Bitcoin Prediction: Can BTC Reach IDR1.63 Billion After the Fed Decision?

Jakarta, Pintu News – The price of Bitcoin has risen again after hitting a low of Rp1,238,800,000 on March 12, 2025. On March 16, 2025, BTC managed to recover to Rp1,385,500,000, registering an 11% increase in the past week.

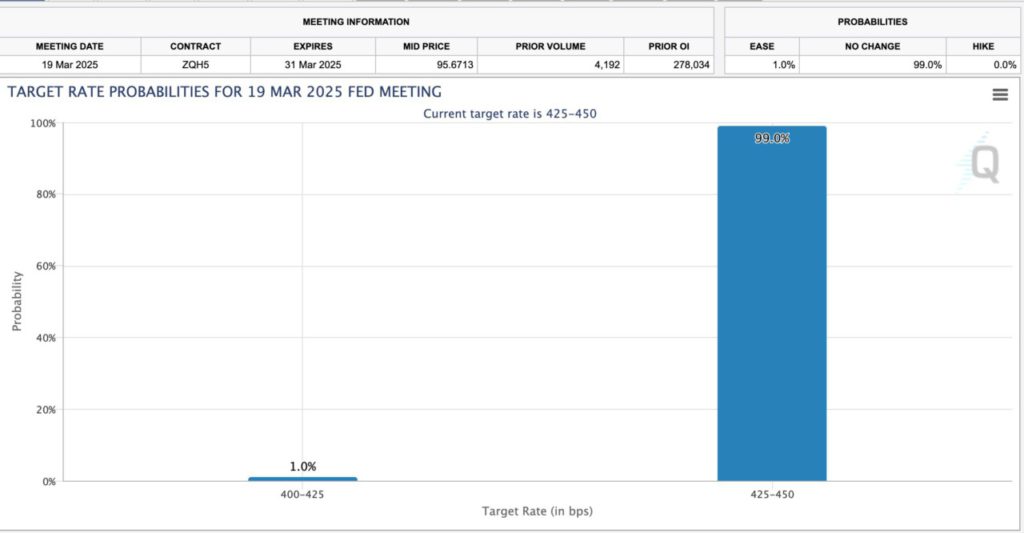

This recovery came after US inflation reports, namely the Consumer Price Index (CPI) and Producer Price Index (PPI), showed a slowdown. This increased investor optimism that the US Federal Reserve (Fed) is unlikely to raise interest rates further. The Fed’s decision on March 19, 2025 is an important factor that could determine the direction of Bitcoin’s price movement.

The Impact of the Fed’s Decision on the Crypto Market

The Fed’s decision on interest rates has always been a major factor affecting the crypto market. If the Fed decides to keep interest rates on hold or signals future cuts, then the crypto market, including Bitcoin, could potentially experience a price surge.

Conversely, if the Fed signals a tighter policy, then liquidity in the market could shrink, making it difficult for Bitcoin to break the psychological level of Rp1.63 billion ($100,000). Based on the latest data from CME Group, about 99% of investors expect that the Fed will hold interest rates, so there is a chance for BTC to continue to strengthen after the official announcement.

Also Read: Ethereum Prediction: Recovery or Bearish Signal? Here’s the Mid-March 2025 Technical Analysis!

Bitcoin Derivatives Market: Are the Bulls Still in Charge?

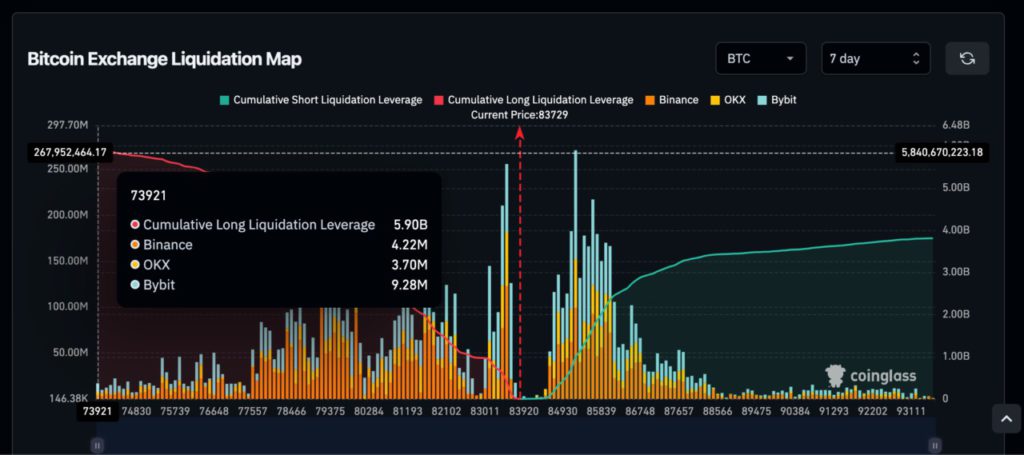

The derivatives market is showing bullish dominance amidst Bitcoin’s price recovery. In the past week, total long leveraged positions reached IDR 79.9 trillion ($4.9 billion), higher than short leveraged positions of only IDR 61.9 trillion ($3.8 billion). This means that bulls still dominate the market by a margin of IDR18 trillion ($1.1 billion).

However, keep in mind that when the market is over-leveraged, there is a risk of liquidation which can trigger sharp price movements. If Bitcoin fails to break the key resistance at Rp1,450,000,000 ($89,000), then highly leveraged investors could start closing their positions, which could trigger a drop back to Rp1,304,000,000 ($80,000).

Technical Analysis: BTC targets $1.63 billion, but hurdles remain

Technically, Bitcoin is currently in a recovery trend after touching the 1.618 Fibonacci level at Rp1,244,000,000 ($76,555). If BTC manages to break the resistance level at Rp1,450,000,000 ($89,000), the next targets are Rp1,515,000,000 ($92,956) and Rp1,579,000,000 ($96,827).

However, the Parabolic SAR indicator shows that the level of Rp1,582,800,000 ($97,068) will be a big challenge for the bulls. In addition, the Bear/Bull Power (BBP) indicator is still negative at -10.559, indicating that the bearish pressure has not completely disappeared. If Bitcoin fails to hold the Rp1,304,000,000 ($80,000) level, then there is a risk of BTC dropping back to Rp1,238,800,000 ($76,000).

Conclusion: Is it Time to Buy or Wait?

Bitcoin is showing strong signs of recovery with an 11% gain in the past week. If the Fed’s decision favors a looser monetary policy, BTC could potentially reach Rp1.63 billion ($100,000).

However, investors should remain wary of a potential price correction, especially if BTC fails to break Rp1,450,000,000 ($89,000). With the market still influenced by macroeconomic factors and a highly leveraged position, investors need to be cautious in making decisions, whether to buy, hold, or sell BTC in the near future.

Also Read: XRP Predictions and Impact on Crypto Market: 8% Drop After Positive Trend March 2025

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Ibrahim / Coingape. Can Bitcoin Reach $100K After The Upcoming US Fed Decision? ( Accessed March 17, 2025).

- Featured Image: Generated by AI