A Look at the Silver Price Chart for the Last 10 Years: Historical Spike to a New Record

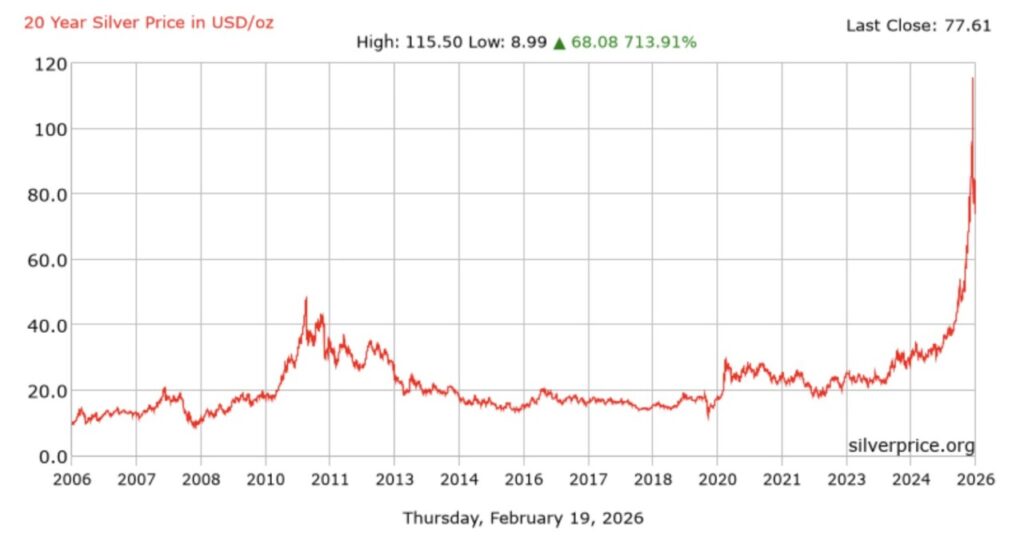

Jakarta, Pintu News – Understanding silver’s long-term price movements is crucial for investors who want to see the asset’s potential as a resilient hedge. In contrast to the daily volatility of digital assets, the silver price chart over the past ten years shows a dynamic journey, ranging from a consolidation phase to a remarkable surge that peaked in early 2026. This historical data provides a clear picture of why silver remains one of the most highly regarded physical investment instruments by global market participants today.

Silver Price Journey from 2016 to 2023

Looking back, the period between 2016 to 2019 shows a relatively stable silver price chart and tends to movesideways in the range of USD 15 to USD 20 per oz. In this phase, silver is more influenced by manufacturing industry demand and has not gained great momentum as a major speculative asset. Entering 2020, precisely when the global pandemic hit, silver prices began to show signs of revival by breaking the level of USD 20 to USD 30 per oz as demand for safe haven assets increased.

Throughout 2021 until the end of 2023, silver prices continued to maintain their support level above USD 20 per oz despite facing pressure from rising global central bank interest rates. The chart shows frequent fluctuations, but the long-term trend is beginning to form a solid foundation for a more massive price increase. The resilience of silver prices in this period proves that this precious metal has an intrinsic value that is highly respected by investors amidst the uncertain world economic turmoil.

Also Read: 5 Diamond Price Updates per Gram and Carat 2026, Some Penetrate Rp5 Billion!

Historical Silver Surges in 2024 and 2026

The most significant turning point in the silver price chart began to appear at the end of 2024, where prices began to skyrocket vertically until early 2026. The latest data as of Thursday, February 19, 2026, notes that the price of silver has touched the last closing figure of USD 77.61 per oz. Overall, the chart records a fantastic total increase of 713.91% or the equivalent of a USD 68.08 increase from previous low points.

In this historical record, the price of silver even touched ahigh of USD 115.50 per oz, while itslow was USD 8.99 per oz. This massive surge in 2026 represents a major shift in market sentiment, with investors once again trusting silver as the most effective wealth-protecting instrument in an era of high inflation. The exponential movement of the chart at the end of this period strongly signals that silver is entering a new cycle in the world commodity market.

Silver Performance Comparison with Popular Digital Assets

While the silver chart shows a historical spike, some popular digital assets were observed to experience quite diverse daily price corrections at the same time. For example, Ripple recorded a decline of 2.83% which brought it to the level of IDR 24,235 per coin. This difference in performance highlights the role of silver as an asset that tends to be more stable or move independently compared to digital assets that are highly volatile in daily time duration.

Even meme coins such as Popcat also experienced a price drop of 2.03% to the level of IDR 863.3 on February 19, 2026. Although the cryptocurrency industry offers the potential for rapid growth in the short term, silver’s 10-year chart proves the consistency of physical value over the long term that is difficult to match by any digital coin. For investors who prioritize capital security for the future, silver’s historical data provides more measurable growth certainty than price speculation on trending digital assets.

Factors Driving Silver Chart to Remain Bullish in 2026

The main reason the silver chart looks so sharply elevated in 2026 is a combination of high tech industry demand and limited global mining supply. Silver is a vital component in the production of solar panels and electric vehicles, two sectors that have experienced massive growth in the last five years. In addition, the condition of the rupiah exchange rate against the US dollar, which is in the range of IDR 16,895.17, also makes the valuation of silver in rupiah feel more expensive for domestic Indonesian investors.

Geopolitical factors and monetary uncertainty in the global market have also triggered massive capital migration from risky assets to physical precious metals. In contrast to spot gold whose price today is at the level of IDR 2,712,268 per gram with a mild correction, silver appears to have a more aggressive upward momentum on a historical percentage basis. This situation makes silver a strategic asset for those who are keen to see the pattern of global commodity price movements from year to year to secure their portfolios.

Tokenized Silver ETF (SLVon) as an Alternative Commodity Asset in the Crypto Ecosystem

SLVON4.64% Tokenized Silver ETF->Current SLVON PriceRp 1,204,2524.64%Market Cap-Volume Trading-Circulating Supply- is a digital token issued by Ondo Global Markets and designed to follow the price movements of iShares Silver Trust (SLV), the world’s largest silver ETF managed by BlackRock.

Each SLVon has the equivalent value of an SLV share (1:1), so its price moves up and down according to the global silver price in troy ounces. Through SLVon, investors can gain exposure to the silver market on-chain in the form of an easily accessible digital asset.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

- Reference: SilverPrice.org. Silver Price History: 10 Year Silver Price in USD/oz. Accessed February 19, 2026.