7 Market Signals to Watch: Ethereum (ETH) Hunted Despite Bearish Pressure

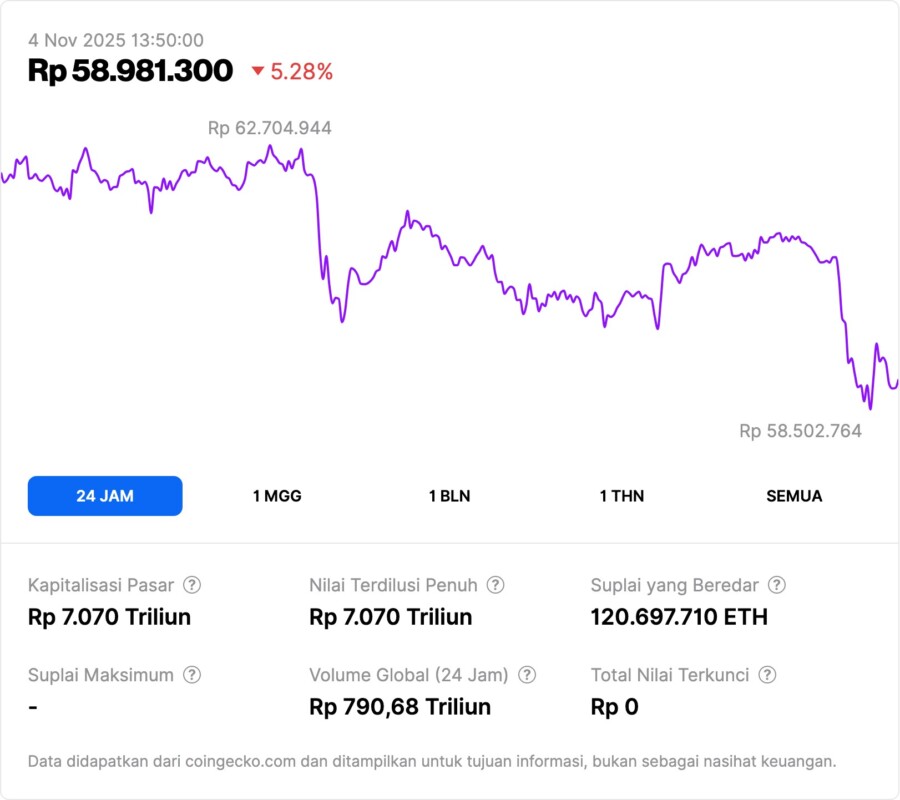

Jakarta, Pintu News – Ethereum is back in the news after a 4.5% drop in the last 24 hours, trading at around Rp62 million ($3,710). However, while market pressures make it correction-prone, on-chain data is showing signs of accumulation that have gotten serious attention from whales and long-term investors.

Here are 7 important facts related to the latest Ethereum conditions that are trending:

1. ETH price plummets but still holds key support

Based on technical analysis, ETH failed to break the resistance of IDR63.5 million ($3,800) and is now testing the important support area of IDR62 million ($3,715).

This level has been tested many times since October 2025 and is referred to as the “battle zone” between selling and buying pressure, according to Bitcoinist analysts.

If the price closes below €61.5 million ($3,680), ETH could potentially drop deeper to €59.1 million ($3,550) or even €58.5 million ($3,500).

Also Read: 5 Shocking Ethereum (ETH) Predictions from Robert Kiyosaki that Made Crypto Hunted by Whales

2. RSI and MACD Indicators Show Weakening Momentum

Technical indicators such as the Relative Strength Index (RSI) and MACD signal that the buyers’ momentum continues to weaken.

This reinforces the view that the market is still in the grip of sellers, and a potential price reversal is still pending, according to a report from Bitcoinist.

However, if there is a bounce from this support, ETH could again test the resistance areas at IDR65.5 million ($3,920) and IDR67 million ($4,000).

3. 600 Million Dollars ETH Scraped: Whale Accumulation Signal?

According to data from Glassnode and Sentora, more than IDR 10 trillion ($600 million) worth of ETH has been withdrawn from crypto exchanges in just a week.

These moves often signal massive accumulation, as investors tend to move assets to private wallets for long-term storage.

This action is gaining attention as it could be an indication of investors’ confidence in Ethereum’s price recovery in the near future.

4. ETH MVRV Ratio Still Positive, a Sign of Market Confidence

ETH’s MVRV (Market Value to Realized Value) metric is currently at 1.50-levels which, according to historical analysis, signals the market is in a neutral to bullish phase.

Interestingly, staked ETH has a higher MVRV ratio of 1.7, suggesting that long-term ETH owners remain confident in the upside potential.

Currently, a total of 36.1 million ETH have been staked, or about one-third of Ethereum’s total supply.

5. Stablecoin activity on ETH network explodes 45%

During October 2025, the transaction volume of stablecoins on the Ethereum network jumped 45% to IDR 47.1 quadrillion ($2.82 trillion).

This spike was triggered by yield farming activities and institutional capital rotation, not a signal of market exit.

According to analysts, this indicates that investors are simply “parking” on the stablecoin while waiting for a re-entry signal to ETH.

6. Institutional Inflow to Reach IDR250 Trillion in 2025

Ethereum-based financial products have attracted institutional inflows of more than IDR 250 trillion ($15 billion) through 2025.

This strengthens Ethereum’s (ETH) position as the backbone of the decentralized finance ecosystem and blockchain-based payment systems.

This long-term trust is an important foundation even though ETH is currently in a consolidation phase.

7. ETH Rebound Potential to IDR68 Million?

Although short-term volatility is still high, some analysts predict ETH could recover to the IDR68 million-IDR70 million ($4,100-$4,200) range in the next few weeks.

This is based on the falling wedge technical pattern, which often signals a reversal towards a bullish trend.

If the purchase volume continues to increase, Ethereum could be back in the spotlight as one of the top cryptos.

Conclusion

Although Ethereum (ETH) is currently under bearish pressure, various key metrics point to improving fundamental strength. With whales buying ETH again, rising stablecoin volumes, and institutional confidence remaining high, the current correction could just be a pause before the next rally.

Also Read: Can You Live Only on Crypto? Here are 3 Sources of Income & Challenges You Need to Know About

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- James Halver/Bitcoinist. Ethereum (ETH) Under Bearish Pressure as On-Chain Data Hints at Market Reversal. Accessed on November 4, 2025