Current Bitcoin Market Conditions, Is it Time to Buy BTC at the Lowest Point? (12/3/25)

Jakarta, Pintu News – The Bitcoin market is currently facing mounting selling pressure, with most holders incurring unrealized losses. This has sparked fears of a possible further price drop below $80,000.

Current Bitcoin Market Conditions

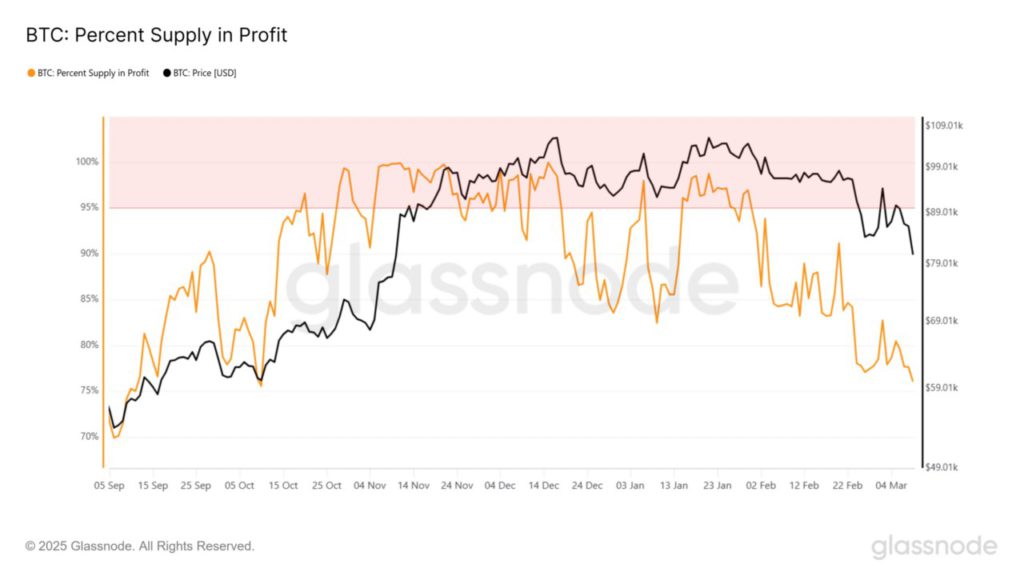

Bitcoin (BTC) recently experienced a hard rejection at the $97,000 resistance level, which triggered a sharp drop to the current price of $82,000. Despite the drawdown, 76.08% of the Bitcoin (BTC) supply is still profitable, indicating that most holders still see profits in their investments. However, this also means that about 23% of the circulating supply, or about 4.56 million Bitcoin (BTC), is in unrealized losses.

Also Read: Bitcoin and Stock Market Plummet, Arthur Hayes Asks Investors to Be Patient: Why is Crypto Red?

Market Analysis: Sales and Purchase Dynamics

Trading volume has increased significantly by 178.22% to $43.12 billion, but net deposits on exchanges also rose by 3.96%. This suggests that selling outweighed buying on major exchanges.

This condition is exacerbated by low buying pressure from US investors, who are still hesitant amid economic uncertainty. The involvement of a third player, most likely institutions, will probably play an important role in determining the next direction of the market.

High Leverage Risk in Bitcoin Derivatives Trading

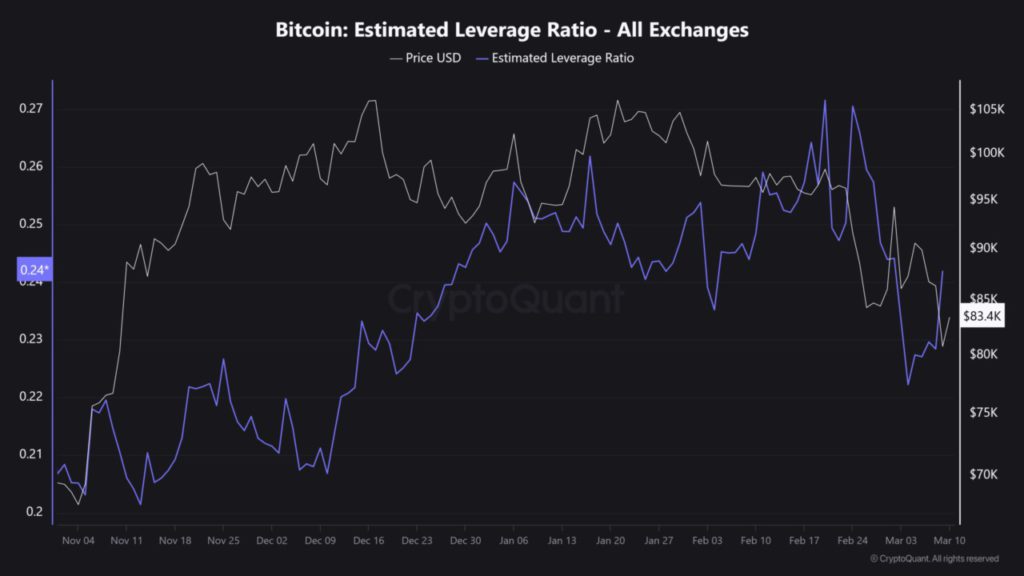

With weak buying in the spot market, the Estimated Leverage Ratio (ELR) for Bitcoin (BTC) has surged, hitting a three-month low. On March 9, Bitcoin (BTC) experienced a 6.41% drop to $80,000, resulting in the liquidation of $195.86 million worth of long positions.

Despite the trend of “buying at the bottom” by institutions, the challenge to break the $85,000 resistance zone remains high. An increase in selloffs could trigger further liquidation, pushing Bitcoin (BTC) prices below $80,000 again.

Market Outlook: Is It the Right Time to Buy?

Institutional capital seems to be soaking up sell-side liquidity from traders trying to break even after Bitcoin’s (BTC) weekly decline of 17%. However, the risks associated with this “buying at the bottom” strategy remain high. Investors and traders should consider the current market volatility and the potential for further declines before making investment decisions.

Bitcoin’s Future Amid Market Uncertainty

With uncertain market conditions and the potential for further declines, Bitcoin (BTC) holders may need to consider their strategies. The decision to sell or hold the asset should be based on in-depth analysis and an understanding of the risks involved.

Also Read: Drastic 19% Drop in Solana Futures – Here’s Solana’s Technical Outlook in March 2025

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Bitcoin: 23% of BTC supply in loss; time for another dip below $80k. Accessed on March 12, 2025

- Featured Image: The image created by AI