Bitcoin doesn’t move despite US dollar plunge, what’s going on?

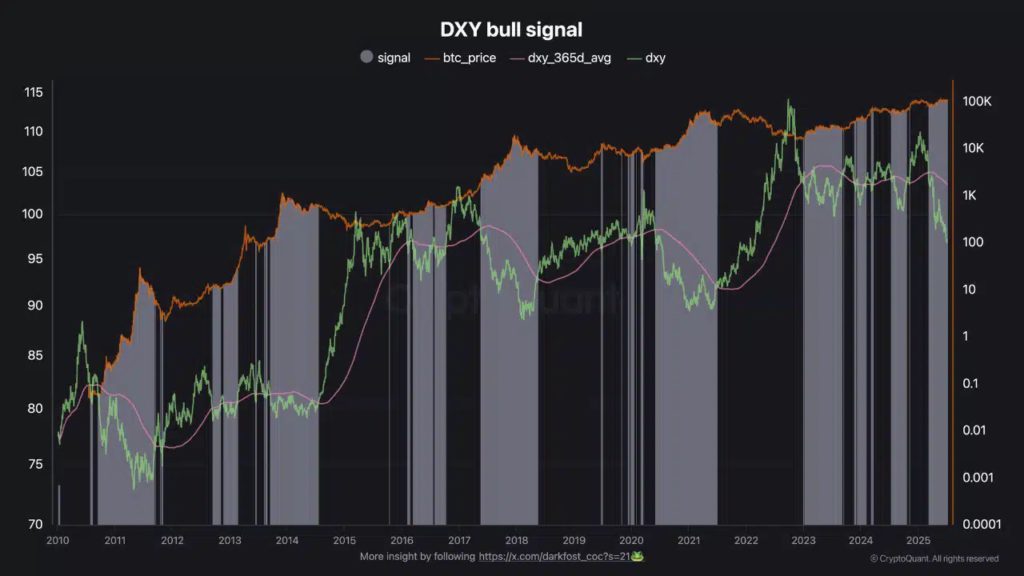

Jakarta, Pintu News – The Bitcoin market seems to be unaffected by the significant drop in the US Dollar Index (DXY), which has recorded its biggest decline in 21 years. While usually the weakness of fiat currencies such as the US dollar encourages investors to turn to riskier assets such as Bitcoin (BTC), this time the market reaction to this cryptocurrency appears flat. This situation raises questions about what might be delaying the market’s response to favorable macroeconomic conditions.

Is Silent Accumulation Happening?

Bitcoin (BTC) recorded a net outflow of $24.56 million, indicating a downward trend in reserves on major exchanges. Sustained outflows usually indicate that investors prefer to keep coins off-exchange, which reduces immediate selling pressure.

This behavior often correlates with accumulation phases, especially when they occur amid macroeconomic instability such as dollar weakness. Although the scale of the current outflows is still moderate compared to past rallies, their consistency suggests that investors may be preparing for a volatility event. This suggests that there is a high probability of significant changes in the Bitcoin (BTC) market in the near future.

Also Read: Will TRUMP Break $10? Check out the Whale Movement!

Bearish Crowd Growing Louder

On Binance, 62.6% of traders in the Bitcoin (BTC) USDT perpetual market hold short positions, which brings the Long/Short ratio down to 0.60. This signals a strong bearish bias, which could be fuel for a sudden reversal.

Such imbalances have historically triggered short squeezes, where a change in market momentum forces short traders to close their positions, which in turn can accelerate price spikes. Although price action remains calm, this skewed ratio reflects the presence of rising tensions. Therefore, the market should remain wary of sudden volatility, as the current derivatives landscape can amplify upward moves with little warning.

Why did the Pope pull out despite the weak dollar?

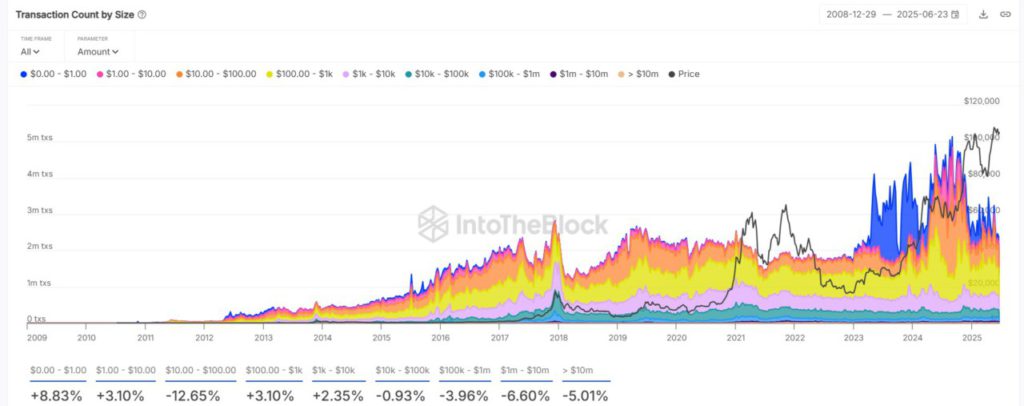

Despite favorable macro conditions, on-chain data shows a significant decline in high-value Bitcoin (BTC) transactions. Transfers in the $1 million to $10 million range fell by 6.6%, while those above $10 million decreased by 5.01%. These withdrawals suggest that large investors remain cautious, perhaps due to continued regulatory or macroeconomic uncertainty.

The lack of activity from these whales limits momentum and casts doubt on whether they see this as a true accumulation zone. Without their participation, retail investor-driven price gains may not have the staying power required for sustained price appreciation.

Conclusion

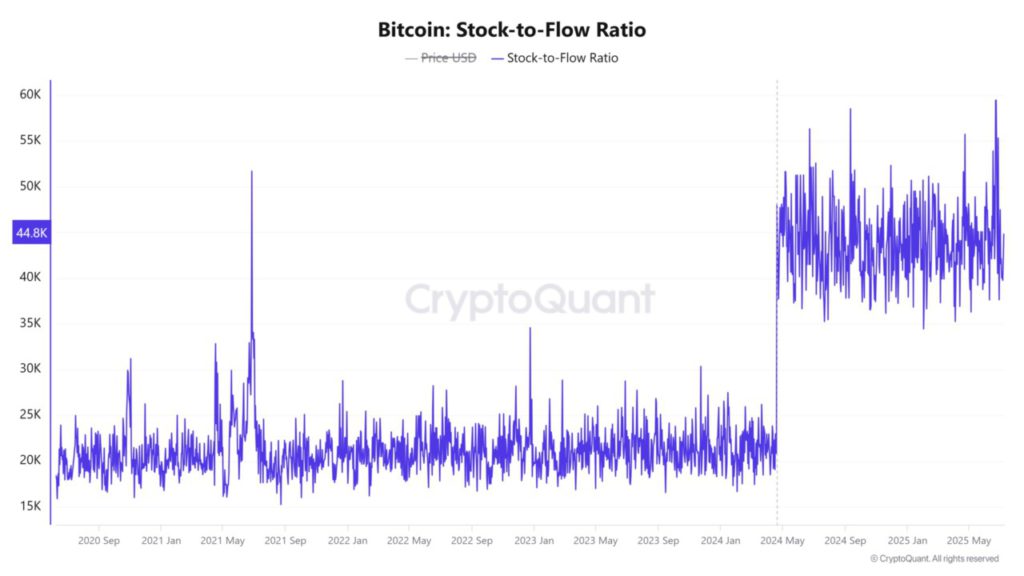

Although macroeconomic pressures such as US dollar weakness usually favor bullish setups for Bitcoin (BTC), the current price action remains uncertain. Outflows from exchanges and bearish derivatives positions suggest the potential for a reversal, but a decline in whale activity and a weakening scarcity narrative cloud the outlook. A breakout is still possible-but not guaranteed-unless there is fresh capital or momentum that pushes the market out of its current impasse.

Also Read: 5 Best Free Bitcoin (BTC) and Litecoin (LTC) Cloud Mining Platforms in 2025

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Bitcoin Ignores Historic Dollar Breakdown, How Long Can This Calm Last?. Accessed on July 11, 2025