Bitcoin Price Climbs on March 13 – Is Falling US Inflation (2.8%) the Catalyst?

Jakarta, Pintu News – February marked a key turning point for the U.S. economy as the Consumer Price Index (CPI) dropped to 2.8% year-on-year, falling below expectations of 2.9%. This unexpected decline boosted market confidence, fueling gains across multiple sectors—including Bitcoin , which surged to $83,616.

What’s next for BTC? Will the rally continue today?

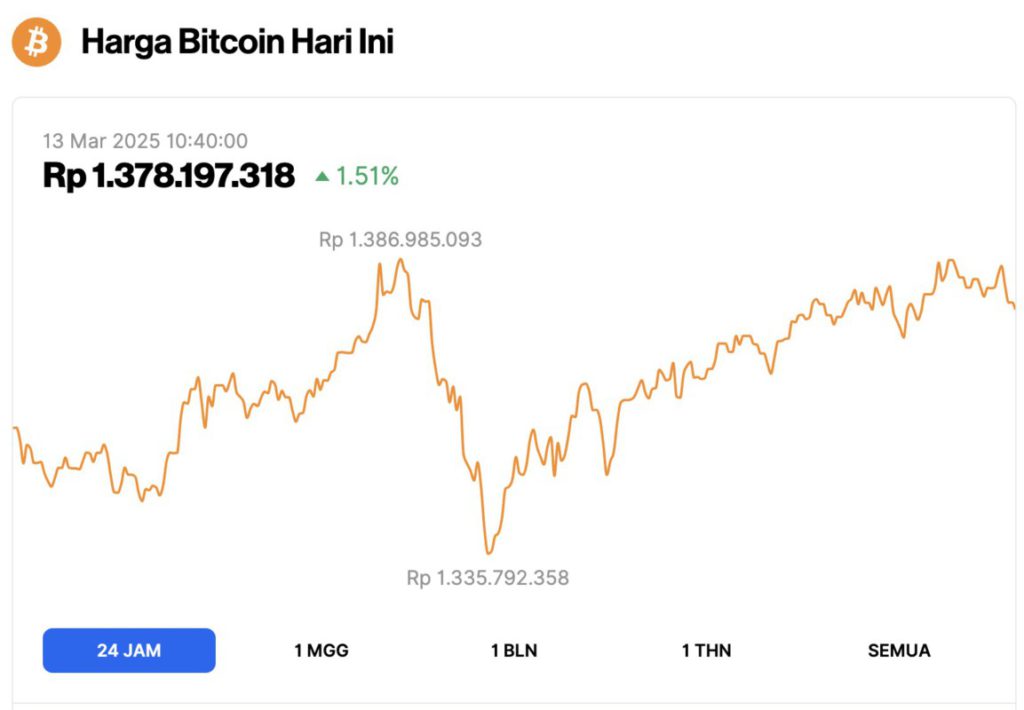

Bitcoin price rises 1.51% in 24 hours

On March 13, 2025, Bitcoin (BTC) saw a 1.51% uptick in the past 24 hours, trading at $83,616 (approximately IDR 1,378,197,318). During this period, BTC hit a low of IDR 1,335,792,358 and peaked at IDR 1,386,985,093, reflecting steady market movement.

According to CoinMarketCap, Bitcoin’s market capitalization is now $1.65 trillion, with trading volume in the last 24 hours falling 20% to $38.56 billion.

Read also: 3 Cryptos that Whales are Buying Despite the Market Shock!

Impact of Inflation Data on the Market

The drop in inflation in the US to 2.8% has sent a wave of optimism throughout the financial markets. In response, Bitcoin (BTC) saw a notable increase in value, reaching $83,616.

This decline in inflation signals less likelihood for the Federal Reserve (Fed) to implement tighter monetary policy, which generally favors risky assets.

Major stocks also reacted positively to the news, with major stock market indices rising, while the US dollar and Japanese yen showed declines.

Furthermore, this decline in inflation is expected to prompt the Fed to adopt a more dovish approach in their monetary policy.

Core CPI Data Analysis

Core CPI, which excludes volatile components such as food and energy, also recorded a decline to 3.1% year-on-year, lower than the previous prediction of 3.2%. This was the first time since July 2024 that both core and headline inflation showed a significant decline.

Read also: Market Activity Plummets, XRP Price Held Above $2.00 – Ready for a Big Rebound?

This decline suggests that inflationary pressures in the US are easing. If this trend continues, the Fed may be more inclined to lower interest rates, which will increase liquidity in the market. This is certainly good news for risky assets like stocks and crypto.

Analyst Perspectives and Their Impact on Bitcoin

Despite concerns from some analysts regarding the impact of the trade tariffs imposed by Donald Trump, many are optimistic that this drop in inflation will benefit Bitcoin (BTC).

Bitcoin (BTC) often benefits from looser monetary conditions. With inflation lower than expected, many expect that the Fed will take steps to lower interest rates in the near future.

This is expected to encourage further investment into riskier assets such as Bitcoin (BTC), which could see a further rise in value.

Overall, the CPI data showing a decline in inflation opens new hope for the financial market. With expectations of a rate cut by the Fed, investors may see an increase in risky asset investments.

Bitcoin (BTC), with its rise in value, is expected to continue to benefit from these conditions. Looking ahead, all attention will be on the Fed’s next policy.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin Jumps as CPI Lower Than Expected. Accessed on March 13, 2025