5 facts why crypto treasury companies lose purchasing power in September 2025

Jakarta, Pintu News – In early 2025, many digital asset treasury (DAT) companies such as Strategy, BitMine, and SharpLink aggressively accumulated major crypto assets such as Bitcoin (BTC), Ethereum (ETH), and Solana (SOL).

However, entering September, the strategy backfired. Based on reports from Kaiko and Artemis Analytics, they are now facing a sharp decline in market value, stock pressures, and skepticism from investors.

1. DAT Company Adds Assets, but Purchasing Power Declines

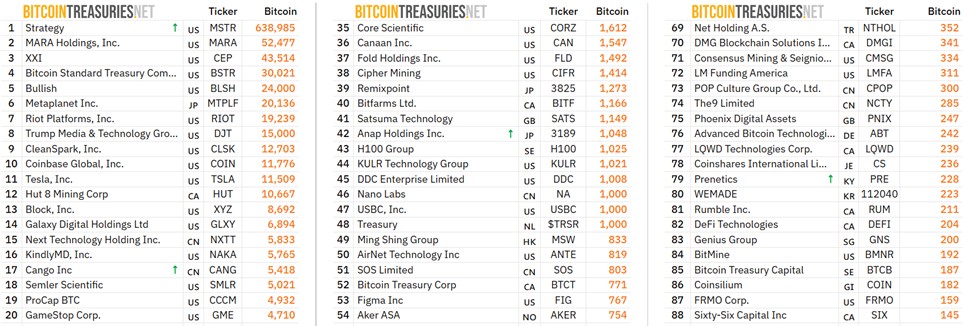

Throughout 2025, DAT firms like Strategy (MSTR) have continued to add to their crypto holdings. Strategy alone has bought more than 190,000 BTC in just nine months, totaling more than 638,000 BTC.

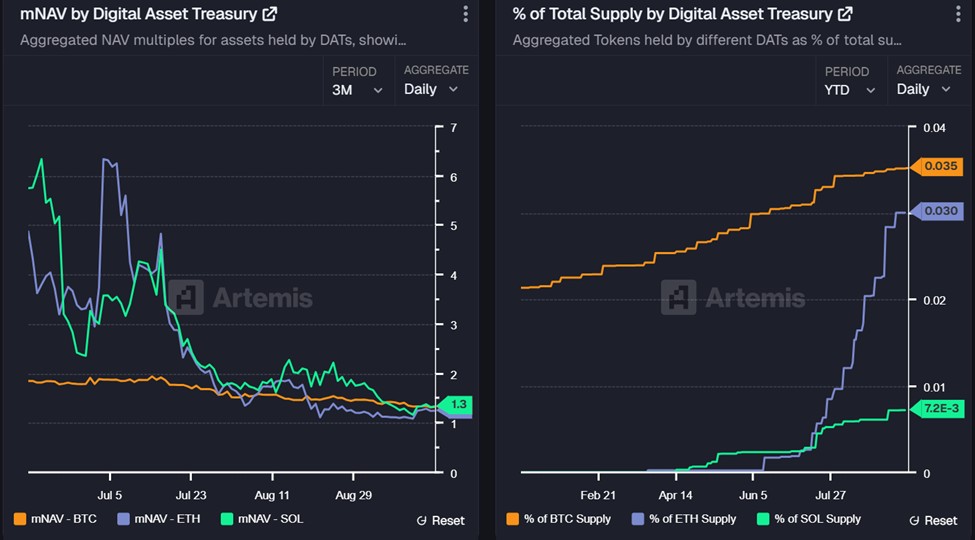

But according to Kaiko, this accumulation has not been enough to arrest the decline in the market value of assets (mNAV). This decline in value shows that while companies are adding crypto holdings, their equity value in the stock market continues to decline.

This makes companies lose purchasing power, as stock prices fall faster than the growth in value of the digital assets they hold.

Also Read: Jake Claver, CEO of Digital Ascension Group’s Shocking Prediction: XRP Will Break $25!

2. Stock prices plummet due to investor skepticism

BeInCrypto reported that Next Technology Holding (NXTT) saw its share price drop by almost 5% after announcing plans to raise $500 million(IDR 8.26 trillion) to buy more Bitcoin.

Although the company already has 5,833 BTC worth around Rp108 trillion, the market has responded negatively. This reflects investors’ concerns that the crypto treasury business model is not robust enough amid the volatility of digital assets.

A more severe case was KindlyMD’s NAKA shares, which plummeted by 55% after PIPE shares were released to the market, totaling a 90% drop in a month.

Also Read: Jake Claver, CEO of Digital Ascension Group’s Shocking Prediction: XRP Will Break $25!

3. Analysts Call Crypto Treasuries a “Ponzi Scheme”?

KindlyMD CEO, David Bailey, stated that volatility is to be expected and called it part of a long-term strategy. But sharp criticism came from anti-crypto figures like Peter Schiff, who called Bitcoin-based treasury companies a “pyramid-shaped Ponzi scheme.”

Schiff highlighted the 96% drop in NAKA’s share price since May as clear evidence of the structural risks of the crypto-asset accumulation model by public companies.

Not only NAKA, MicroStrategy also noted a decline in the value of the NAV multiple from 1.75x in June to 1.24x in September, which effectively inhibited new BTC purchases.

4. Proposed Tokenization of DAT Shares to Expand Liquidity

In the midst of this crisis, some DeFi analysts proposed a bold move: tokenizing DAT company shares to make them accessible to the crypto-native investor community.

An analyst named Ignas mentioned that tokenization could open up arbitrage opportunities, expand liquidity to the on-chain ecosystem, and attract new interest from “crypto degens” who have not been investing in traditional stock markets.

However, he also recognized that adding new speculation to an already volatile instrument could bring additional risks, especially without strong regulatory support and transparency.

5. Treasury Strategies Trapped Between Innovation and Market Reality

The interesting fact about this report is the contradiction that DATs face. On the one hand, they help keep crypto prices strong through accumulation. But on the other hand, their stock is crumbling as investors question the sustainability of the business model.

While this strategy briefly boosted the spot price of Bitcoin and Ethereum, pressure from capital markets has left many DAT companies “out of breath.” Some have not even explored debt-based financing, which could exacerbate their cash pressure going forward.

This represents a major challenge for the future of companies adopting crypto as a primary treasury asset.

Also Read: Maartunn Analyst Says December 2024 Crypto Market Pattern Repeats, What Does It Mean?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Lockridge Okoth / BeInCrypto. From Accumulation to Anxiety: Crypto Treasury Firms Confront Harsh Market Realities

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.