Bitcoin (BTC) Enters Bearish Phase, What to Watch for at the End of March 2025?

Jakarta, Pintu News – According to Ki Young Ju, founder of CryptoQuant, Bitcoin’s bullish period is over. In a statement on X, Ju predicts that there will be a bearish or stagnant period over the next 6-12 months. This is due to a decrease in liquidity in the market. This condition is exacerbated by capital outflows that are not replaced by new fund flows.

Causes of Decreased Liquidity

Ki Young Ju highlighted that the on-chain realized market capitalization has stopped growing, which signals the absence of new capital flows into Bitcoin (BTC). For example, BlackRock’s IBIT investment product experienced three consecutive weeks of fund withdrawals.

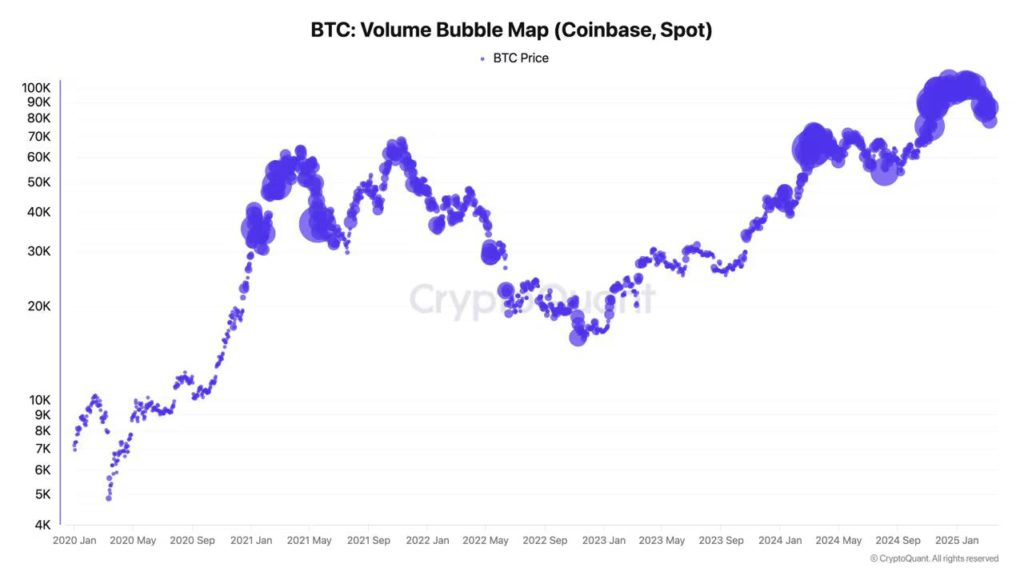

Despite transaction volumes reaching a record near $100,000, Bitcoin’s (BTC) price movement has barely changed. This situation suggests that without new liquidity to balance the massive selling, the market is likely to be bearish.

Also Read: Bitcoin Miner Sales Still High, On-Chain Data Reveals Bearish Trend (3/19/25)

Technical Analysis and Price Predictions

A recent report from CryptoQuant suggests that there is a possibility that Bitcoin (BTC) will return to the $63,000 price, based on bearish signals from valuation metrics such as the Z MVRV Ratio score. This score compares market value (MV) to realized value (RV) to identify overbought or oversold conditions.

A drop in the Z MVRV Ratio score below the 365-day daily average indicates that Bitcoin’s (BTC) price momentum has weakened, which historically correlates with deeper corrections or the beginning of a bear market.

Impact of External Factors

Joel Kruger of LMAX Group and David Duong of Coinbase Institutional have also expressed similar concerns to CoinDesk. They warned that continued weakness in US equity markets amid economic uncertainty and global tensions could exacerbate bearish pressure on crypto markets.

Stagflation is also a possibility that cannot be ignored. Meanwhile, bettors at Polymarket give a 51% chance that Bitcoin (BTC) will end up in the $81-$87K range by the end of the week, and a 31% chance of reaching $75,000 by the end of the month.

Conclusion

With various indicators and analysis pointing to the potential for further declines, investors and market watchers should be aware of the evolving dynamics. Understanding the factors influencing the current market will be crucial in making the right investment decisions in these uncertain times.

Also Read: Ethereum (ETH) has the potential to surge sharply, analysts reveal similarities with 2020 trends

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coindesk. CryptoQuant’s Ki Young Ju Says BTC Bull Market Cycle Is Over. Accessed on March 19, 2025

- Featured Image: Generated by AI