XPR Network Soars 34.5%! Can This Crypto Rally Last?

Jakarta, Pintu News – XPR Network (XPR), formerly known as Proton, has just scored a significant price increase with a 34.5% surge to above the USD 0.004 level in mid-July 2025. This sharp rise ended a months-long consolidation phase and caught the attention of investors who had been waiting for a breakout in the altcoin market. However, the question is: is this XPR rally strong enough to last in the long run?

XPR Price Spike: Breakout from Long Consolidation

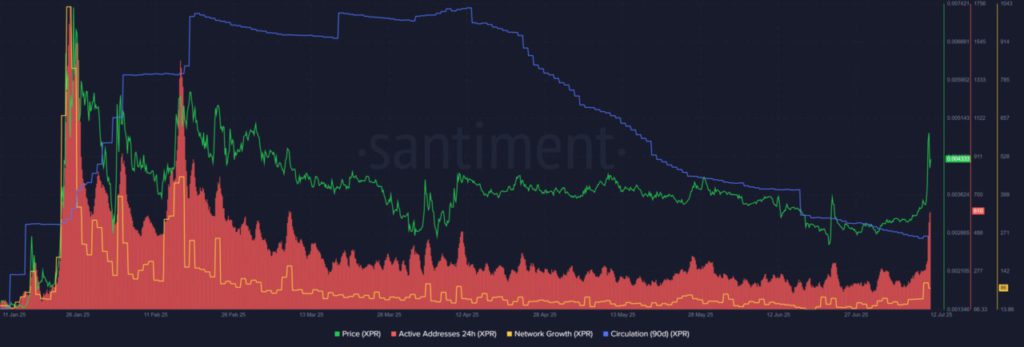

Since January 2025, XPR Network has gone through a period of consolidation after a big rally earlier in the year. For almost six months, the price of XPR moved steadily below the USD 0.00278 resistance, and tested the strong support at USD 0.00082 several times. The big breakout occurred on July 11, where XPR broke through major resistance and posted a daily gain of 34.5%.

However, the weekly trading volume in this rally is still below the peak volume recorded in November 2024 or January 2025. This has made some long-term investors wary, as volumes that are not as high as before are often considered less strong signals for a sustained rally. However, the technical structure on the daily chart remains favorable for a bullish trend, with new support forming at the breakout area.

Also Read: Crypto Investment July 2025: Assets to Watch Out For!

Long-term holders remain optimistic, but beware of pullbacks

On-chain data shows an interesting trend: the number of active wallet addresses and the growth of the XPR network jumped sharply, signaling wider adoption. However, token circulation in the last 90 days has actually decreased, indicating that most holders prefer to hold (HODL) their assets rather than sell amidst price increases.

However, the price of XPR was rejected at the resistance zone of the bearish order block at around USD 0.005 (around Rp81). If selling pressure increases, there is a possibility that the price will retest the support at USD 0.004. A retest to this level could actually be a buying opportunity for new investors, considering that the support was once a strong resistance that has been broken out.

Fundamental Signals: Rising Adoption, Long-term Opportunities?

Increased network activity and a growing number of unique wallet addresses are indicators that the XPR Network is beginning to be more widely adopted, both by individual users and small institutions. Such consistent adoption is usually a strong basis for long-term price rallies, especially if supported by innovations in the blockchain sector or strategic partnerships.

However, rallies without large volume support should still be watched out for. A correction or pullback in the near term is highly likely, and for long-term investors, focusing on fundamental growth and technical analysis is highly recommended before making a decision.

Conclusion

XPR Network’s surge of up to 34.5% in a short period of time confirms the huge potential of this altcoin in the 2025 crypto market. Although the long-term trend is supported by positive on-chain data, investors are advised to stay alert to volatility and potential price corrections. A combination of technical and fundamental analysis remains the key to capitalizing on opportunities in the digital asset market.

Also Read: Revealed! The Future of Bitcoin and Crypto Market in the Second Half of 2025

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMBCrypto. XPR Network soars 34.5% – Assessing if this rally is built to last. Accessed July 14, 2025.