Hyperliquid Faces First Test: Will HYPE Token Unlock End the Rally?

Article Summary:

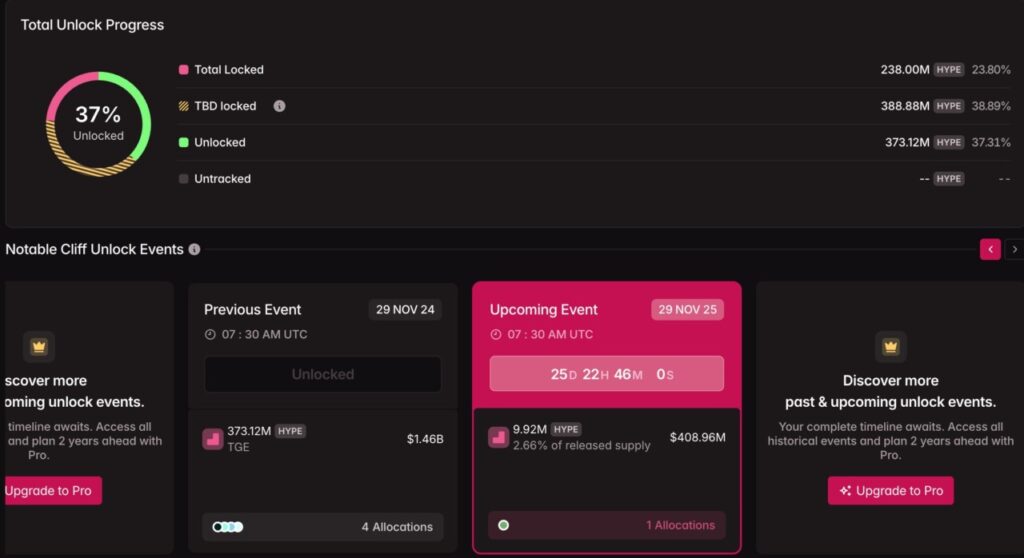

- Hyperliquid will unlock 2.66% of HYPE’s token supply in November 2025, raising market concerns over potential selling pressure and value dilution.

- This large unlock is the first test of the resilience of the largest on-chain DEX project in the perpetual sector, amidst the dominance of daily revenue of more than US$2.2 million (≈ IDR36.26 billion).

- If earnings are used for buybacks or burns, HYPE’s rally could persist; otherwise, a correction towards US$20 (≈ Rp332,360) is a realistic near-term scenario.

Hyperliquids face a major liquidity test; HYPE unlock volatility could determine the next price direction. So, what is the current state of the Hyperliquid market?

Supply Pressure and Dilution Risk

After taking the top spot in the DEX perpetual on-chain sector, Hyperliquid is now facing its toughest test since its launch. This November, the project will unlock 2.66% of the total circulating token supply, potentially triggering selling pressure and dilution risks.

According to data from Tokenomist, large token releases are usually followed by price drops due to increased supply in the secondary market. Some technical analysts note that HYPE is forming a head-and-shoulders pattern on the daily chart, which could trigger a price correction towards US$20, if this pattern is confirmed. However, some experienced traders see potential for short-term arbitrage amid the high volatility of the unlock period.

Also Read: 5 Shocking Ethereum (ETH) Predictions from Robert Kiyosaki that Made Crypto Hunted by Whales

On-Chain Revenue to Support Fundamentals

Amid short-term concerns, Hyperliquid’s fundamentals remain strong. Data from Artemis cited by BeInCrypto shows that in the last 24 hours, Hyperliquid recorded more than US$2.2 million in transaction fee revenue-the highest of any blockchain network.

Additional reports also show that this project accounts for about 33% of the total revenue of the DeFi ecosystem, making it a “transaction fee goldmine” in the DEX sector. According to analysts, if a portion of these revenues were allocated to buyback, burn, or staking programs, the selling pressure of unlock tokens could be significantly reduced. However, if the revenue is not managed productively, the market could potentially experience a sharper correction.

Test of Rally Resilience and Long-term Prospects

This month’s HYPE token unlock will be the first “crash test” for Hyperliquid, which will determine whether the rally since early 2025 still has a strong foundation or is starting to lose steam.

The team’s success in managing volatility, maintaining community trust, and utilizing on-chain revenue to strengthen liquidity will go a long way in determining the next direction. If the revenue allocation strategy is successful, HYPE could maintain bullish momentum.

Conversely, failure to maintain price stability may trigger capital rotation to other DeFi projects with more manageable risks. For investors, this period is not just a phase of volatility, but an evaluation of the economic resilience of Hyperliquid tokens amid the intense competition of the DeFi 2025 market.

Also Read: Can You Live Only on Crypto? Here are 3 Sources of Income & Challenges You Need to Know About

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Linh Bùi. Hyperliquid Faces Its First Real Crash Test – Will the $HYPE Unlock Break the Rally? Accessed on November 4, 2025