DAOstack Token Collapse After a Silent Closure in 2022, Here Are the Details!

Jakarta, Pintu News – After experiencing a little-known shutdown in 2022, the DAOstack token is now experiencing a significant drop in value. Despite raising $30 million during the 2017-2018 ICO wave, this failure marks the end of one of the early DAO experiments in crypto.

Check out the full information in this article!

Start-up and Funding Failure

DAOstack, known as one of the early initiatives in the formation of decentralized autonomous organizations (DAOs), managed to raise significant funds during the ICO period. According to data from ICO DROPS, DAOstack secured $21.909 million from a private round, $4.69 million from a pre-sale round, and $3,398,910 from an initial coin offering that took place from the fourth quarter of 2017 to May 2018. The funds are planned for the development of decentralized governance protocols.

However, at the end of 2022, DAOstack announced the closure of its operations due to running out of funds. The total market capitalization of DAOstack GEN is now only $68.18K. The token price of DAOstack GEN, which was a previous project of the xStocks team, never reached the funding price even at its peak; it experienced a huge drop in May 2021 and continued to decline to almost $0.

Read also: First Solana Staking ETF in the US Officially Launched, What are the Prospects?

The Crypto Market and Its Impact

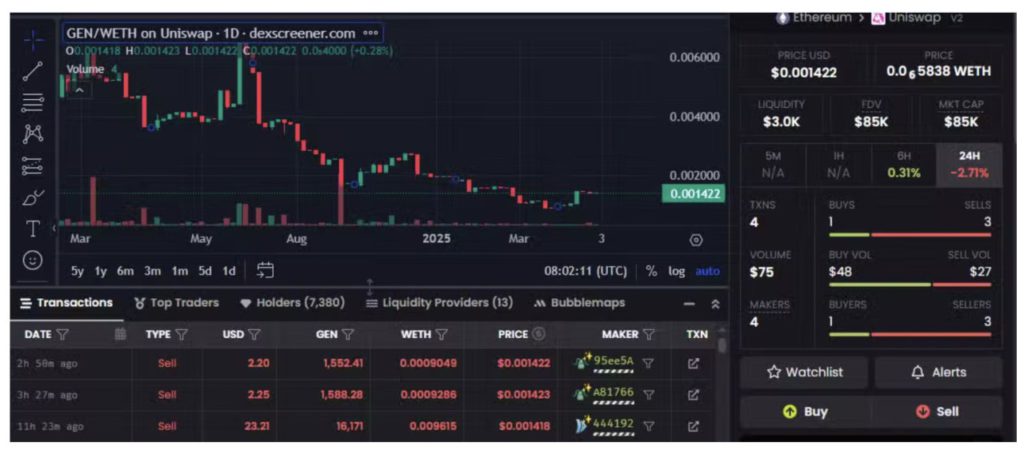

The decline in value of the DAOstack GEN token is a reflection of the challenges faced by many crypto projects trying to survive in a highly volatile market. Currently, the token is trading at $0.001422, with a 2.71% drop in the last 24 hours. This shows how quickly the dynamics in the crypto market can change and affect projects that were initially considered promising.

DAOstack’s downfall also highlights the importance of effective financial management and adaptation strategies in the face of market changes. Despite having a large start-up capital, the failure to maintain operational and financial sustainability is an important lesson for ongoing or future similar projects.

Also read: Ripple (XRP) July 2025 Prediction: Potentially Bullish Post ETF Approval by SEC?

Legacy and Continuing Influence

Although DAOstack has ceased operations, its influence is still felt through its former staff. The three founders of Backed Finance, the company that developed the popular tokenized stock market xStocks, are former DAOstack employees. This shows that the experience and knowledge gained while working at DAOstack has contributed to the success of their new initiatives.

This confirms that even though a particular crypto project may not be successful, the knowledge and experience gained during the process can be a valuable asset that brings a positive impact on other projects in the crypto industry. DAOstack’s legacy lives on through the innovations made by its former employees in various new initiatives.

Conclusion

The DAOstack collapse provided a valuable lesson on the importance of sustainability and adaptation in the crypto industry. Despite facing failure, the experience gained can pave the way for future success through other projects. This shows that in every failure there are seeds of success that may not yet be visible.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto Times. DAOstack Token Crashes After a Quiet 2022 Shutdown. Accessed on July 4, 2025

- Featured Image: Decentralized Explained