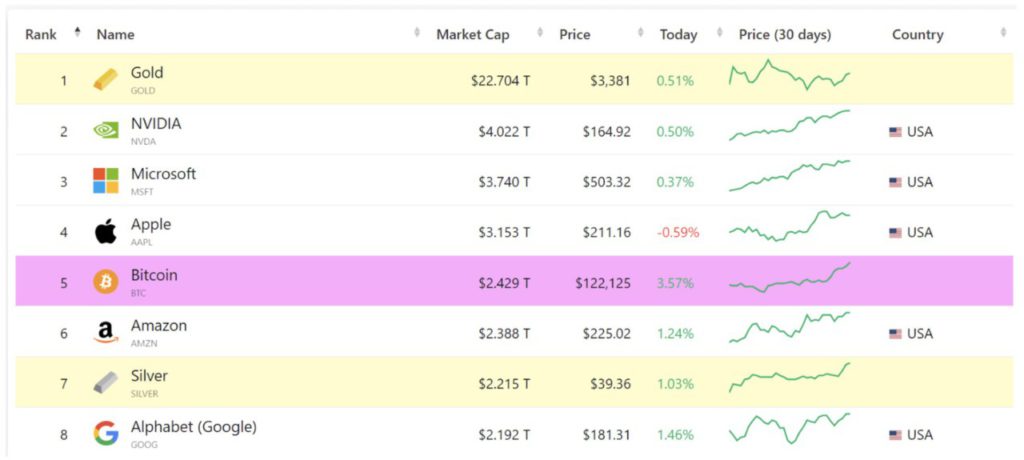

Bitcoin Overtakes Amazon to Become the World’s 5th Largest Asset!

Jakarta, Pintu News – Bitcoin has now surpassed Amazon’s market value after setting a new record high price of $122,600. With consistent gains, the cryptocurrency is now the fifth largest asset in the world, trailing only Apple.

This increase marks a new era for Bitcoin as a digital asset that is not only dominant but also as an investment instrument that is increasingly trusted by large institutions.

Bitcoin Market Cap Surpasses Amazon

The price of Bitcoin (BTC) surged to an all-time high of $122,600 on Monday (July 14) and has risen nearly 13% over the past week, according to a report from Cointelegraph.

Read also: Metaplanet Buys Another $93.6 Million Worth of Bitcoin, Total BTC Holdings Now Reach 16,352!

This increase allowed Bitcoin to surpass a market capitalization of $2.4 trillion, beating Amazon at $2.3 trillion,silver at $2.2 trillion, and Alphabet (Google’s parent company) at $2.19 trillion, according to available data.

This means that Bitcoin’s market capitalization is only about $730 million away from tech giant Apple at the time of writing.

This development signals Bitcoin’s growing presence in the global financial system, according to Enmanuel Cardozo, market analyst from real-world asset tokenization platform, Brickken.

He told the Cointelegraph website:

“With institutional giants like BlackRock and MicroStrategy treasury continuing to grow, Bitcoin’s legitimacy as an investable asset class is no longer in question, especially with regulatory momentum also starting to shift.”

Institutional Accumulation and Macro Environment Support Bitcoin’s Rise

Continued institutional accumulation and a favorable macro environment could also help Bitcoin surpass Apple’s valuation, meaning the price could reach more than $142,000, Cardozo said.

Investors are not only targeting Apple; surpassing Microsoft’s market capitalization is also the next target. It indicates the price of Bitcoin could reach $167,000, which it says “is not impossible, given the huge demand coming from spot Bitcoin ETFs.”

Bitcoin’s new record high comes amid rising institutional adoption, as the number of Bitcoin-owning companies has doubled since June 5.

Today, more than 265 companies hold Bitcoin on their balance sheets, up from 124 just a few weeks ago.

A total of 3.5 million Bitcoins are now held in company treasuries, with 853,000 BTC (or 4% of the total supply) in public company treasuries, and over 1.4 million BTC (or 6.6% of the supply) held through spot Bitcoin exchange-traded funds (ETFs).

Read also: Binance Launches TGE with Curve Bonding System with Four.Meme!

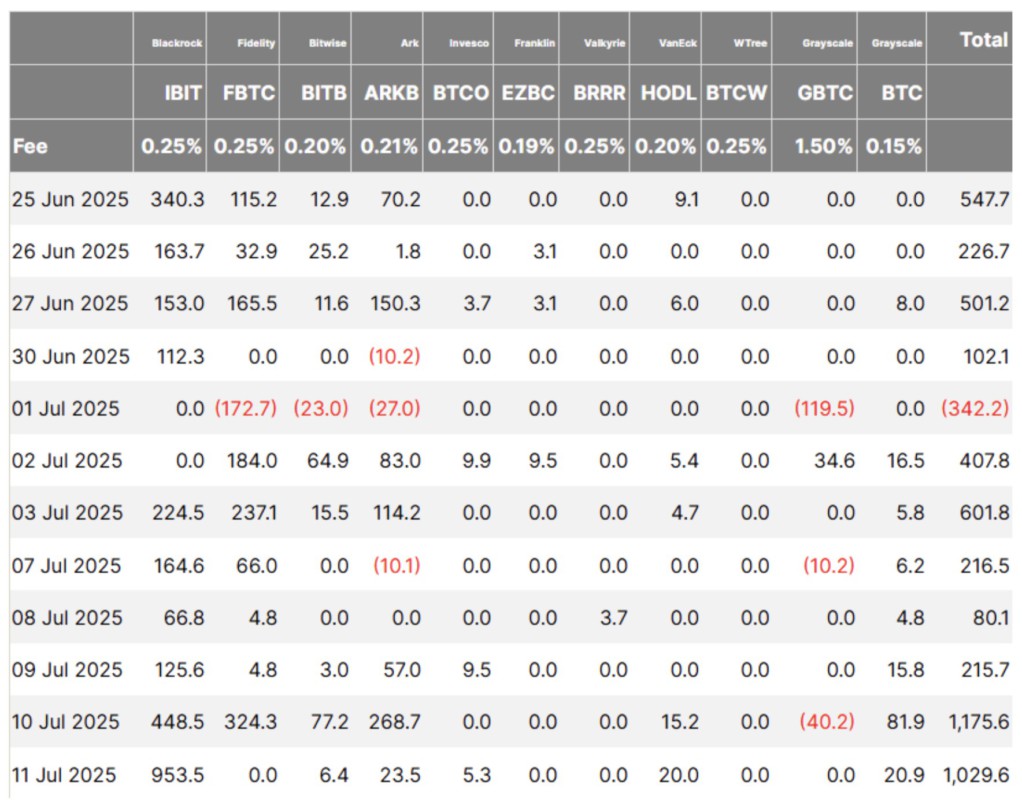

Surge in Bitcoin ETF Purchases Boosts BTC Momentum

Spot Bitcoin ETFs in the United States ended last week’s trading session on a buying trend for the seventh consecutive day, adding significant liquidity that strengthened Bitcoin’s price momentum.

According to data from Farside Investors, spot Bitcoin ETFs recorded net positive inflows of more than $1 billion on Friday, marking the seventh consecutive day of new investment.

This inflow of funds from spot Bitcoin ETFs was the main driver of Bitcoin’s price rise to the latest record high.

In February 2024, the ETF accounted for about 75% of total new investments into Bitcoin over a two-week period. This activity helped push the price of BTC through the $50,000 level.

The price of Bitcoin is also likely to be driven by increased interest in the wake of the US government’s agenda called “Crypto Week.”

This week, legislators are looking to pass three important bills that are believed to strengthen the national crypto industry, namely:

- GENIUS Act(Guiding and Establishing National Innovation for US Stablecoins)

- CLARITY Act(Digital Asset Market Clarity Act)

- Anti-CBDC Surveillance State Act, which aims to prevent the establishment of central bank digital currencies (CBDCs).

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinspeaker. Bitcoin Value Surpasses Amazon, BTC ATH $122.5K. Accessed on July 15, 2025

- Cointelegraph. Bitcoin Flips Amazon Market Cap to Become Fifth Global Asset. Accessed on July 15, 2025