Ethereum (ETH) Derivatives Surge Reaches $560 Billion, Is This a Sign of the Next Rally?

Jakarta, Pintu News – Ethereum (ETH) managed to maintain support above $3,950, showing bullish momentum despite profit-taking and a potential short-term correction. Ethereum (ETH) derivatives trading volume on Binance reached nearly $560 billion in October, one of the highest levels in history.

Market Power Reveal of $560 Billion Derivatives Surge

The large spike in derivatives activity points to increased speculative momentum and strong institutional interest in Ethereum (ETH) which is holding near $4,000. This increase reflects higher risk-taking, with more participants using futures and options to capitalize on short-term volatility and potential upside continuation.

Massive derivatives expansion often heralds phases of strong momentum and liquidity rotation across the broader Ethereum (ETH) market ecosystem. Ethereum (ETH) continues to hold its upside support near $3,950, showing resilience despite recent profit-taking. The 4-hour chart reveals a steady uptrend since mid-October, where buyers have consistently defended higher lows, keeping the structure intact.

Also Read: 5 Strong Signals Dogecoin (DOGE) Could Explode in November: Here’s What Analysts Say

Long Trader Positioning: Indicators of Ethereum’s Next Rally?

Data from Binance shows that 70.63% of Ethereum (ETH) traders are in long positions, with only 29.37% holding short positions. This predominance of bullish accounts reflects strong conviction among traders using leverage. Imbalances like this often occur when sentiment turns decisively towards upside expectations, supported by improvements in on-chain structures and technicals.

However, heavy long positions may also cause a spike in volatility if liquidation increases during small drawdowns. Despite the dominance of long positions and strong support near $3,950, this imbalance could trigger volatility if liquidation pressure increases.

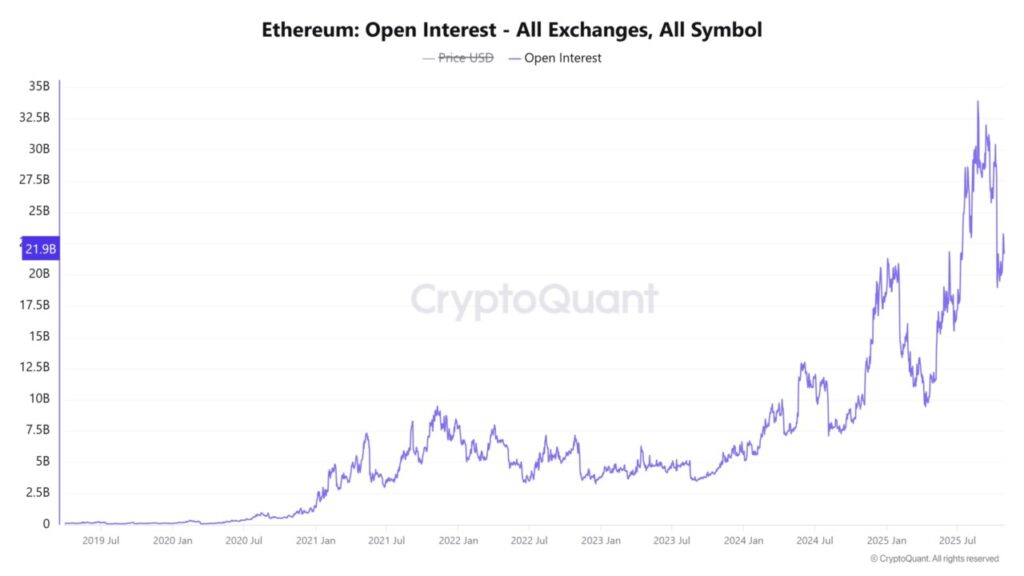

Therefore, the bullish view on Ethereum (ETH) remains valid only if fresh capital inflows can sustain the rally beyond $4,756, supported by a steady recovery in Open Interest (OI).

Open Interest Withdrawal: A Signal of Caution in the Market

Ethereum’s (ETH) Open Interest (OI) fell by 4.28%, suggesting that some traders are reducing leverage after rapid derivatives development. These short-term adjustments often signal profit-taking or strategic reallocation rather than weakness.

As volatility increases, disciplined participants typically reduce exposure to manage risk, paving the way for renewed accumulation once stability returns. Sustained liquidity around current price levels suggests that capital remains engaged, in line with the broader bullish framework observed in derivatives and spot markets.

Strength and Caution in Ethereum Market Activity

Ethereum (ETH) market activity is showing strength but also signs of caution. Record derivatives volume of $560 billion reflects growing speculative demand, but a 4.28% drop in OI suggests that traders are reducing leverage rather than expanding it. Despite the dominance of long positions and strong support near $3,950, this imbalance could trigger volatility if liquidation pressure increases.

Also Read: Will Ripple (XRP) Surge Before 2030? Check out his bold prediction!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Is Ethereum’s $560B surge in derivatives a sign of the next ETH rally?. Accessed on October 31, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.