Did Bitcoin Traders Get Their Predictions Wrong? Tensions in the Crypto Market are Rising!

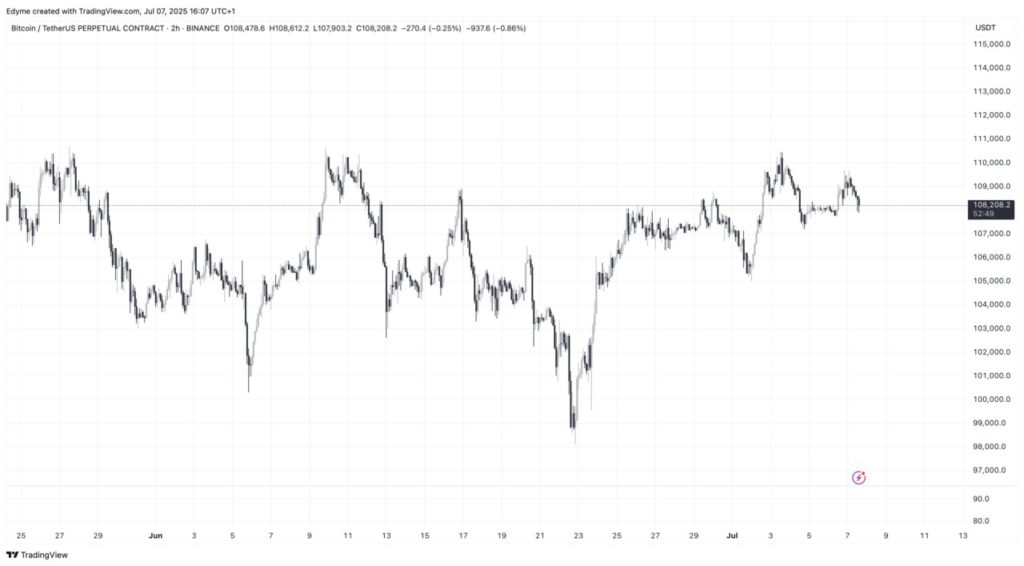

Jakarta, Pintu News – Bitcoin (BTC) continues to move in a tight range below its previous record high, showing some signs of recent price gains but unable to reach its previous price peak. In the last seven days, Bitcoin (BTC) reached a high of $110,307, but has now declined slightly to $108,311, down 0.3% in the last 24 hours. Although the market is still generally optimistic, some indicators show that market participants are divided in their predictions of Bitcoin (BTC)’s next direction.

Additional Short Positions on Binance Despite Rising Price

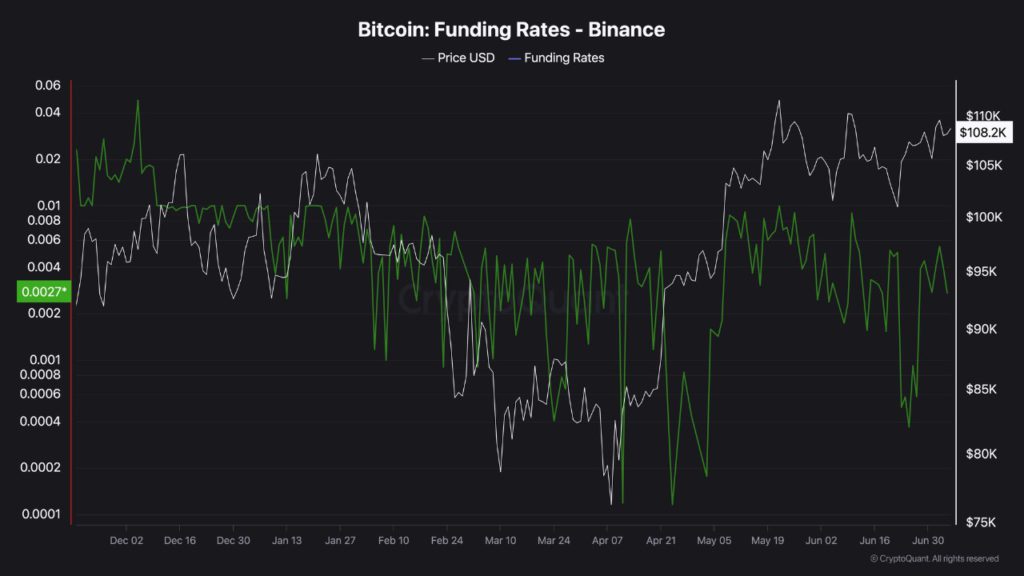

Despite the price strength seen in recent days, some signals suggest friction between bullish price action and bearish positioning from traders. Recent analysis by CryptoQuant contributor BorisVest shows that Bitcoin’s (BTC) rise was followed by a drop in funding rates on Binance, the largest crypto exchange by volume.

These trends can play an important role in shaping short-term market behavior. BorisVest notes that as Bitcoin (BTC) consolidates in the $100,000 to $110,000 range, funding rates on Binance are gradually decreasing. This suggests that a significant number of traders are taking short positions, betting that the Bitcoin (BTC) rally will soon reverse. The analyst explained that this behavior indicates skepticism about the sustainability of the latest price increase, especially among retail and leverage-focused traders.

Also Read: XRP price surges but corrects, can bulls take over again?

On-Chain Metrics Show Warning

While the dynamics of the futures market attracted attention, on-chain data also showed signs worth monitoring. Another analyst from CryptoQuant, Burak Kesmeci, highlighted the movement of Bitcoin’s (BTC) NVT Golden Cross metric, a tool used to assess market value relative to on-chain transaction volume. This metric has historically marked local peaks when it moves above a certain threshold.

In his analysis, Kesmeci pointed out that the NVT Golden Cross successfully identified three previous short-term peaks in 2025, each followed by corrections ranging from 9% to over 20%. Currently, the metric stands at 1.98, below the 2.2 threshold that often indicates overheated market conditions, but the trend is upward. “Although the current level is not yet in the danger zone,” Kesmeci wrote, “its upward trajectory could be an early warning that price momentum is starting to be excessive.”

Will Short Positions Reverse the Market?

With an increasing number of short positions amid rising prices, the market may face unexpected volatility. If Bitcoin (BTC) manages to break through resistance and reach a new higher price, traders holding short positions may be forced to close their positions, which could trigger further price spikes.

However, if their predictions are correct and the price of Bitcoin (BTC) drops, this could reinforce the bearish view in the market. This battle between bullish and bearish expectations creates uncertainty in the market. Investors and traders should pay attention to both technical and fundamental indicators to make informed decisions. Monitoring funding rates and on-chain metrics such as the NVT Golden Cross can provide additional insight into the potential future price movements of Bitcoin (BTC).

Conclusion

In the world of Bitcoin (BTC) trading, volatility is the norm, not the exception. Traders who dare to go short in the middle of an uptrend may be gambling with their capital, but only time will tell who will end up having the last laugh. By keeping an eye on market indicators and current news, market participants can be better prepared for whatever may happen in the crypto market.

Also Read: Bonk Crypto Surges: Is the Next Target Beyond $0.000025?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin Traders Are Betting Against the Rally, Will It Backfire? Accessed on July 8, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.