Trump’s Tariff Strategy Claims to Reduce Americans’ Tax Burden, Here Are the Facts!

Jakarta, Pintu News—In the early 20th century, the United States was the richest country in the world, with government funding coming mostly from import tariffs instead of income taxes. This policy is making a comeback with Trump’s latest proposal, which could save Americans significant tax costs. Check out the full news below!

History and Potential Tax Savings

Before the 16th Amendment was ratified in 1913, the United States federal government was funded more by tariffs than income taxes. Income taxes were not permanent, and most of the government’s revenue came from import tariffs.

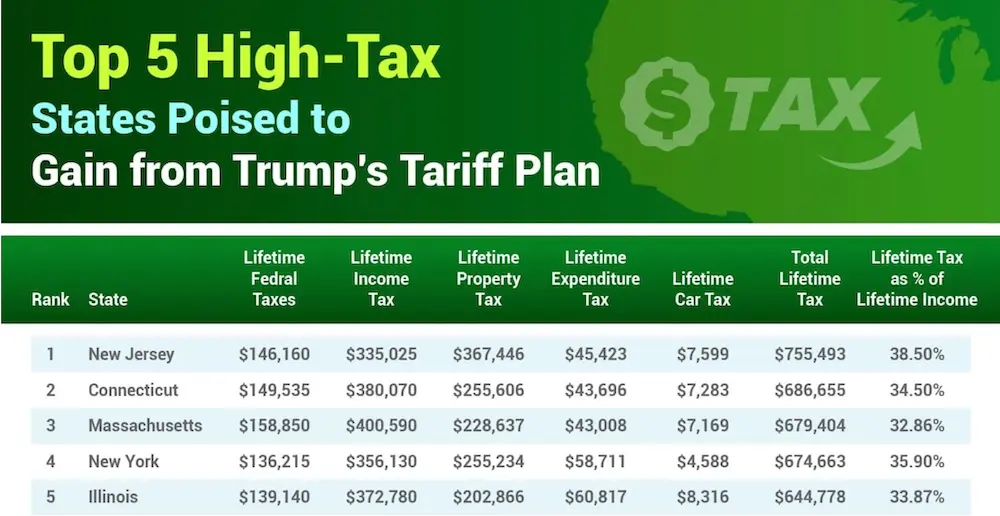

According to a report from Dancing Numbers, replacing income tax with tariffs could result in significant tax savings for Americans. Eliminating the federal income tax could save the average American at least $134,809 over a lifetime.

If the state’s payroll-based income tax is removed, the total lifetime savings could reach $325,561 per person. This shows the huge potential in reducing the tax burden for people.

Read also: Crisis in the Crypto World: AI and Gaming Sectors to Fall the Hardest in 2025!

Tax Refund Proposal and Economic Impact

Punit Jindal, founder of Dancing Numbers, provided further details on the potential tax changes. He stated that Trump’s plan will likely be preceded by a ‘DOGE Dividend’ tax refund of 20% of the cost savings from the Department of Government Efficiency. This move is expected to provide immediate financial relief to citizens.

Changes from income tax to rates can affect asset prices and trading costs. Some experts suggest that lower income taxes may increase consumer spending and market investment.

However, higher tariffs on imported goods may increase prices for some products. This is an important consideration in assessing the effectiveness and impact of tariff policies.

Read also: Pi Network Makes a Big Deal! Now Property and Car Payments Can Use Pi Coin?

Replacing the IRS: Trump’s Tariffs and the New Tax Agency

In January 2025, Howard Lutnick, who was confirmed as Secretary of Commerce in February 2025, echoed Trump’s proposal. He suggested replacing the Internal Revenue Service (IRS) with an external revenue service.

Lutnick commented on the history of tariffs as a source of funding for the US government, emphasizing the protection of workers from unfair trade policies through tariffs. He added, “Imagine politicians, who can’t even balance their chequebooks, taking our money, and what do they do every year? They just take more.”

These comments reflect a broader discussion about the future of tax policy in the United States. Legislators and economists continue to debate proposals to replace the IRS with a rate-based tax system.

Conclusion

This proposed tariff policy opens a new discussion about the tax structure in the United States. Revisiting old funding methods could potentially reduce the tax burden on citizens, albeit with consequences for the price of imported goods and global trade dynamics. Going forward, it will be important for policymakers to weigh the pros and cons of these changes in depth.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News for the latest updates on crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- CoinChapter. Trump’s Tariffs Could Save Americans Over $134K in Taxes. Accessed on February 27, 2025

- Featured Image: Bitcoin News