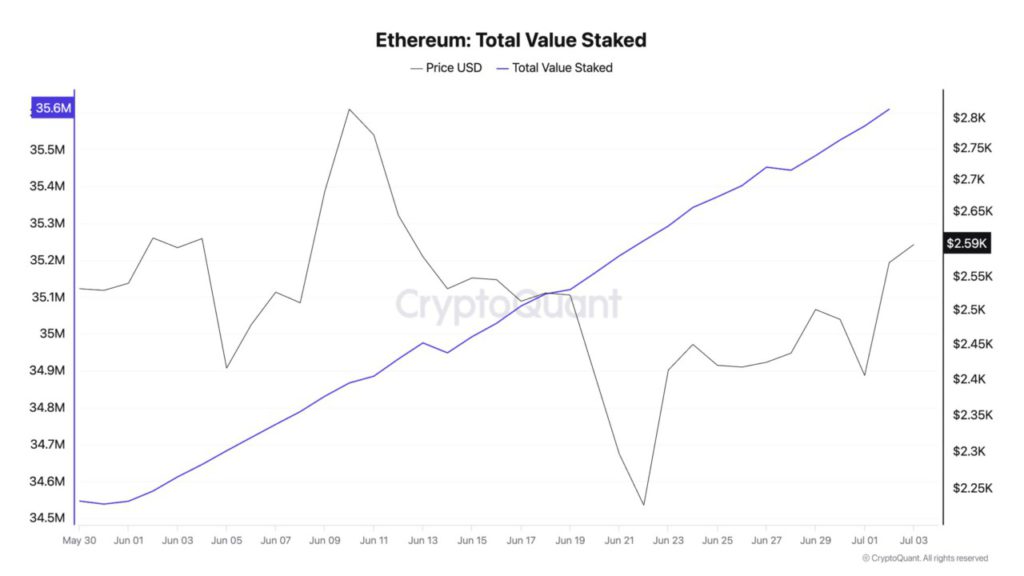

A recent report from CryptoQuant revealed that this stagnation is due to a standoff between massive accumulation by whales and declining retail investor participation.

According to the report, whales are consistently moving around 60,000 ETH per week into staking contracts, showing long-term confidence in the network and the coin.

Based on data from CryptoQuant, the total ETH staked has reached 36 million coins, up 3% throughout June.

In addition, large withdrawals from exchanges-some exceeding 200,000 ETH-highlight the efforts of large investors to absorb selling pressure and reduce available supply.

When the total value of ETH staked increases, it signals growing confidence among major holders in the coin’s long-term prospects. Coupled with reduced inflows to exchanges, this usually tightens market liquidity and potentially supports price stability.

However, this is not the case with ETH. Demand from retail investors remains weak despite large investors showing bullish behavior.

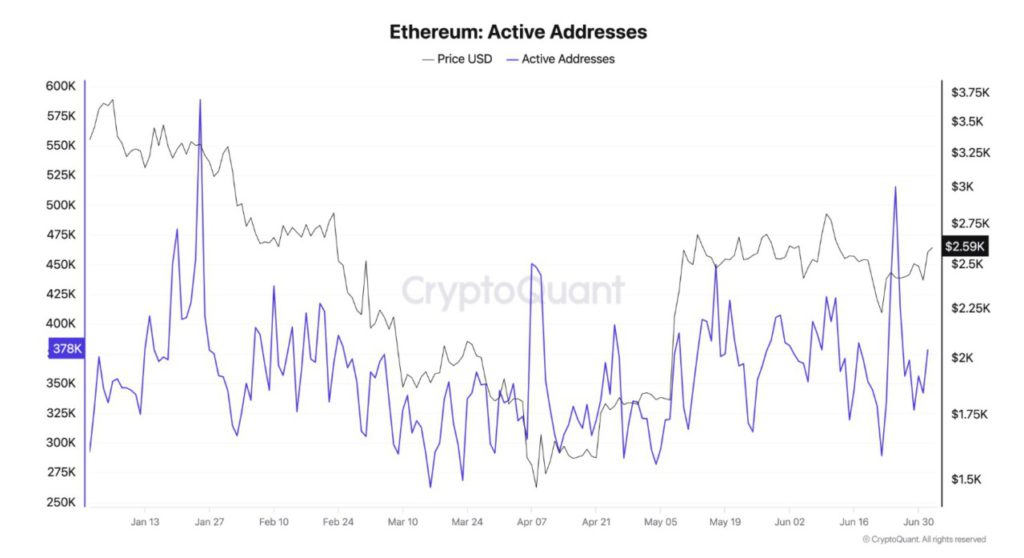

CryptoQuant’s report notes that the number of daily active addresses trading ETH is stagnant at between 300,000 to 400,000-far below the levels usually seen during bullish breakouts.

Read also: XRP, SOL, and ADA Ready to Explode? Grayscale ETF Approval by SEC is the Reason!

Although whales continue to absorb ETH, the decline in demand from retail has kept the coin’s price stuck in a narrow range.

Ethereum Technical Indicators Show Breakout Potential

Meanwhile, the TronWeekly report (3/7) states that ETH is technically expected to experience a significant price surge.

Technical chart watcher BigMike7335 released a 30-minute chart of ETH and identified an Inverse Head and Shoulders (IH&S)pattern-a bullish structure that usually precedes a price increase.

The neckline is around the $2,530 area, which is a major resistance zone. If ETH manages to break this level, the price could potentially push up to the $2,900 area based on conventional chart analysis methods.

The chart analysis includes signals from the Ichimoku Cloud, the Elliott Wave principle, as well as wave-based predictions that support a potential rise to $3,820 inwave 5.

With the volume starting to show momentum and the price approaching the breakout zone, ETH has a great chance of rising sharply if the major obstacles are overcome in the near future.

As signals from institutional investors and technical analysis begin to align, ETH is showing renewed strength and may well lead the next phase in the crypto market cycle.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Ethereum Whale Activity Surges, but Price Stalls – What’s Holding ETH Back? Accessed on July 4, 2025

- TronWeekly. Ethereum Price Sees Bullish Surge, ETF Inflows Target $2,900. Accessed on July 4, 2025