Bitcoin Spot ETF Experiences $900 Million Outflows: What Impact on the Market?

Jakarta, Pintu News – In the past 5 weeks, the Bitcoin Spot ETF has seen a huge decline in the number of funds under management. Last week alone, the total outflows reached IDR14.67 trillion ($900 million), bringing the total outflows to IDR88.02 trillion ($5.4 billion) since the beginning of this downward trend.

This massive withdrawal reflects the weakening of institutional investors’ confidence in Bitcoin in the short term. The crypto market has been under significant pressure, with the price of BTC falling around 11.95% in the past month, reaching a low of Rp1,255,100,000 ($77,000).

Who Withdraws Funds from the Bitcoin Spot ETF?

Large Institutional Funds Experience Outflows

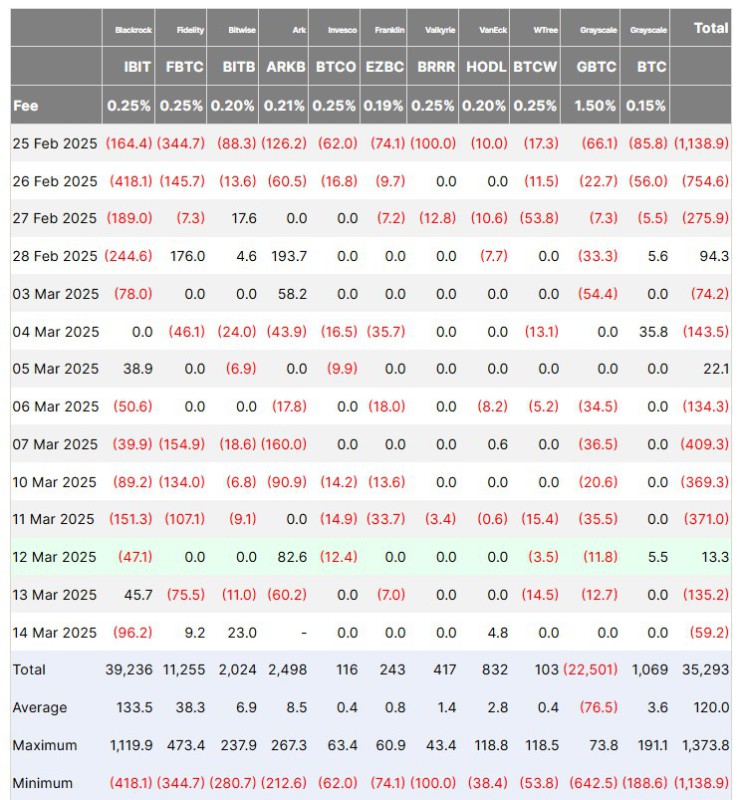

According to data from Farside Investors, most of the outflows came from the two largest ETFs:

- BlackRock’s IBIT: IDR5.51 trillion ($338.1 million) exited this fund in the past week.

- Fidelity’s FBTC: Had an outflow of IDR5.01 trillion ($307.4 million).

In addition, ETFs from Ark Invest (ARKB), Invesco (BTCO), Franklin Templeton (EZBC), WisdomTree (BTCW), and Grayscale (GBTC) also experienced outflows of between IDR538 billion – IDR1.32 trillion ($33 million – $81 million).

However, one exception came from Grayscale’s BTC ETF, which actually recorded inflows of IDR89.65 billion ($5.5 million). This shows that not all investors are withdrawing their funds from the crypto market.

Also Read: Ethereum Prediction: Recovery or Bearish Signal? Here’s the Mid-March 2025 Technical Analysis!

Why are Investors Withdrawing Funds from Bitcoin ETFs?

1. BTC Price Correction Continues

Since its peak, Bitcoin’s price has dropped by more than 11% in the past month. This price drop has caused institutional investors to be more cautious, with many of them choosing to secure profits or avoid further risk.

2. Macroeconomic Uncertainty

The crypto market sentiment is also affected by the US Federal Reserve’s monetary policy. Investors are still waiting for more clarity regarding potential interest rate cuts, which could affect investment flows into riskier assets like crypto.

3. Capital Rotation to Other Instruments

Some analysts believe that investors may shift their funds to other assets, such as technology stocks or bonds, which are considered more stable in uncertain market conditions.

How will this impact the Bitcoin market?

Bearish Scenario: Potential for Further Selling Pressure

If the trend of outflows from Bitcoin ETFs continues, BTC prices could come under further pressure. With total assets under management by Bitcoin ETFs falling by 21.7% to IDR1,465 trillion ($89.89 billion), there is a risk that investors will become increasingly cautious of BTC in the short term.

Bullish Scenario: Rebound Opportunity if Sentiment Improves

On the other hand, if these outflows start to slow down and Bitcoin price is able to hold above the key support level of IDR1,255,100,000 ($77,000), the potential for recovery remains. Many investors still see Bitcoin as a strong long-term asset, and if macroeconomic conditions improve, inflows into ETFs could pick up again.

Conclusion: What Should Investors Watch?

The massive outflow from the Bitcoin Spot ETF suggests that institutional investors are taking a more cautious approach. However, this is not necessarily a sign that BTC will enter a deeper bearish trend.

In the next few weeks, investors should pay attention:

- BTC price movement around the key support level (IDR1,255,100,000 or $77,000).

- The Federal Reserve’s decision on interest rate policy, which could affect investors’ appetite for risky assets.

- Volume outflows from Bitcoin ETFs-ifthey slow down, this could be a signal of stabilization.

With market conditions still volatile, caution is still required before making investment decisions in Bitcoin or other crypto assets.

Also Read: XRP Predictions and Impact on Crypto Market: 8% Drop After Positive Trend March 2025

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- NewsBTC. Bitcoin Spot ETF Exodus Continues – $900 Million Outflows Extend Losing Streak. (Accessed March 17, 2025).

- Featured Image: Generated by AI