Rise in Bitcoin Mining Difficulty: What will be the Impact on the Crypto Market in March 2025?

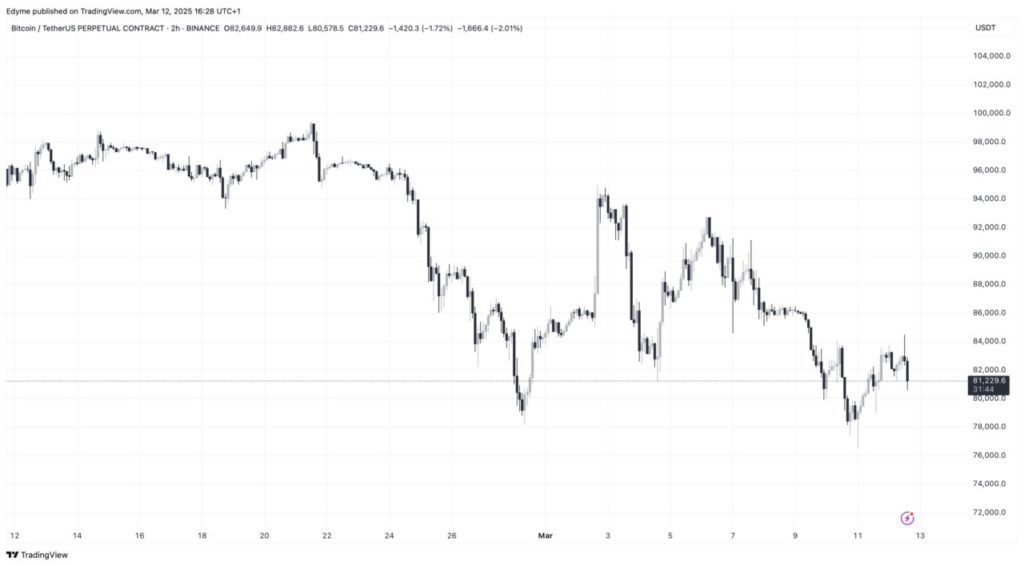

Jakarta, Pintu News – Despite the cryptocurrency market’s decline, Bitcoin is showing signs of a possible recovery. Currently, the price of Bitcoin (BTC) stands at $83,510, up 2.6% although still below $85,000. The weekly decline of 7.5% still reflects a continued bearish trend, but there are interesting dynamics happening behind the scenes, especially in Bitcoin (BTC) mining activity.

Bitcoin Mining Difficulty Increases

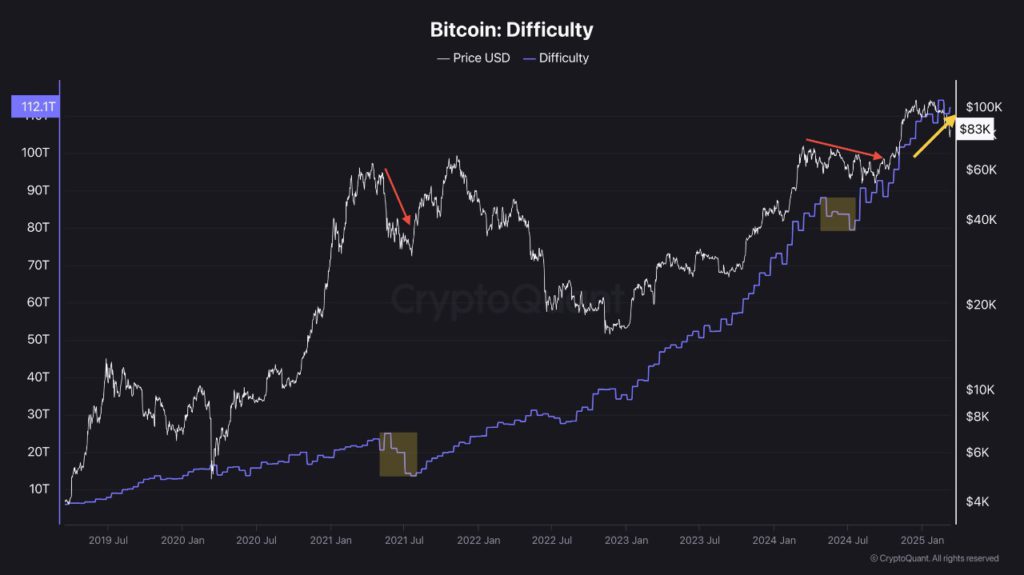

According to CryptoQuant analyst Avocado Onchain, Bitcoin’s (BTC) mining difficulty continues to rise despite the market’s 30% correction. In the correction phase that began in March 2024, there was a temporary decrease in mining difficulty, which led some to speculate that this was similar to the end of the 2021 cycle.

However, the prediction was not proven as the price of Bitcoin (BTC) subsequently rebounded sharply. Although it is currently experiencing a correction of around 30%, mining difficulty continues to rise. Historically, a decline in mining difficulty is often associated with the shutdown of less efficient rigs, which usually signals a broader market disruption.

However, recent data shows that miners have not started selling large amounts of Bitcoin (BTC), suggesting that they are choosing to hold onto their reserves rather than sell them at low prices.

Miner Detention Strategy

The Miner Position Index (MPI) indicator described by Avocado previously showed selling pressure in November 2024. However, this activity did not lead to a significant market decline. Instead, miners seem to be maintaining a holding strategy, which suggests that the broader uptrend still remains intact.

If the Bitcoin (BTC) correction continues further, the drop in mining difficulty could be a potential indicator of miner capitulation. However, for now, the network remains resilient. This suggests that despite selling pressure and price corrections, the fundamental structure of Bitcoin (BTC) mining is still strong and able to withstand market shocks.

Stablecoin Transfers and Market Uptake

In a separate analysis, CryptoQuant analyst Mignolet observed a spike in the number of stablecoin transfers, a trend that typically occurs after a price drop, during a market consolidation phase. This suggests that large-scale investors may be absorbing market shocks through over-the-counter (OTC) transactions, which mitigates the impact of further price drops.

Mignolet also noted that an increase in stablecoin transfer activity, combined with an increase in active Bitcoin (BTC) addresses, signals higher network participation. This pattern historically indicates spot accumulation, which could be a precursor to a price recovery. If accumulation continues while market sentiment remains low, the market may enter a phase where a short squeeze forces a rapid upward movement in Bitcoin (BTC) price.

Conclusion

Despite facing challenges in the form of price corrections and selling pressure, the Bitcoin (BTC) mining structure is showing significant resilience. With miners maintaining reserves and an increase in stablecoin transfers, there is potential for a strong price recovery in the future. Market watchers should continue to monitor these indicators to gain a better understanding of the direction the cryptocurrency market will take.

Also Read: Pi Network Price Predictions to 2050: What to Expect?

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin Mining Difficulty Rises Despite Market Drop, What Does It Mean. Accessed on March 14, 2025

- Featured Image: Generated by AI