Will XRP Correct to $2.72 in October 2025? Check out the Analysis!

Jakarta, Pintu News – XRP is under increasing selling pressure as network activity declines and sales dominance grows stronger. Various indicators suggest that the digital currency may face further declines.

XRP Price Drop: Will it Continue?

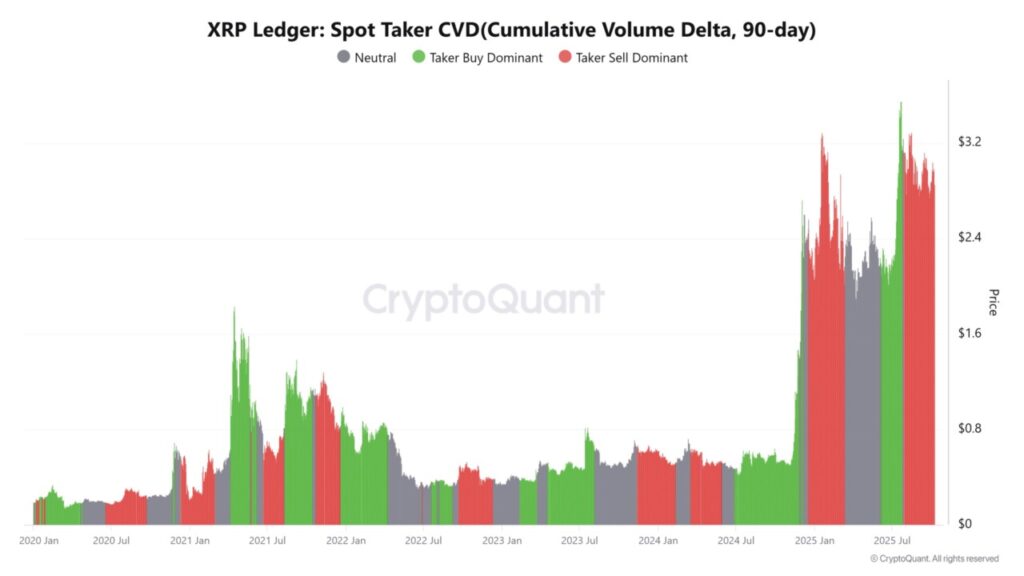

The descending triangle pattern on the XRP chart, reinforced by the Cumulative Volume Delta (CVD) Sales Dominance, suggests continued selling pressure. This could push the price to retest the $2.72 level. If selling continues to dominate, the chances for a significant price recovery become slimmer.

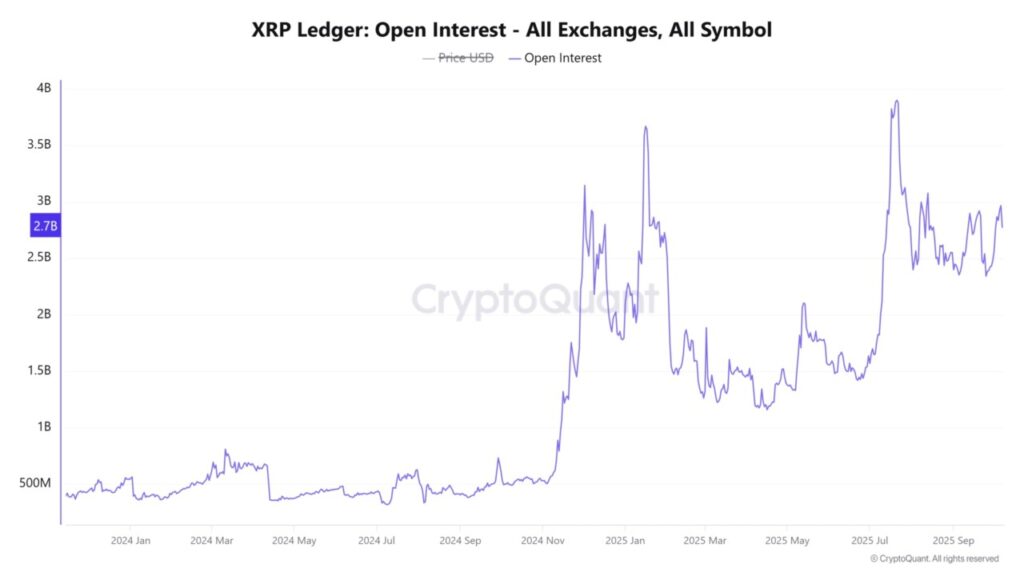

The situation was exacerbated by a decline in interest from market participants, which was reflected by a drop in Open Interest in the derivatives market. The 6.51% drop to $2.78 billion suggests that participation in trading XRP derivatives is weakening, which could worsen the near-term outlook.

Also Read: Trump’s Secret Plan May Push Bitcoin (BTC) to $250,000!

Impact of Weak On-Chain and Derivatives Activity

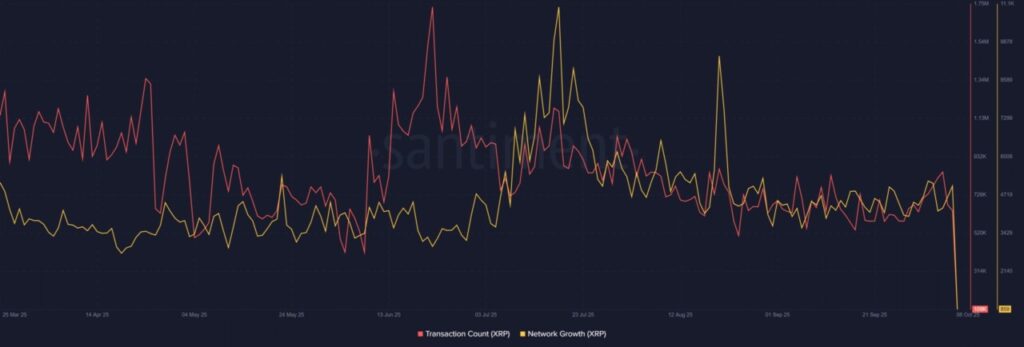

On-chain data shows a significant drop in network participation, reflecting reduced investor enthusiasm for Ripple (XRP). This could be an early indicator that investors are starting to lose faith in the long-term prospects of this digital currency.

Additionally, the decline in Open Interest in the derivatives market suggests that not only retail investors, but also professional traders are starting to reduce their exposure to XRP. This adds to indications that selling pressure may continue, limiting the potential for price gains in the near term.

Technical Analysis and Future Price Predictions

With various indicators showing selling pressure, XRP is at a tipping point. Technical analysis suggests that if this selling pressure continues, there is a high probability of XRP reaching or even breaking the $2.72 price target. It is important to monitor indicators such as the Spot Taker CVD which remains in a zone of selling dominance. This indicates that sellers in the spot market continue to actively sell, which could prevent XRP’s price from rising in the near future.

Conclusion: The Future of XRP in Bear’s Hands

With various factors at play, the future of XRP price seems to be filled with challenges. Investors and traders should pay close attention to market indicators and network activity to make informed decisions. Given the current conditions, it is highly likely that XRP will test lower price levels before any potential recovery.

Also Read: 5 Robert Kiyosaki Predictions: USD Crashes & Crypto is Bought, Bitcoin Price Breaks Rp2 Billion!

Also Read: 5 Coin Memes Predicted to Explode After Bitcoin Breaks $125,000

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Decoding XRP’s price test: Will bears push it below $2.72? Accessed on October 10, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.