Ethereum’s Big Buy: Signal of Recovery or Investor Maneuver? (7/3/25)

Jakarta, Pintu News – The Ethereum market has recently been abuzz with massive buying that has sparked speculation about a potential rebound or manipulation by investors.

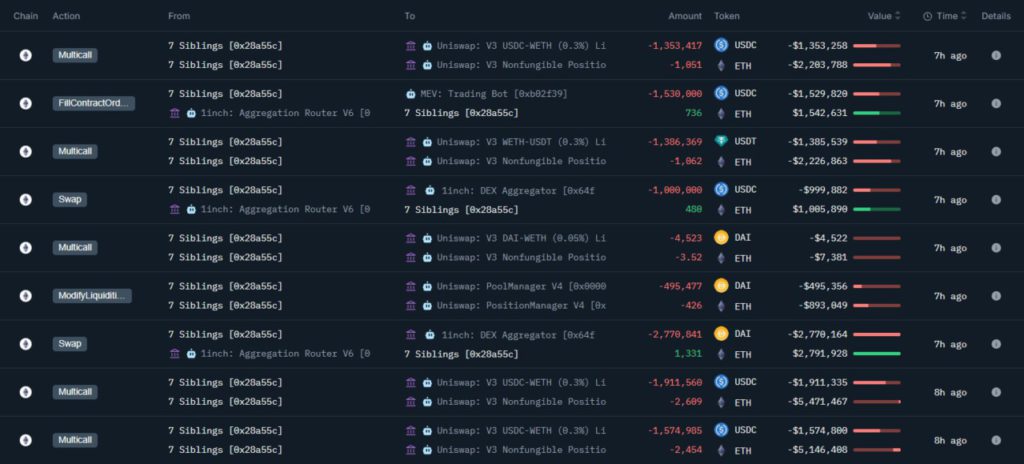

Mysterious Purchase by “7 Siblings”

Recently, the entity known as “7 Siblings” has purchased a total of 17,855.3 Ethereum (ETH) for a total value of $36.68 million, using DAI, USDC, and Tether . The average price per Ethereum (ETH) purchased was $2,054. This large purchase shows a strong belief in the long-term value of Ethereum (ETH), considering that “7 Siblings” owns more than 1,169,015 Ethereum (ETH) worth approximately $2.53 billion.

Institutions usually accumulate assets when the market is down, looking for strategic entry points. This price of $2,054 is in line with the lowest price recently recorded, suggesting that this may be a well-calculated move. If other institutions follow suit, the price of Ethereum (ETH) could increase beyond $2,500, which would attract more retail investors.

Also Read: The Burning of 20 Million SHIBs: Will Shiba Inu Prices Skyrocket? (7/3/25)

A sign of strength or weakness?

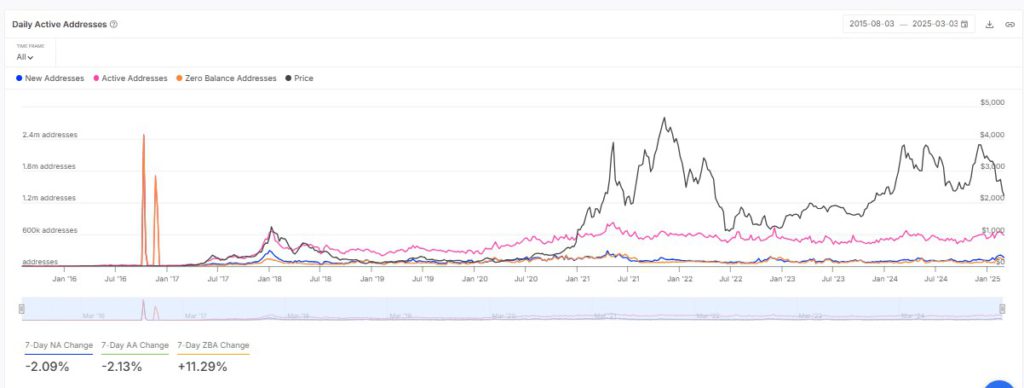

An analysis of active Ethereum (ETH) addresses shows a total of 847,590 addresses, with 160,890 new addresses, 587,720 active addresses, and 98,980 addresses with zero balance as of March 5. A 2.09% decrease in new addresses and a 2.13% decrease in active addresses in the last seven days may indicate a decrease in interest or activity.

However, the peak of 160,890 new addresses in early 2021, which is similar to recent Ethereum (ETH) purchases, suggests there is renewed investor interest. Nonetheless, the 11.29% rise in zero-balance addresses could be indicative of profit-taking or abandoned wallets, which could signal bearish sentiment.

Stabilization of new addresses above 150,000 could confirm growing adoption, while a sustained decline may indicate weakening demand.

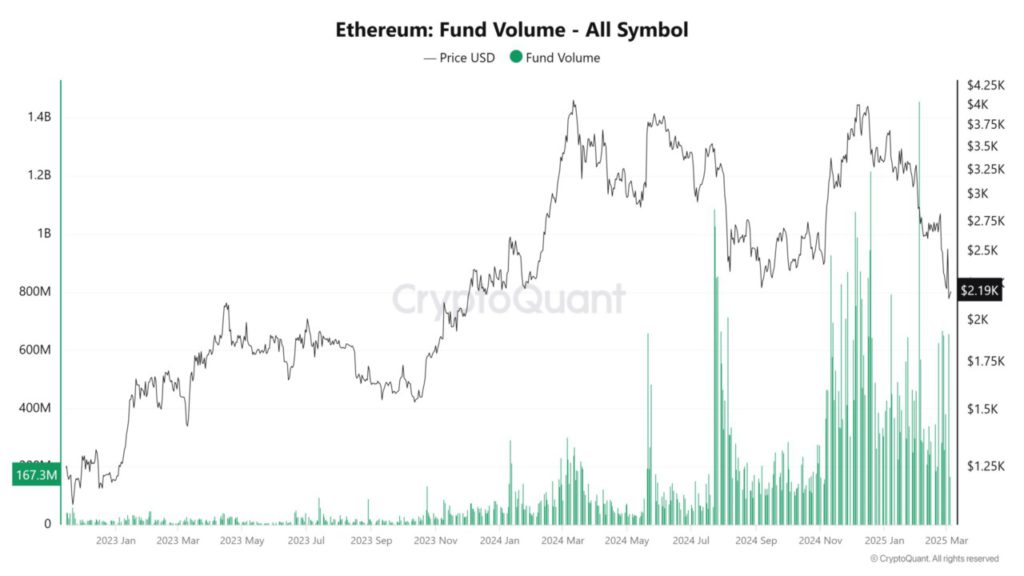

Liquidity Trends

The Ethereum (ETH) funding volume chart from 2023 to March 2025 shows price fluctuations and trading activity. The price peaked at $4,250 at the end of 2023, dropped to $2,194, then rebounded to $2,925 in March 2025. Funding volume reached 1.4 billion in mid-2024, dropped to 167.3 million in early 2023, and recently surged to 800 million.

This surge is in line with the purchase of Ethereum (ETH) by “7 Siblings” for $36.68 million at $2,054, which increased the funding volume to 800 million. Strong buying pressure at $2,925 suggests that Ethereum (ETH) could reach $3,500 if volumes remain high. However, a drop below 400 million may signal a correction towards $2,194.

Conclusion

The Ethereum (ETH) market remains highly responsive to institutional activity, with the purchase of 17,855.3 Ethereum (ETH) by “7 Siblings” signaling potential bullish momentum. Funding volume trends suggest a possible upside if sustained, with $2,500 as a key level and $3,500 as a potential target. However, a drop below $2,000 remains a risk if selling pressure increases.

Also Read: Litecoin (LTC) Hit a Record High, Will the Price Surge? (7/3/25)

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Ethereum’s Large Purchase: Potential Rebound or Investor Trick. Accessed on March 6, 2025

- Featured Image: Generated by AI