Revealed! More than a Third of US Inflation Data is Only Estimates

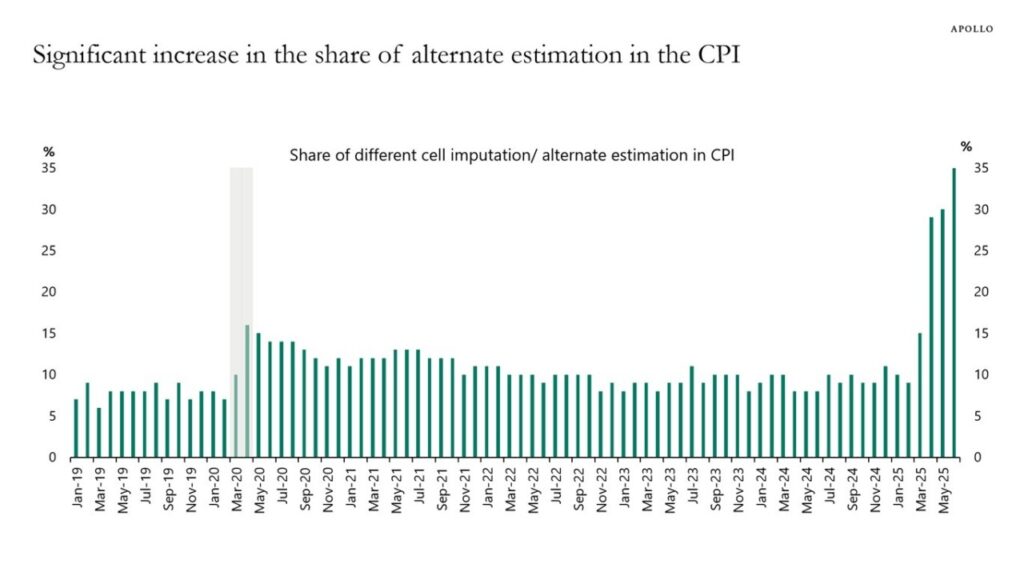

Jakarta, Pintu News – Growing skepticism about US inflation statistics has intensified after it was revealed that more than a third of the US Consumer Price Index (CPI) data in August 2025 was estimated rather than directly observed. This raises serious questions about the accuracy of data that is an important reference for the Federal Reserve’s monetary policy.

CPI Estimates Rise, Investor Confidence Declines

In August 2025, the proportion of estimated prices in the US CPI reached 36%, up from 32% in July. This was the highest since the Bureau of Labor Statistics (BLS) began tracking the metric. The increase surprised many and raised concerns about the reliability of the data used to measure inflation.

The increase in the proportion of these estimates suggests a potential distortion in the understanding of true inflation. Investors and analysts are becoming more critical of the data released, given its huge impact on investment decisions and monetary policy.

Also Read: Jake Claver, CEO of Digital Ascension Group’s Shocking Prediction: XRP Will Break $25!

Fed Policy Under the Spotlight

The CPI is the leading indicator used by the Federal Reserve to measure consumer inflation and an important basis for interest rate setting and monetary policy. However, the mismatch between price pressures felt by households and official data can complicate the Fed’s inflation targeting strategy.

Questions regarding these data may also reduce public confidence in the policy signals given by the Fed. This in turn could affect market expectations and overall economic stability.

Pressure for BLS Transparency

Economists and market participants urged the BLS to be more transparent regarding the components of the CPI that use imputed data as well as the methodology used in the estimation. While imputation is a common statistical practice, the sheer scale of its use today has surprised many observers and emphasized the need for stronger disclosure.

This transparency is expected to help restore confidence in the inflation data released, allowing market participants to make more informed decisions based on accurate and reliable information.

Conclusion

The uncertainty arising from the use of estimated data in calculating the US CPI has raised serious concerns among investors and policymakers. Efforts to improve data transparency and accuracy are essential to ensure that monetary policy can be implemented effectively and market confidence is maintained.

Also Read: Maartunn Analyst Says December 2024 Crypto Market Pattern Repeats, What Does It Mean?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Why Smart Investors No Longer Trust US CPI. Accessed on September 18, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.