Pi Coin Price Plummets! Investor outflows trigger downward pressure on crypto market

Jakarta, Pintu News – The Pi Coin (PI) market is facing heavy pressure as a massive wave of selling by coin holders. Investor outflows are pushing the price of Pi Coin close to its lowest level, reinforcing the bearish sentiment among traders and the crypto community. This phenomenon highlights the importance of analyzing fund movements in assessing the stability of digital assets such as PI.

Large Outflows and Downward Pressure on Prices

According to a report by BeInCrypto, the sell-off by Pi Coin holders has triggered a significant price drop in recent times. Data shows that the volume of outflows from exchanges to private wallets or sales to the market is very high, thus increasing selling pressure in the spot market. This reinforces the downward trend in prices, especially if important support levels cannot be maintained.

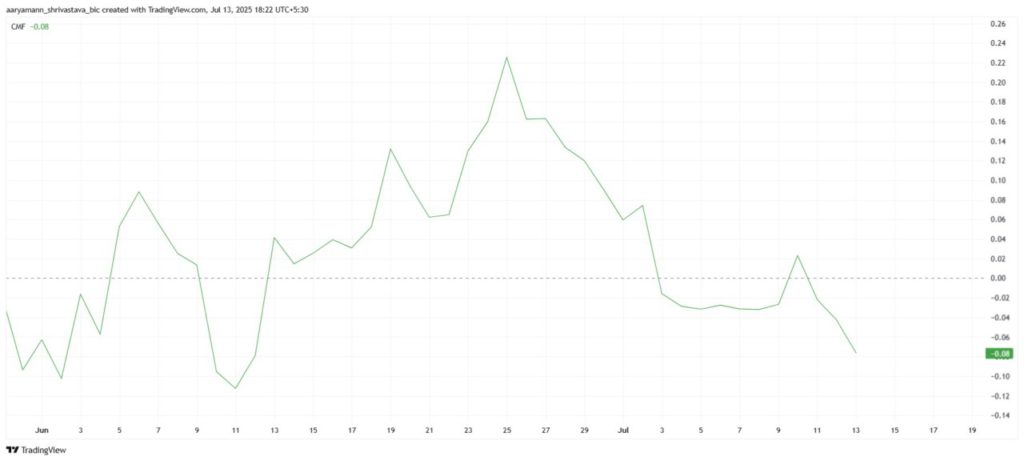

This situation also reinforces the bearish pattern, where PI price declines get sharper every time there is a surge in outflows. Several technical indicators such as the DMI, EMA, and CMF are also showing negative momentum, warning of the risk of a further correction if the selling pressure does not subside soon. Under these conditions, many traders choose to be cautious and wait for confirmation of a reversal before re-entering the market.

Also Read: Crypto Investment July 2025: Assets to Watch Out For!

Prices Approach Bottom, Risks Remain High

Pi Coin’s current price is reportedly moving close to its historical low. BeInCrypto mentioned that if support levels such as USD 0.49 or USD 0.40 fail to hold, the price could fall deeper. Some analysts have also highlighted the fact that PI trading volumes are sharply declining, signaling a drop in market interest in this asset.

A surge in PI supply on the exchange of more than 30% in the last quarter also triggered selling pressure. A price drop of up to 15% within 24 hours was recorded due to massive outflows from existing holders. In such a situation, investors are advised to monitor key support levels and not rush to take new positions until market conditions stabilize.

What are the Implications for Crypto Communities and Investors?

The trend of outflows and falling PI prices reminds the crypto community of the importance of monitoring sentiment and fund flows before investing in new digital assets. Furthermore, such high volatility can be an opportunity for short-term traders but can also be risky if not supported by disciplined risk management.

A similar phenomenon can also occur in other crypto assets if there is a change in sentiment or large outflows. Education on technical and fundamental analysis is very important for investors, in order to identify potential trend reversals or avoid further losses when the market is bearish.

Conclusion

The case of Pi Coin’s price drop due to investor outflows shows the dynamics and high risks in the crypto market. Investors need to be more observant in reading the movement of funds and strengthen risk management strategies before making decisions amid extreme volatility.

Also Read: Revealed! The Future of Bitcoin and Crypto Market in the Second Half of 2025

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Pi Coin Holders Continue to Sell as Pi Network Faces All-Time Low. Accessed July 14, 2025.