XAUUSD Analysis and Prediction Today (February 11, 2026)

Jakarta, Pintu News – Technical analysis of XAU/USD (gold against US dollar) on February 11, 2026 shows short-term downward pressure after the daily candle closed bearish on the price action chart. This reflects market uncertainty in the early trading session and signals that the upward momentum is still not clearly confirmed.

1. Daily Candle Structure Shows Downward Pressure

On the daily chart, the closing candle for XAUUSD today closed bearish, which in theory indicates the potential for downside pressure is still dominant this session. This signal arose from a stronger sell-off at the end of the previous trading session.

Nonetheless, this downward pressure is only a temporary indication and has yet to break the medium-term trend structure. Traders need to wait for confirmation from price action at key support and resistance levels to validate the next direction.

Also Read: 5 Shocking Facts About Jeffrey Epstein’s Influence in Silicon Valley

2. 1.19200 Resistance Level Is a Trend Determining Factor

The nearest resistance is identified at the level of 1.19200 which is currently an important point for the formation of a continued trend. If XAUUSD manages to break this level convincingly, bullish pressure could potentially return and open up room for price recovery.

On the contrary, if XAUUSD fails to break the said resistance and turns down, the bearish scenario could be dominant again, particularly below the psychological support level around 1.17700.

3. US Dollar Sentiment Remains the Key Variable

The movement of XAUUSD is inseparable from the dynamics of the US dollar rate as both have a general negative correlation. Under current conditions, a strengthening US dollar will increase selling pressure on gold, while a weakening dollar can reduce that pressure and give gold prices room to rise.

Traders are advised to monitor US fundamental data such as macroeconomic releases or the Fed’s monetary policy, as these often trigger strong volatility in the XAUUSD pair.

4. Potential Daily Movement Range Still Limited

Based on the existing candle structure and technical levels, the XAUUSD value is likely to move within a limited range in the daily term. Despite the downward pressure signals, traders should remain wary of false breakouts as gold volatility is often affected by sudden market sentiment.

The narrow intraday range also requires a strict risk management strategy, especially if using high leverage in trading gold on forex.

5. Bullish Scenario If Break 1.19250

The bullish scenario will become more credible if XAUUSD manages to break the 1.19250 level and hold above it, as this suggests that the short-term selling pressure has been dampened. Such a breakout could provide a technical opportunity to test higher resistance in the next session.

Other important support levels also need to be confirmed to ensure that the rebound is not just a technical correction within the ongoing downtrend.

6. Bearish Scenario If Tem bus 1.17800

If the price breaks below the key support around 1.17800, then the bearish pressure becomes more dominant. A break below this level could indicate a continuation of the short-term downtrend and increase the chances of the XAUUSD issuer entering a further downward phase.

Traders who take short positions need to monitor these levels closely as well as consider other indicators such as volume and relative momentum to increase the validity of trading signals.

Gold-Based Crypto: When Physical Assets Meet Crypto Technology

As blockchain technology develops, gold can now be owned not only in physical form such as jewelry or bars, but also in digital form through gold-based crypto assets.

One of the most popular is Tether Gold (XAUt), a physical gold-backed ERC-20-based stablecoin, where 1 token represents 1 troy ounce of pure gold. The gold is stored in vaults in Switzerland and each token is directly linked to certified gold bullion. The system uses automated algorithms to efficiently manage the allocation of gold and Ethereum addresses.

XAUt tokens are available and traded on various crypto exchanges. XAUt is also an attractive alternative for those looking to hedge against inflation or global economic uncertainty, while remaining within the digital asset ecosystem.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

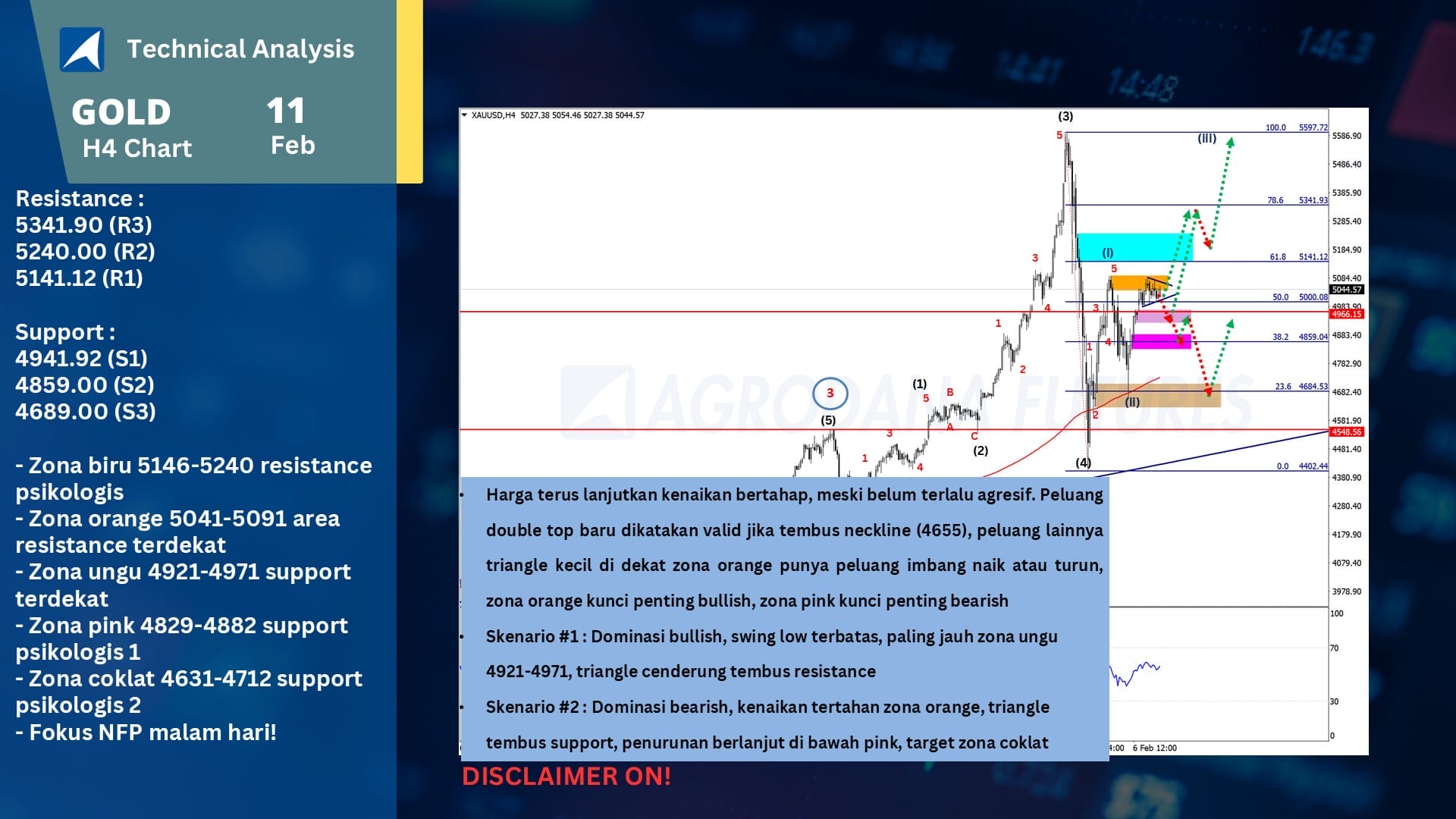

- Technical Analysis Forex. Gold (XAUUSD) February 11, 2026. Agrodana Futures. Accessed February 11, 2026.